Marvell’s AI Data Center Rollout Might Change the Case for Investing in Marvell Technology

October 12, 2025

- Marvell Technology, Inc. recently showcased its latest advancements in accelerated infrastructure at the OCP Global Summit in San Jose, California, featuring innovations in custom silicon, memory architectures, and AI-enabling connectivity.

- This unveiling highlights Marvell’s full-stack portfolio for AI infrastructure, reflecting an intensified industry focus on scalable, efficient data center solutions fueled by growing artificial intelligence demand.

- We’ll explore how Marvell’s new AI infrastructure offerings could shape expectations for growth in the company’s investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part – they are all under $10b in market cap – there’s still time to get in early.

Advertisement

Marvell Technology Investment Narrative Recap

To own shares of Marvell Technology, investors need confidence in the company’s ability to convert rising demand for AI data center infrastructure into sustainable revenue growth, while managing its high dependence on large hyperscaler customers. The recent OCP Global Summit news spotlights Marvell’s innovation pipeline, which is crucial for maintaining design win momentum, but does not materially reduce the near-term risks of revenue concentration or project delay exposure.

One of the most relevant recent announcements is Marvell’s product demonstration at the 2025 European Conference on Optical Communication, where it unveiled advanced interconnect technologies for AI data centers. These enhancements support Marvell’s push to secure more design wins, directly aligning with the company’s growth catalysts in custom silicon and high-speed networking.

Yet, in contrast, investors should keep an eye on how concentrated exposure to hyperscaler clients could affect Marvell’s revenue if…

Read the full narrative on Marvell Technology (it’s free!)

Marvell Technology’s narrative projects $12.1 billion in revenue and $2.9 billion in earnings by 2028. This requires 18.7% yearly revenue growth and a $3.0 billion increase in earnings from the current level of -$103.4 million.

Uncover how Marvell Technology’s forecasts yield a $87.23 fair value, in line with its current price.

Exploring Other Perspectives

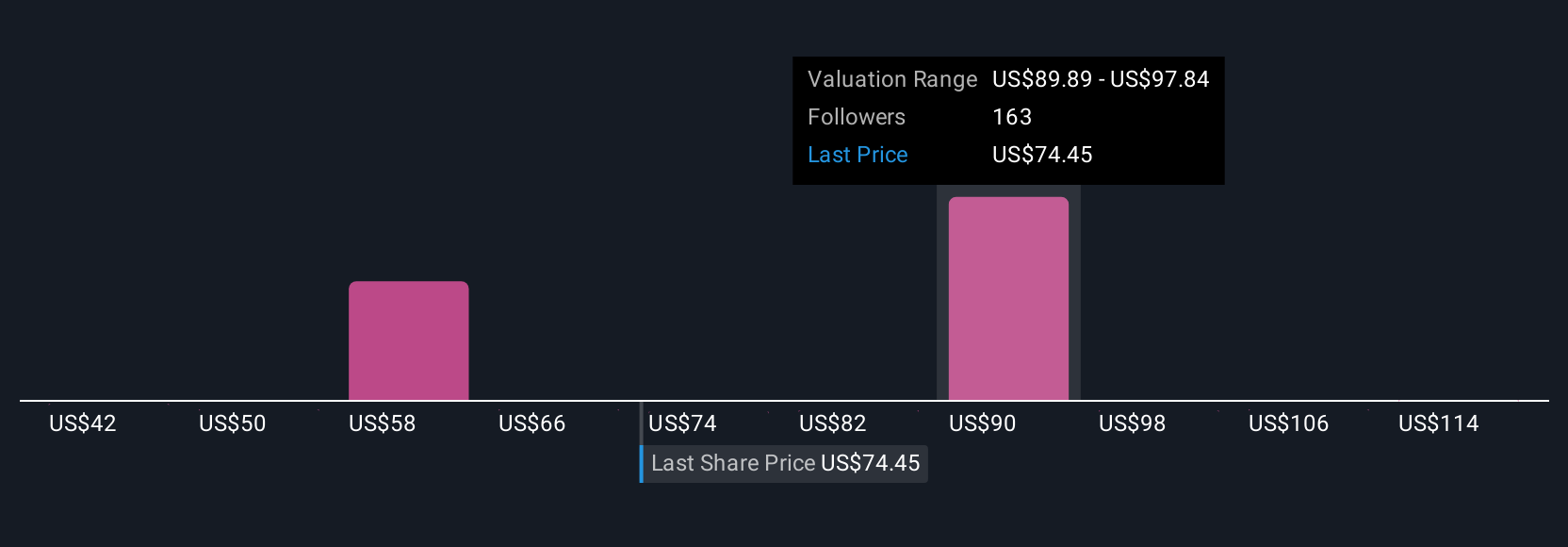

Twenty-eight members of the Simply Wall St Community valued Marvell between US$45 and US$112.78 per share, reflecting wide-ranging views. With much of Marvell’s revenue now tied to hyperscalers, these differences highlight how future shifts in client demand could reshape performance.

Explore 28 other fair value estimates on Marvell Technology – why the stock might be worth as much as 32% more than the current price!

Build Your Own Marvell Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marvell Technology research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Marvell Technology research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Marvell Technology’s overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don’t delay:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post