Ethereum on the Line as Binance and BlackRock Sell Into Whale Bids

November 14, 2025

Ethereum is caught between heavy selling from major players and fresh whale demand at a fragile $3,200 support zone. As Binance and BlackRock offload about $1 billion in ETH, large spot orders and key chart levels now decide the token’s next move.

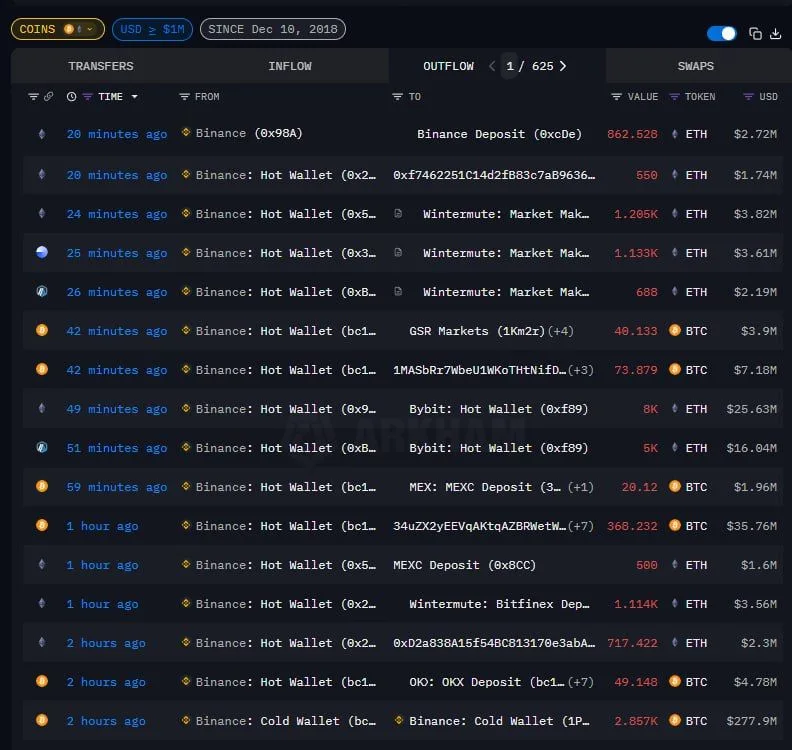

Fresh data from Arkham shows a sharp wave of Ethereum outflows from major Binance wallets in the past few hours, adding pressure to a trend that has unfolded for three straight days. Several Binance hot wallets moved large batches of ETH to market-maker addresses and exchanges, signaling continued selling activity as traders track the scale of withdrawals.

In the last hour, multiple transactions above $1 million each moved from Binance’s hot wallets toward Wintermute, Bybit and other settlement addresses. One transfer sent 1,205 ETH, while another pushed 1,133 ETH to Wintermute. Additional outflows included 550 ETH, 688 ETH and several smaller batches that followed the same pattern. These movements came as part of a broader series of ETH transfers leaving Binance throughout the morning.

At the two-hour mark, more sizable flows appeared. One wallet sent 1,114 ETH to Wintermute, while another moved 717 ETH to an external address before additional flows routed toward OKX and MEXC deposit wallets. The continuous transfers point to sustained pressure across centralized exchanges as liquidity shifts into trading venues or market-maker accounts.

Arkham ETH Outflows Dashboard. Source: Arkham/x

Rekt Fencer highlighted the acceleration in a separate update, noting that Binance and BlackRock offloaded roughly $1 billion worth of ETH over the last 10 hours. He added that both players have been selling consistently for three days, raising questions about why large holders are reducing exposure while ETH trades near key technical support.

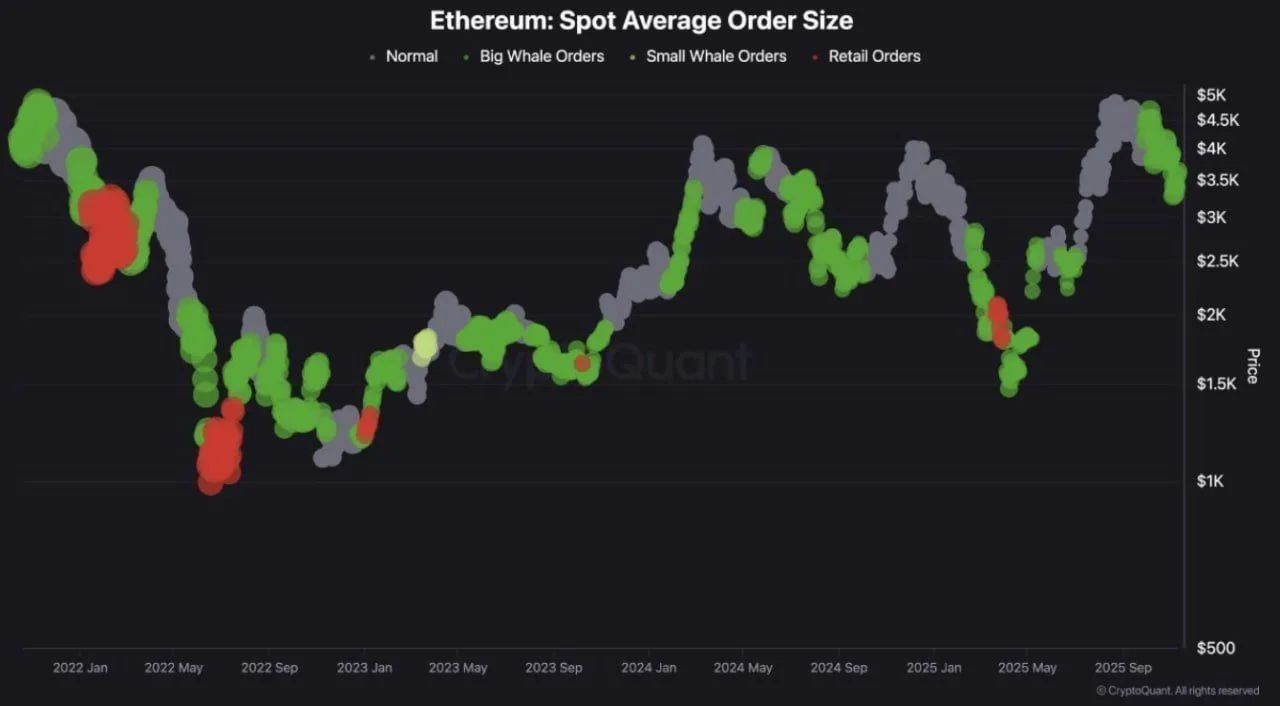

Meanwhile, Ethereum’s spot market is seeing a new wave of large-sized orders, according to fresh CryptoQuant data shared by analyst CryptoGoos. The chart shows a clear pickup in big-whale activity, with green and dark-green clusters appearing again after a quiet stretch earlier in the quarter.

Ethereum Spot Average Order Size. Source: CryptoQuant/X

The renewed concentration of large orders comes as ETH trades near a key support area that has shaped recent volatility. The data highlights strong participation from big wallets rather than retail traders, marking a notable shift in the order-flow profile. At the same time, the average spot order size has climbed back toward levels last seen during the early-2024 accumulation period.

These clusters indicate whales are actively positioning while the broader market digests recent selling pressure across exchanges. The appearance of steady large orders suggests that high-volume players are building exposure during a period of compressed price action, adding another layer to Ethereum’s current market structure.

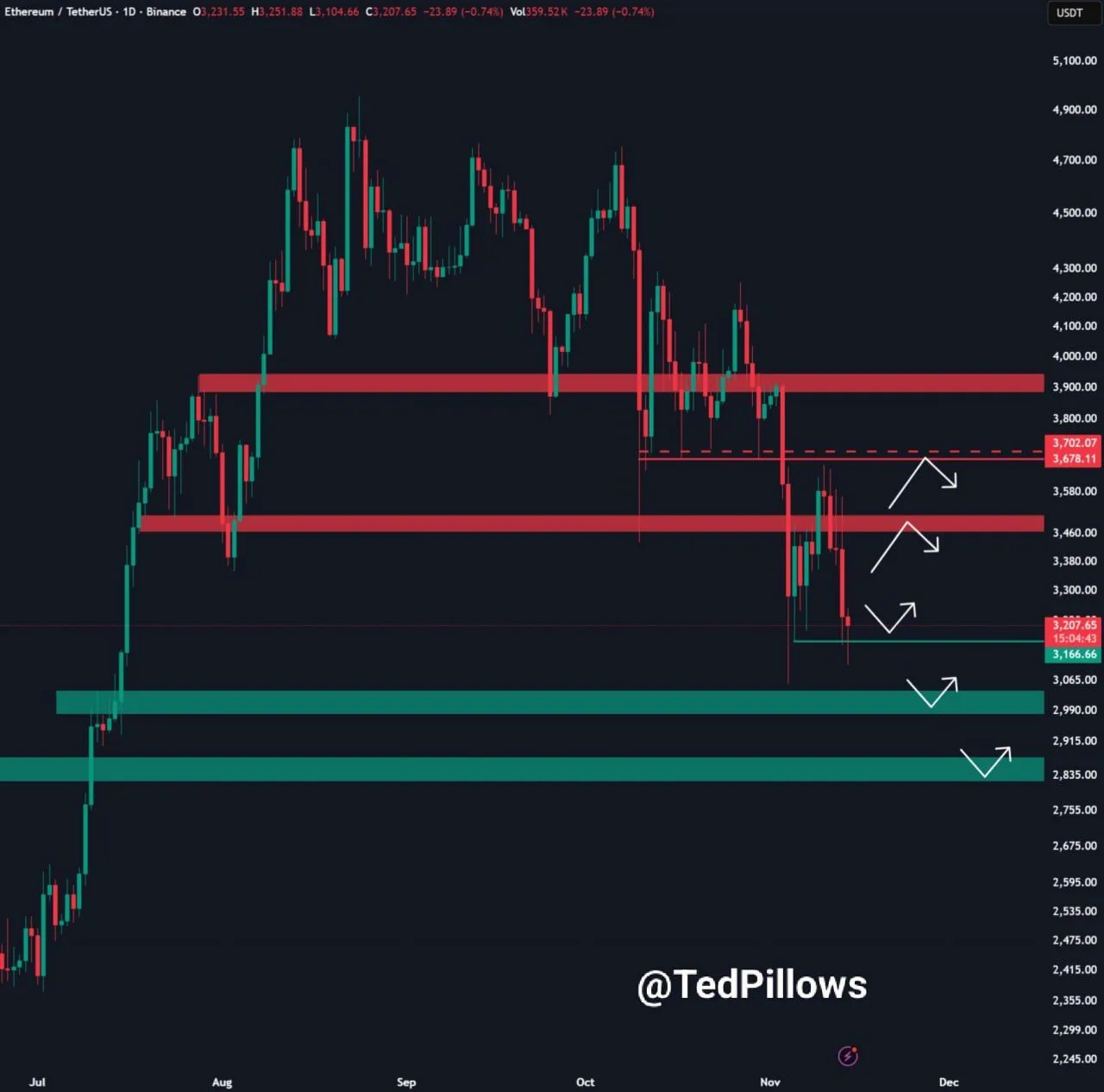

Ethereum is consolidating around the $3,200 level, a price area that chart analysts describe as a pivotal line for short-term direction. Fresh analysis from TedPillows shows ETH holding inside a narrow band after a series of sharp moves earlier in the week.

Ethereum Price Support and Resistance Map. Source: TedPillows

The chart highlights $3,200 as the immediate support that continues to absorb sell pressure. ETH has tested this zone multiple times, creating a tight consolidation structure that now shapes the next move. If the level holds, the chart outlines potential relief bounces toward resistance zones between $3,380 and $3,700, where previous breakdown points sit.

Below the current range, Ethereum faces a cluster of deeper support levels near $3,050 and $2,915. A clean break through $3,200 would put those lower zones back in play, signaling a broader shift in momentum as the market digests heavy exchange outflows and renewed volatility.

The setup places added focus on ETH’s ability to maintain stability around this midpoint area, with traders tracking whether buyers can prevent a move below the $3,000 threshold.

Search

RECENT PRESS RELEASES

Related Post