Time to Abandon Solar Stocks or Buy the Dip?

November 29, 2024

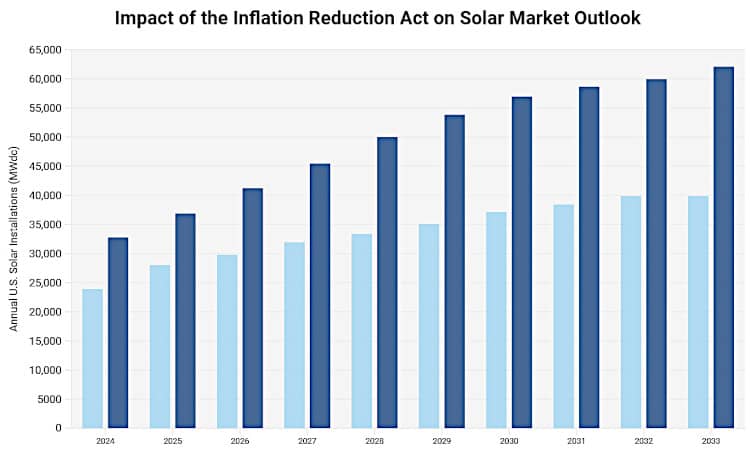

It was almost exactly a year ago that we published a couple of articles investigating the steep drops in many renewable energy stocks, from offshore wind energy to the biggest solar stocks. And it appears green tech stocks still haven’t reached the bottom. We recently issued yet another Trade Alert for Solar Edge (SEDG) after it sank 18% on the results of the U.S. presidential election. As we wrote in the alert, President Trump is more in the camp of “drill, baby, drill” and could weaken or repeal the Inflation Reduction Act (IRA), a bill that provides billions of dollars for clean energy investments and incentives.

We’ve been here before when it comes to predicting political headwinds and tailwinds. After President Biden was elected in 2020, the Invesco Solar ETF (TAN), a pure-play solar ETF, soared more than 50% as investors got ready to start hugging trees. Yet the fund is down 70% with just $1 billion in assets under management (AUM) since Biden’s inauguration, despite the IRA and similar legislation in Europe. Now the assumption is that lights will go out on solar and other cleantech initiatives under the new administration, which is probably yet another overreaction by investors. However, the see-saw sentiment does underscore a very real problem with the entire green energy investment thesis: These industries still rely heavily on government subsidies, regulations, and investments.

At this point we have to ask ourselves if we want any more skin in the green game. After all, we already hold the world’s biggest electric utility stock in NextEra (NEE), which is also the world’s largest generator of wind and solar (and a dividend champion on top of that). Since solar was supposed to be the shining example of the potential for alternative energy solutions, we’re going to dive into what is happening in that sector today as a proxy for investing in green technology.

Where is the Solar Market Headed?

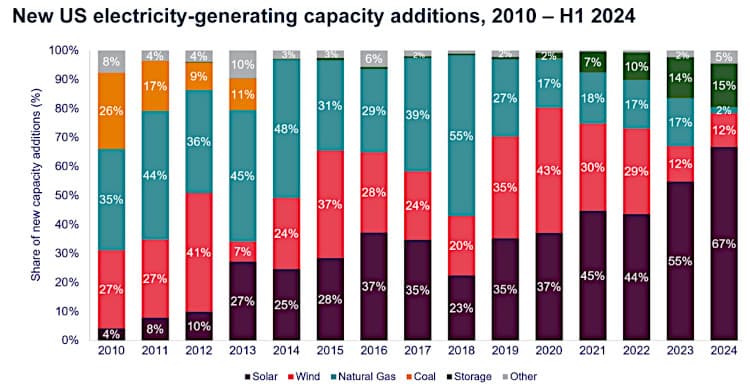

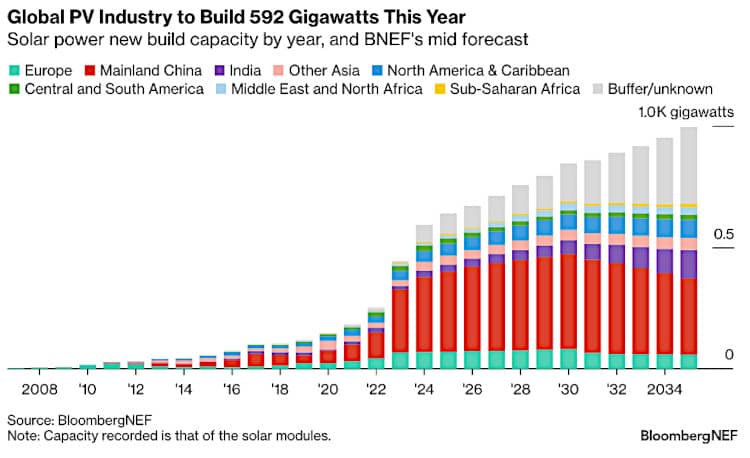

Solar is far and away the dominant green technology today. Solar photovoltaics (PV) accounted for 67% of all new electricity-generating capacity added to the U.S. grid in the first half of 2024, according to the Solar Energy Industries Association (SEIA). Installations actually increased 29% in Q2-2024 compared to a year ago. Additionally, the PV industry is expected to install 592 gigawatts of modules globally this year, up 33% from the boom year of 2023, Bloomberg NEF reported.

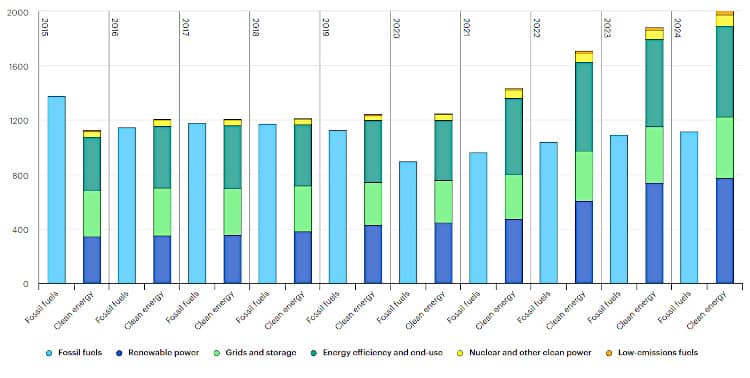

Investment in clean energy technology also remains strong, particularly in solar, according to the International Energy Agency (EIA). The world now invests almost twice as much in clean energy as it does in fossil fuels at $2 trillion in power generation, storage, efficiencies, and other system components. Investments in PV alone are expected to exceed $500 billion in 2024, surpassing all other generation sources combined.

Yet there is obviously weakness in the sector as well. In the United States, the SEIA expects residential solar installations to shrink 19% this year, up from its earlier forecast of 14%. Major bankruptcies by Titan Solar and SunPower are part of that story. In addition, certain kinds of investment have been held back by higher financing costs, though the purse strings may start to loosen soon, as interest rates begin to fall slowly in the United States.

Whether funds will flow in time to help certain companies weather current price pressures remain to be seen. Specifically, polysilicon prices have fallen below production cost for nearly all manufacturers, Bloomberg NEF reported, and firms are shutting down factories for maintenance. Production of polysilicon, a high-purity form of silicon that serves as a foundational material in the PV industry, is expected to fall to less than 2 million metric tons – about 900GW of modules. Bloomberg NEF analysts concluded:

“Most solar manufacturers are expected to report losses this year, their convertible bonds are showing signs of weakness, and some will not survive this cycle.”

The IEA has put positive spin on falling PV module prices, noting that each dollar invested in wind and solar PV yielded 2.5 times more energy output than a dollar spent on the same technologies a decade prior. In fact, it reports that the rise in solar and wind deployment has driven wholesale prices down in some countries, occasionally below zero, particularly during peak periods of wind and solar generation.

Checking in on Solar Stocks

Cheaper may be good for consumers of these systems but not necessarily for the manufacturers. Where does all this leave the three big solar stocks that we have been following for the last few years?

Post-mortem on SolarEdge Technologies Stock

Even the sunniest spins can’t brighten the forecast for SolarEdge, a leading manufacturer of inverters, optimizers, and other solutions for solar energy systems. As recently as April 2023, the company was a shining light in the industry before things suddenly turned dark by February 2024. Revenue dropped off a cliff, excess inventory piled up, and gross margins dipped into negative territory. It only got worse throughout the year, culminating in a catastrophic Q3-2024 where year-over-year revenue decreased 64% from about $725 million to $260 million. The company reported about $1 billion in asset impairment and write-downs, including more than $600 million related to inventory. That led to a huge loss and a negative gross margin of 265.4%. The stock is down 85% so far this year and it’s become a turnaround story. We don’t invest in turnaround stories.

Enphase is Entering a New Phase?

Compare that to its chief rival in solar inverters, Enphase (ENPH). While year-over-year revenue for the company’s latest quarter was down 31%, revenue sequentially was up to $380.9 million, from $303.5 million in Q2-2024. Additionally, Enphase still managed to turn a profit and report a positive gross margin near 47%. It has almost $1.8 billion in cash and securities. Enphase seems to be navigating ye olde macroeconomic headwinds more deftly than SolarEdge by diversifying its product line, including battery storage solutions, and expanding into new markets. Meanwhile, SolarEdge is taking a beating in Europe, where it generated more than 60% of its revenues in 2023. It is also reportedly struggling with quality control, as higher failure rates and warranty issues lead to increased costs.

While Enphase is outshining rival SolarEdge, its stock is still down more than 50% this year. That’s left the company with a simple valuation ratio ($8 billion market cap/$1.5 billion in annualized revenue) of about 5. Investors keen on the theme could be tempted to buy ENPH on the dip, but there may be a better option for those with higher risk-reward tolerance.

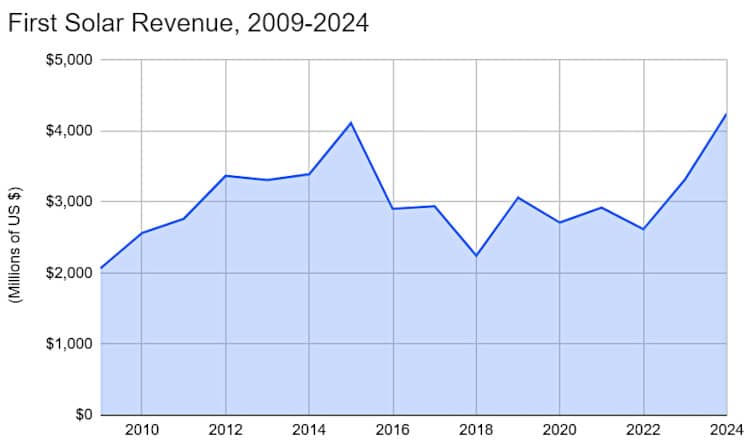

Subsidies Help First Solar Stock Shine

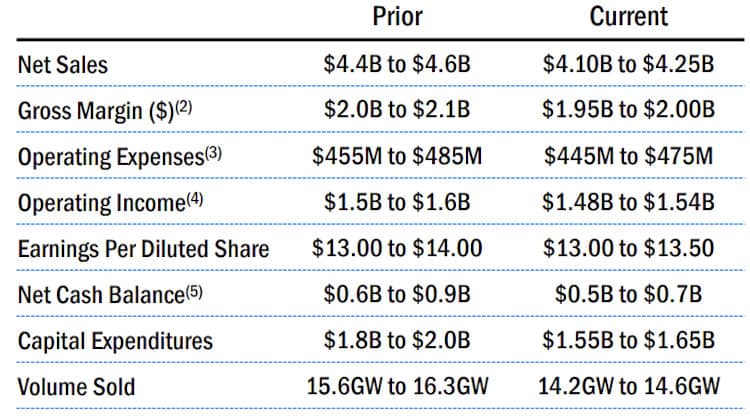

First Solar (FSLR) sports a similar valuation ($19.4 billion market cap/$3.6 billion in annualized revenue) as Enphase but appears on track to increase revenues for the second year in a row following a drop in 2022. The only major U.S.-based solar panel manufacturer, First Solar is guiding to between $4.1 billion and $4.25 billion in 2024, which would represent a 24% to nearly 29% increase over 2023. That suggests the company is expecting a massive Q4-2024, as it has only generated $2.7 billion in sales through the first nine months of the year. At one point, First Solar stock was trading up about 75% this past summer but has steadily declined. It got swept up in the recent downturn following the U.S. presidential election, and is now up just 5% for the year.

Green tech investors would probably be happy to finish out a volatile year in solar stocks in positive territory – and might even be tempted to buy on the dip. However, they should take note of a few key developments – good and bad – before pulling the trigger.

First, management actually revised its original guidance down about 7%, which continued the stock’s steady slide after peaking in June. A number of factors came into play, starting with operational challenges and disruptions stemming from manmade and natural disasters such as the CrowdStrike outage and an unprecedented hurricane season. Additionally, several customer contracts were abruptly terminated, and First Solar is still fighting to get its cancellation fees out of two customers in India (good luck with that). Conversely, First Solar is paying $50 million in warranties related to initial production issues with their new Series 7 product that have reportedly since been resolved.

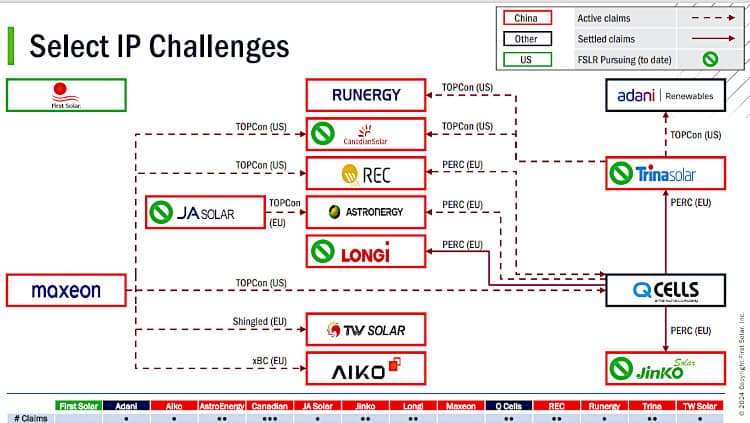

But probably one of the bigger disruptions involves the Chinese dumping cheap PV tech into the Indian market, which artificially lowered the average selling prices (ASPs) of panels to just $0.19 per watt. In response, First Solar is mixing up its India production and exporting a portion of its Indian-manufactured products to the U.S. market, where it can achieve higher ASPs. First Solar competes against the might and dominance of China’s subsidized solar industry. In 2023, for instance, China accounted for more than 90% of the world’s solar-grade polysilicon, 98% of solar wafers, more than 85% of solar cells, and more than 80% of PV modules, according to China’s Ministry of Industry and Information Technology. However, the country’s weakening economy may no longer be able to sustain unfettered financial support to its solar industry, with investments drying up and Chinese solar stocks falling dramatically this year.

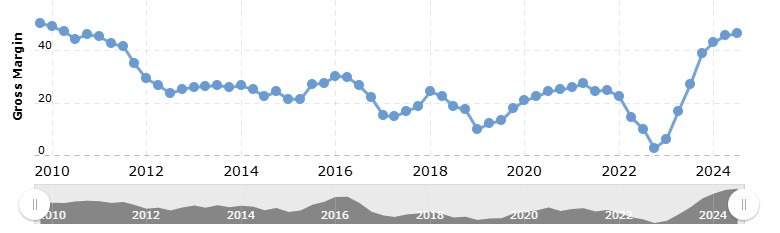

Meanwhile, the United States is helping prop up its solar industry through the IRA, and First Solar is among the first to reap the benefits in a big way. The company expects to recognize more than $1 billion in tax credits under Section 45X of the IRA that it will use for investing in R&D and increasing manufacturing capacity. It’s kind of complicated, but essentially First Solar sells its tax credits to a third party, which applies them to its own tax liability, in exchange for cash money. On one hand, this helps even the playing field against Chinese competitors, putting FSLR in a strong financial position. On the other, it is yet another government subsidy that is scheduled to run out in 2032. Or maybe sooner? When you add in the volatile gross margins it points to a great deal of uncertainty and risk which is a key characteristic of the solar industry.

Some Thoughts on Solar

Since the beginning of TAN – the Invesco Solar ETF – investors have been punished for trying to invest in the most successful source of renewable energy thus far. Hardware manufacturers are constantly facing pricing pressures while few have meaningful recurring revenue streams that can support the business should hardware spending tail off. Government subsidies come and go for all stakeholders in the solar game which leads to lots of volatility and uncertainty. Bankruptcies are a key feature of the space and things can go from great to dire in just months as we’ve observed with SolarEdge.

If you’re going to invest in solar, do so during the dips with the understanding that the risks in this volatile space seem to outweigh the rewards. That pattern has persisted consistently over time and doesn’t seem like to change based on all the external risk factors that can’t be controlled or hedged away.

Conclusion

The solar industry faces a complex landscape of growth and challenges. While global installations and investments continue to rise, individual companies struggle with market pressures and political uncertainties. The potential repeal of supportive legislation like the IRA looms large (will Sir Elon Musk save the day?), highlighting the industry’s vulnerability to policy shifts. Major players such as SolarEdge have faced significant setbacks, while others like Enphase and First Solar show more resilience but still grapple with headwinds. The sector’s heavy reliance on government support remains a double-edged sword, providing essential backing but exposing companies (and retail investors) to political volatility.

Search

RECENT PRESS RELEASES

Related Post