4 Unmissable DeFi Projects with Up to 30x ROI Potential on the Ethereum (ETH) Network

December 24, 2024

Many projects have contributed to the Ethereum network’s 65% yearly rise in 2024, a performance last seen in 2021.

Four notable projects—Rexas Finance, Aave, Lido, and EigenLayer—are leading the Ethereum ecosystem’s DeFi boom with strong fundamentals and exciting development potential. Due to their unique value propositions and widespread adoption in decentralized finance, these protocols could yield 10x-30x ROI.

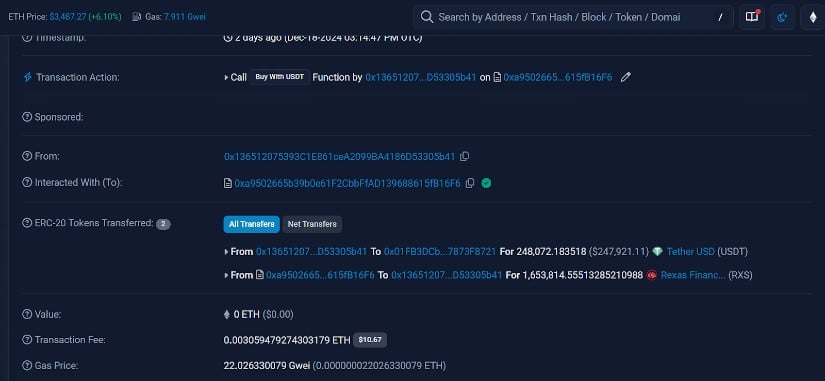

Crypto Whales Purchased RXS Token

Rexas Finance (RXS)

The pioneering real-world asset (RWA) tokenization platform Rexas Finance is one of the Ethereum network’s most promising DeFi projects. RXS, an ERC-20 token, is the cornerstone of a varied ecosystem that tokenizes ownership on the blockchain to democratize access to tangible assets, including real estate, commodities, and financial instruments. This novel approach boosts liquidity and makes high-value asset markets accessible to investors. The Rexas Finance ecosystem stands out for its automated yield optimization, smart contract security checks, and no-code token generation tools. Rexas Treasury automatically optimizes multi-chain yield farming and earns compound interest on Ethereum and other compatible blockchain deposits.

The Rexas Token Builder simplifies token production and administration, attracting businesses, artists, and entrepreneurs. Due to its successful presale, the project entered Stage 10 ahead of schedule. Over 356 million RXS tokens were sold, raising $29.64 million at 92% completion. RXS is currently priced at $0.15 and will rise to $0.175 in its final presale stage. After the presale, Rexas Finance will list on at least three top Tier-1 cryptocurrency exchanges for $0.20 per RXS, adding liquidity and accessibility. Ethereum’s infrastructure should attract DeFi investors to Rexas Finance. Due to its focus on RWA tokenization and seamless integration into Ethereum, Rexas Finance is poised for significant growth in the coming months.

Aave (AAVE)

The flagship DeFi protocol Aave has reclaimed its dominance with a huge price rise. Last seen in November 2021, Ave’s fundamentals had raised investor confidence as she broke above $300. Having a TVL of over $10.5 billion, the platform enables users to lend and borrow crypto assets without middlemen at 36.3% market share in distributed lending. Technically, AAVE’s price has broken out of a weekly megaphone pattern, suggesting additional gains. The Relative Strength Index (RSI) rising above 70% also indicates bullish momentum. Aave’s recently increased Ethereum borrowing activity, which topped $15.8 billion, strengthens its DeFi liquidity role. Whale trades above $100,000 have increased, according to IntoTheBlock. The Trump-backed World Liberty Financials (WLFI) possesses almost 4 million AAVE tokens worth $1.4 million, suggesting institutional faith. The increasing desire for decentralized funding makes Aave a great candidate for a 20x gain in the coming months.

Lido DAO

Lido dominates the Liquid Staking Derivatives (LSD) sector with a 60% market share and $23.5 billion TVL. Lido allows users to stake Ethereum but preserve liquidity, letting them participate in DeFi protocols without locking up assets. This breakthrough propelled Lido to the top of Ethereum’s staking ecosystem. The price of Lido’s governance token, LDO, is positive. The 50-day and 200-day EMAs formed a Golden Cross, helping LDO reach a monthly peak at $2.35. This technical trend and rising on-chain activity suggest LDO could break $3, a level not seen since mid-2024. Investor trust has increased due to Lido’s strategic expansion to accommodate Solana and Polygon blockchains and good governance. Popularity and financial efficiency make Lido a great candidate for 10x profits as the Ethereum staking market grows.

EigenLayer(EIGEN)

EigenLayer, an Ethereum ecosystem pioneer, recently introduced restaking. It lets users reallocate staked ETH to secure new protocols, improving capital efficiency and security in decentralized apps. The platform’s TVL is $11.8 billion, giving it 85.5% of the restaking sector. EigenLayer’s EIGEN coin has gained popularity despite a recent airdrop distribution dispute. On December 17, it reached a new all-time high of $5.64. Whale accumulation has boosted investor confidence, with Binance transferring 2 million tokens worth $9 million. While EigenLayer faces competition from Symbiotic and Karak, its unique use of Ethereum’s architecture and dominance pave the way for future growth. EigenLayer’s trajectory meets yield optimization and protocol security needs as Ethereum restaking changes the DeFi market.

Conclusion

The Ethereum ecosystem continues to innovate in DeFi, with Rexas Finance, Aave, Lido, and EigenLayer showing excellent foundations and significant upside. These platforms will profit when the crypto market enters a new bull cycle. Rexas Finance is particularly appealing. Due to its innovative RWA tokenization and Ethereum DeFi integration, RXS is poised to create considerable ROI. Its presale is nearing completion, and its Tier-1 exchange listing is imminent.

For more information about Rexas Finance (RXS) visit the links below:

Website: https://rexas.com

Win $1 Million Giveaway:https://bit.ly/Rexas1M

Whitepaper:https://rexas.com/rexas-whitepaper.pdf

Twitter/X:https://x.com/rexasfinance

Telegram:https://t.me/rexasfinance

This is a sponsored article. Opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on information presented in this article.

Search

RECENT PRESS RELEASES

Related Post