Meta (META): Reviewing Valuation as New AI Products and Partnerships Drive Growth Narrativ

October 12, 2025

Meta Platforms (META) is making headlines again, thanks to a steady rollout of new AI-powered features that are shaping its advertising and business tools. Investors are watching closely as recent collaborations and cutting-edge hires fuel momentum and optimism in anticipation of the company’s next earnings report.

See our latest analysis for Meta Platforms.

Meta’s latest moves in AI go hand in hand with its remarkable performance this year, where strong revenue growth and relentless product innovation have kept investors interested despite recent volatility. While the last month’s 6.7% share price drop has caught attention, momentum remains clearly positive thanks to a year-to-date share price return of 17.7% and a one-year total shareholder return near 20%. This stretches to 460% over three years.

If Meta’s AI momentum has you curious what else tech leaders are building, now’s the perfect time to discover the next wave of innovators with See the full list for free.

Yet with shares still trading at a notable discount to analyst price targets, and strong analyst optimism around Meta’s AI strategy, the real question is whether investors are looking at an undervalued stock or whether the market has already priced in the next stage of growth.

Advertisement

Most Popular Narrative: 18% Undervalued

Meta’s widely-followed narrative places its fair value substantially above the last close, which is viewed as a bullish signal for investors watching the next phase of AI and digital monetization unfold. The gap between consensus expectations and current market pricing is driving intense interest in what is fueling this premium fair value estimate.

Platform ecosystem advantages support durable revenue growth, competitive strength, and expanded monetization as digital commerce and advertising shift online. High spending on AI and metaverse, regulatory headwinds, and uncertain monetization create risks to margins, cash flow, and long-term revenue sustainability despite strong user engagement.

Why is Meta’s future valuation so heavily weighted towards these new frontiers? There is a bold assumption built in: continued revenue expansion and higher margins powered by emerging business lines and ongoing investment. Curious about the financial rationale that underpins this rich fair value estimate? Explore what drives the narrative’s conviction in Meta’s growth trajectory and high future profit multiple.

Result: Fair Value of $863.20 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, rising regulatory headwinds and the high costs tied to Meta’s ambitious AI investments could challenge the bullish thesis if growth does not materialize as expected.

Find out about the key risks to this Meta Platforms narrative.

Another View: Sizing Up Value by Market Comparisons

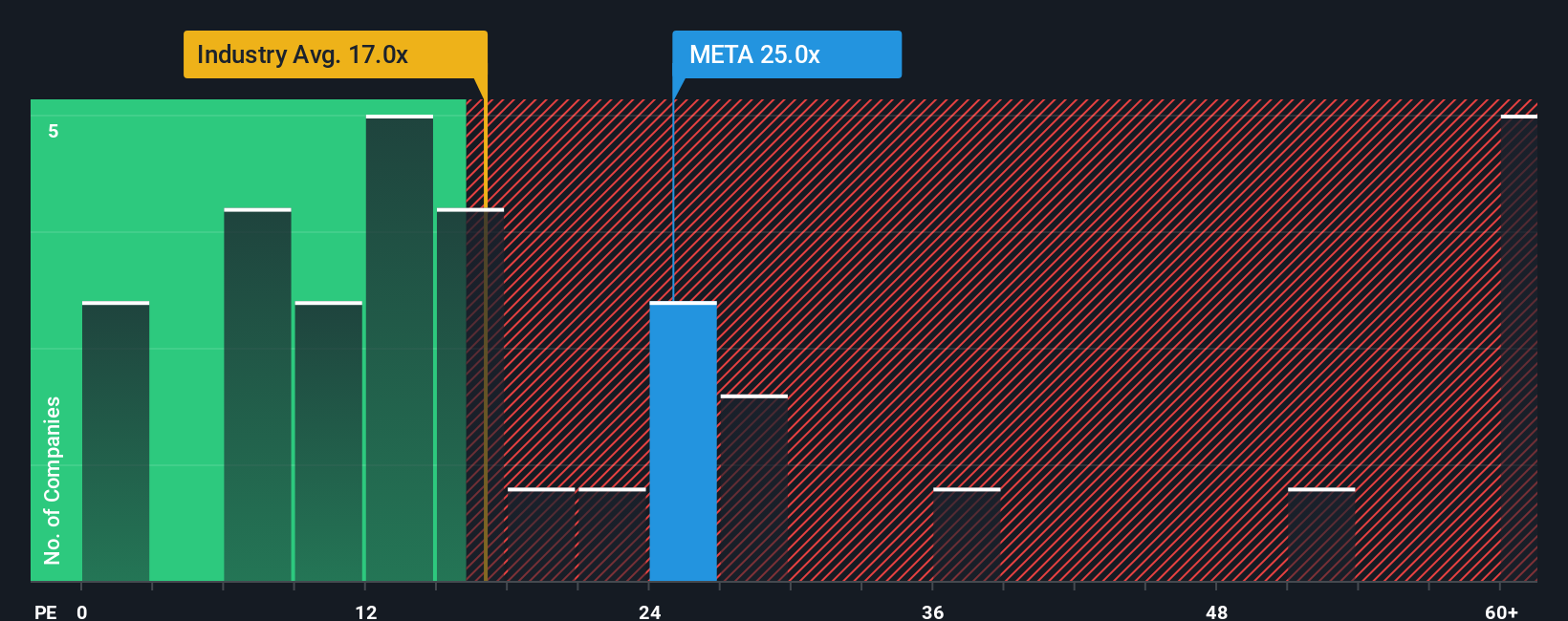

While the current valuation highlights Meta as undervalued, a closer look at its price-to-earnings ratio suggests a different story. At 24.8 times earnings, Meta is more expensive than the broader industry average of 15.3, but offers better value compared to peer averages of 37.3 and even sits below its fair ratio of 39. This gap could mean investors are factoring in stronger growth or unique risks. So does the market see hidden upside, or is there room for caution?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Meta Platforms Narrative

If the consensus view does not align with your outlook or you want to dive deeper into the numbers, you can shape your perspective by building your own narrative in just a few minutes. Do it your way

A great starting point for your Meta Platforms research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Gain an edge by acting now on unique stock opportunities you will not want to miss. The right market moves today can set you up for smarter growth tomorrow.

- Uncover high-yield potential by checking out these 19 dividend stocks with yields > 3%, which offers consistent payouts above 3% for income-focused investors.

- Catch early trends shaping tomorrow’s technology by targeting these 26 quantum computing stocks, a resource at the forefront of breakthroughs in computing and innovation.

- Accelerate your search for strong value plays with these 893 undervalued stocks based on cash flows, which is primed for future growth based on robust cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post