Clean Utilities for Affordable Housing

October 2, 2024

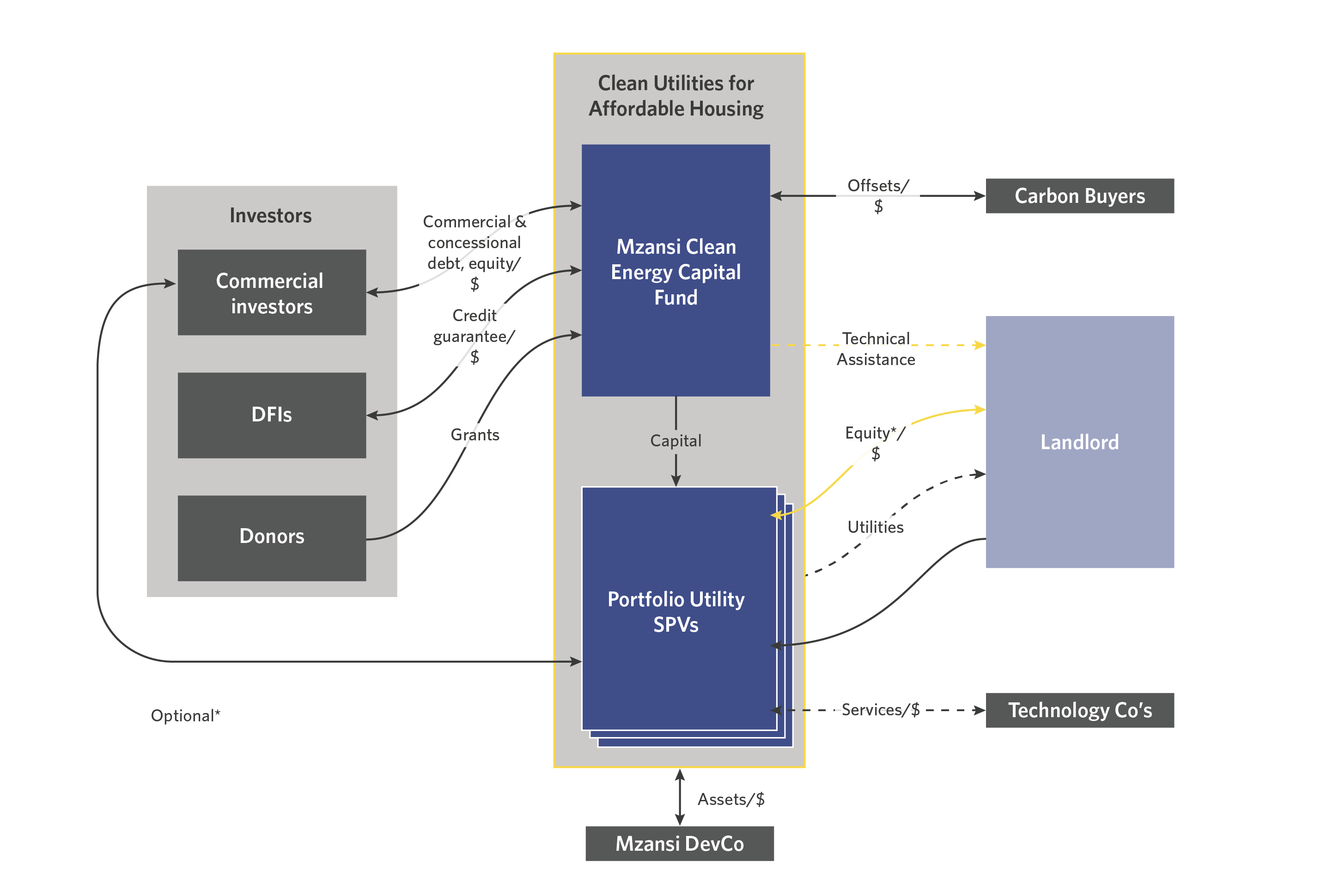

Clean Utilities for Affordable Housing expands access to renewable energy for low-income households by partnering with landlords and using credit enhancement strategies to attract large-scale commercial capital.

ABOUT

In South Africa, low- and middle-income (LMI) households face significant barriers to accessing affordable renewable energy. Constrained by building typology, rental tenure, and limited credit availability, they rely instead on unstable, expensive, and carbon-intensive grid electricity supplied by aging coal-fired power plants. Moreover, landlords lack the capital and expertise to implement clean energy solutions, including solar-embedded generation. By contrast, uptake is high amongst wealthier households, facilitated by growth in renewable energy investment in South Africa. A lack of bankable pipeline projects also serves as a barrier to investment in resource efficiency in township retail markets, where the risk-return profile is equally perceived as unfavorable.

INNOVATION

Clean Utilities is a first-to-market African instrument that addresses the barriers to renewable energy adoption in grid-connected LMI households. By partnering with major landlords, it reduces the financial risks inherent in the affordable housing market by aggregating smallerscale projects and offering bankable offtake agreements. Flexible, scalable utility solutions are delivered to residents, improving quality of life and financial security, accelerating South Africa’s just energy transition. Customized TA raises awareness and optimizes uptake. To minimize reliance on grant funding, the fund will seek to pre-sell a strip of carbon credits to heavy emitters subject to carbon tax in South Africa, setting a precedent for impactful climate vehicles.

“The Lab will help us test and improve our blended finance model that addresses the primary barriers to ownership and financing of clean energy projects in Africa.”

Jackline Okeyo, Founder of Mzansi Clean Energy Capital

IMPACT

Clean Utilities targets 28,000 affordable housing units over the next five years, starting with proof-ofconcept projects in Johannesburg and Cape Town. The instrument will deploy USD 54 million in the first phase in South Africa, focusing on solar embedded generation and adding battery storage when feasible. Following a successful first phase, the model will be ready for expansion into adjacent township retail markets, followed by property markets in Kenya and other middle-income African markets. By addressing the energy needs of vulnerable urban populations in Africa, Clean Utilities supports a just transition, aligns with national policies, and attracts private capital to drive sustainable development across the continent.

DESIGN

Clean Utilities centers on a perpetual subordinated capital fund that invests in special purpose vehicles (SPVs) to mitigate credit risk and attract commercial senior debt. The fund’s flexible structure pools first-loss capital, mezzanine finance, and subordinated debt to offer credit enhancement to SPVs tailored to meet the needs of major affordable housing landlords, which can co-invest equity and so share in SPV returns. This approach supports market-linked returns while building capacity for adopting clean technologies.

The fund will initially invest in 10-15 portfolio-linked SPVs of ZAR 50-100m (USD 3-5m) each. These SPVs will partner with experienced engineering, procurement, and construction (EPC) companies to design and execute clean technology projects backed by long-term, inflationlinked offtake agreements signed between the fund and landlords. These arrangements, along with a six-month debt service cover guarantee, will ensure bankability for senior lenders participating at the SPV level.

Over time, Clean Utilities’ scope will expand beyond solar energy to include other sustainable utility services and geographies, including potential expansion into township retail and affordable housing markets in other African countries like Kenya.

Search

RECENT PRESS RELEASES

Related Post