New Chicken Cups Launch Might Change the Case for Investing in Tyson Foods (TSN)

September 27, 2025

- Earlier this month, Tyson Foods introduced Tyson Chicken Cups, a new nationwide product line featuring frozen, individually packaged, microwave-ready chicken cups delivering at least 30 grams of protein per serving and available in four varieties, including Mini Dino Nuggets.

- This launch meets growing US consumer demand for on-the-go, protein-rich foods and marks an innovative pivot in the prepared foods segment, positioning Tyson to compete with other convenience meal brands.

- We’ll examine how Tyson’s entry into convenient, protein-packed meal solutions could shape the company’s outlook and growth priorities.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part – they are all under $10b in market cap – there’s still time to get in early.

Advertisement

Tyson Foods Investment Narrative Recap

To own Tyson Foods shares, investors need to believe that ongoing innovation in prepared foods and resilient consumer demand for protein can offset persistent margin pressures and headwinds like cattle supply constraints in the Beef segment. The nationwide launch of Tyson Chicken Cups directly supports the company’s shift toward value-added, higher-margin products, a positive for short-term catalysts, but it does not materially alter the core risks posed by volatility in beef operating income. If input cost inflation intensifies or sales volumes remain flat, near-term financial results could still face pressure.

Recent moves to eliminate controversial additives such as high fructose corn syrup and synthetic dyes from all branded products in the US add further relevance to the Chicken Cups launch, reinforcing Tyson’s focus on evolving consumer preferences for clean labels and quality. This initiative could strengthen brand trust, aiding the adoption of new, convenient offerings and supporting the transformation of Tyson’s prepared foods portfolio at a time when margin improvement is crucial.

But beneath this progress, investors should watch for evidence of prolonged cattle supply strain impacting profitability and…

Read the full narrative on Tyson Foods (it’s free!)

Tyson Foods’ outlook forecasts $57.7 billion in revenue and $2.3 billion in earnings by 2028. This is based on expected annual revenue growth of 2.1% and an increase in earnings of $1.5 billion from current earnings of $784.0 million.

Uncover how Tyson Foods’ forecasts yield a $63.09 fair value, a 16% upside to its current price.

Exploring Other Perspectives

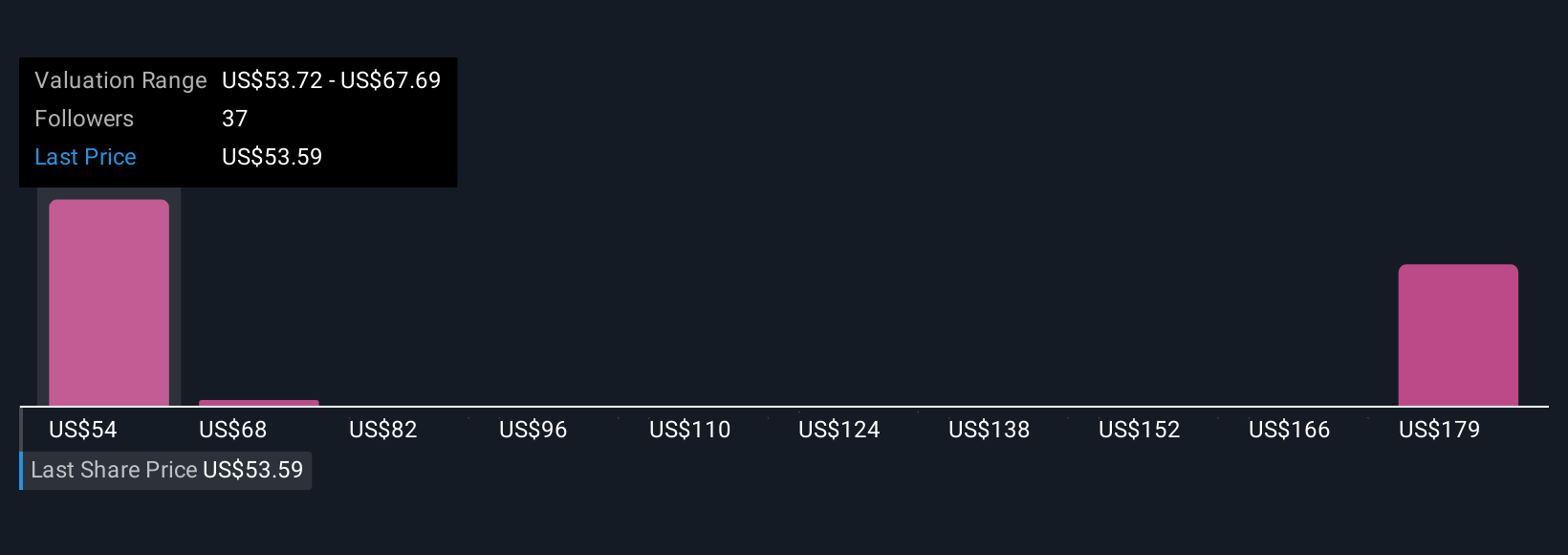

Simply Wall St Community fair value estimates for Tyson Foods range from US$53.72 to US$193.45 per share across nine contributed analyses. While some expect margin expansion from innovation, others highlight that beef segment risks could weigh on results for years, reminding you to weigh multiple viewpoints before making a decision.

Explore 9 other fair value estimates on Tyson Foods – why the stock might be worth just $53.72!

Build Your Own Tyson Foods Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tyson Foods research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Tyson Foods research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Tyson Foods’ overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Tyson Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post