Cannabis Use Is on the Rise – Where and How to Invest Now

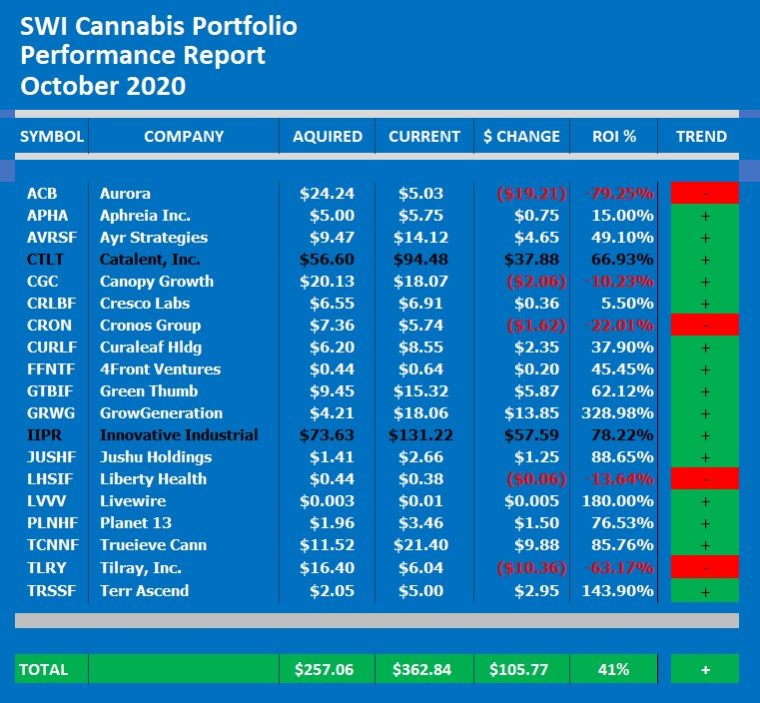

SWI Cannabis Select Portfolio Increases by 41%

Investing in Cannabis has certainly been a wild ride over the last few years, and 2020 was truly a transformative year for the cannabis industry. Expectations were very high; initial fortunes were made quickly and then lost quickly. While you hear headlines “Cannabis Stocks Soaring” or “Do not miss this 2,000% Opportunity” from so many “credible” sources, at SWI, we typically do not join this chorus of sensationalism. These might be the right voices to follow if one enjoys the day trading business’s risk and excitement and takes advantage of these volatile market opportunities. Day trading requires expert skills and high-risk tolerance. While we can appreciate the thrill of day trading, our approach has always been different. We believe in investing versus trading, following smart investing strategies based on solid research, not high-risk speculation.

In the true tradition of our SWI Portfolio, we have picked what we believe to be reasonably priced solid investments representing a promising cross-section of credible and well-managed companies in the evolving cannabis industry that are positioned for success. We have bought positions in these companies at the beginning of 2020, monitoring them throughout the year and providing you now with the results of these investments, with the Portfolio being up 41% from January 2020 to today.

TOTAL PORTFOLIO PERFORMANCE

We have been monitoring the cannabis market intensely over the last three years and have seen many companies suffer from the repercussions of an overhyped market that could not fulfill the oftentimes unrealistic expectations for revenue growth and, more importantly, profits. The days of investors blindly throwing money at the new “Green Gold Rush” are over, and many companies are now carrying the burden of large investments not living up to the expectations and accordingly having to reckon with disappointed investors, sending share prices sinking.

The market has now returned to measuring cannabis companies with the typical yardstick used for the financial performance of all public companies. While painful for some investors, it has also cleared the table, and we now see a newly emerging market dominated by well-managed companies, often companies that have been cut down in size and restructured, that now follow a strict and more realistic performance and financial regime, in order to generate a solid ROI for their investors. Accordingly, this encouraging development has a positive impact on the market and allows well-managed companies to succeed. The table below shows the monthly performance of every stock we acquired, up 41% from January 2020 to today. We will update these charts bi-weekly and provide more detail when warranted.

PORTFOLIO PERFORMANCE BY MONTH

INDIVIDUAL STOCK PERFORMANCE

The table below shows the monthly performance of every stock we acquired. We observed a significant decrease during the months of February, March, and April and considered this a buying opportunity. During the following months, nearly all stocks increased performance significantly, confirming our expectations for the positive development of the entire market based on expanding legalization and increasing consumption.

The TREND is positive for fifteen (15) stocks, and we have highlighted the two “outliers” in the pack in black.

The table below shows the monthly performance of every stock we acquired. Out of the 19 stocks in our portfolio, 14 stocks have improved their performance over the ten (10) month period, and five (5) have decreased somewhat, giving the portfolio a 41% boost over the period. It seems remarkable that ALL stocks experienced a similar decline during the February to April 2020 period and recovered at nearly the same rate. We believe this may be a good time to step into the market.