Indonesia’s nickel companies: The need for renewable energy amid increasing production

October 23, 2024

Executive Summary

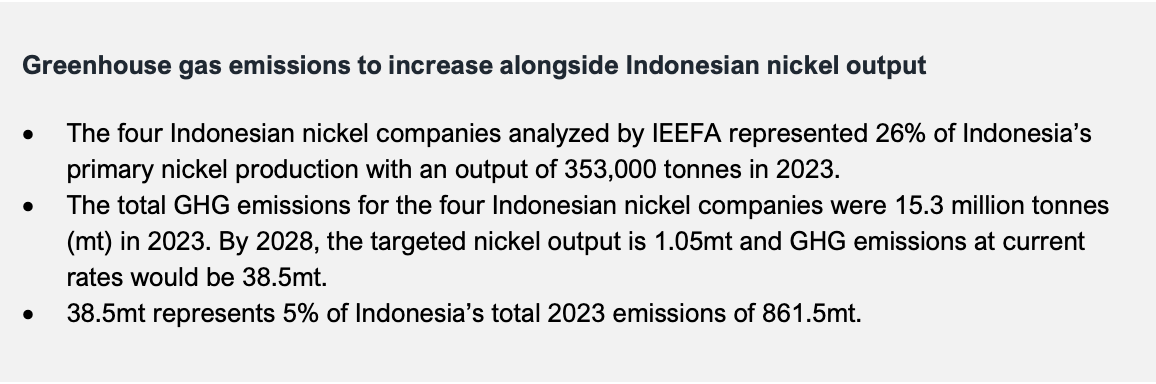

Indonesian nickel producers are emerging as key global players. According to the U.S. Geological Survey (USGS) for 2023, Indonesia accounted for 42% of global nickel reserves and 51% of global mine production. The Indonesian government banned the export of all unprocessed nickel ore in 2020, however the processing of nickel for use in electric vehicle (EV) batteries comes with a significant environmental and carbon footprint. This report examines the activities of four publicly traded nickel companies with significant operations in the country. These companies produced a total of 353,000 tonnes of contained nickel in 2023, which the Institute for Energy Economics and Financial Analysis (IEEFA) estimates accounted for 26% of Indonesia’s primary nickel production of 1.36 million tonnes (mt) in 2023. According to Standard & Poor rankings, Indonesia accounted for 40% of global primary nickel product output (such as ferronickel and matte). Please see Appendix A for further information on the types of nickel metal products.

The four nickel companies analyzed in this report – PT Aneka Tambang (Antam), Merdeka Battery Materials (MBMA), Trimegah Bangun Persada (TBP or Harita), and PT Vale Indonesia (Vale) – reported US$996 million (m) total net profit and US$6.8 billion (bn) revenue for 2023. Compared to the seven listed coal companies examined in IEEFA’s report, “Indonesia’s coal companies: Some diversify, others expand capacity”, the net profit for the four nickel companies in 2023 was 22%, and total revenue was 35%, of the coal companies respectively.

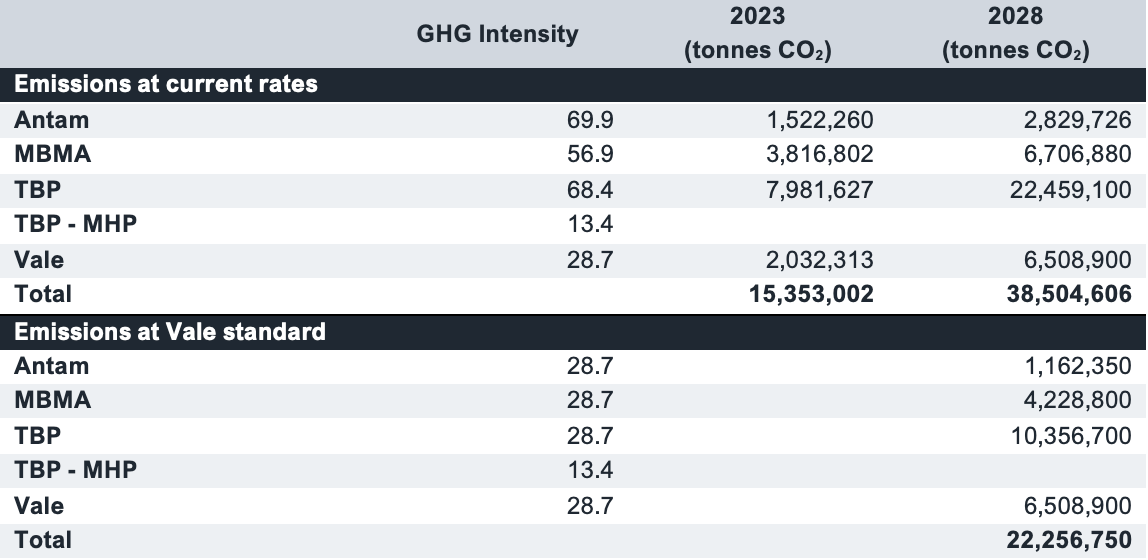

These four companies produced 353,000 tonnes of primary nickel in 2023, generating greenhouse gas (GHG) emissions of 15.3mt. Vale had the lowest intensity of GHG emissions per tonne of nickel for matte or ferronickel, producing 28.7 tonnes of carbon dioxide (CO2) per tonne of nickel (tCO2/tNi). MBMA was ranked second with 56.9 tCO2/tNi, with TBP (Harita) in third place at 68.4 tCO2/tNi, followed by Antam with 69.9 tCO2/tNi. The main reason for Vale’s lower GHG intensity is that it has three hydropower plants with 365 megawatts (MW) of capacity, while the other companies used mainly coal-fired power. TBP (Harita) uses a chemical-based leaching process, High Pressure Acid Leach (HPAL) to produce nickel in mixed hydroxide precipitate (MHP), which is less GHG intensive at 13.4 tCO2/tNi.

Although the CO2 emissions may be lower, Wood Mackenzie estimates that for every tonne of nickel produced using HPAL, around 1.4-1.6 tonnes of waste is also produced, which is considerably more than from nickel smelting. Tailings from the acid-based process are normally stored in dams. However, Sulawesi, where TBP (Harita) and Vale’s HPAL plants are located, has limited space due to topography, thick vegetation, high rainfall, and seismic activity.

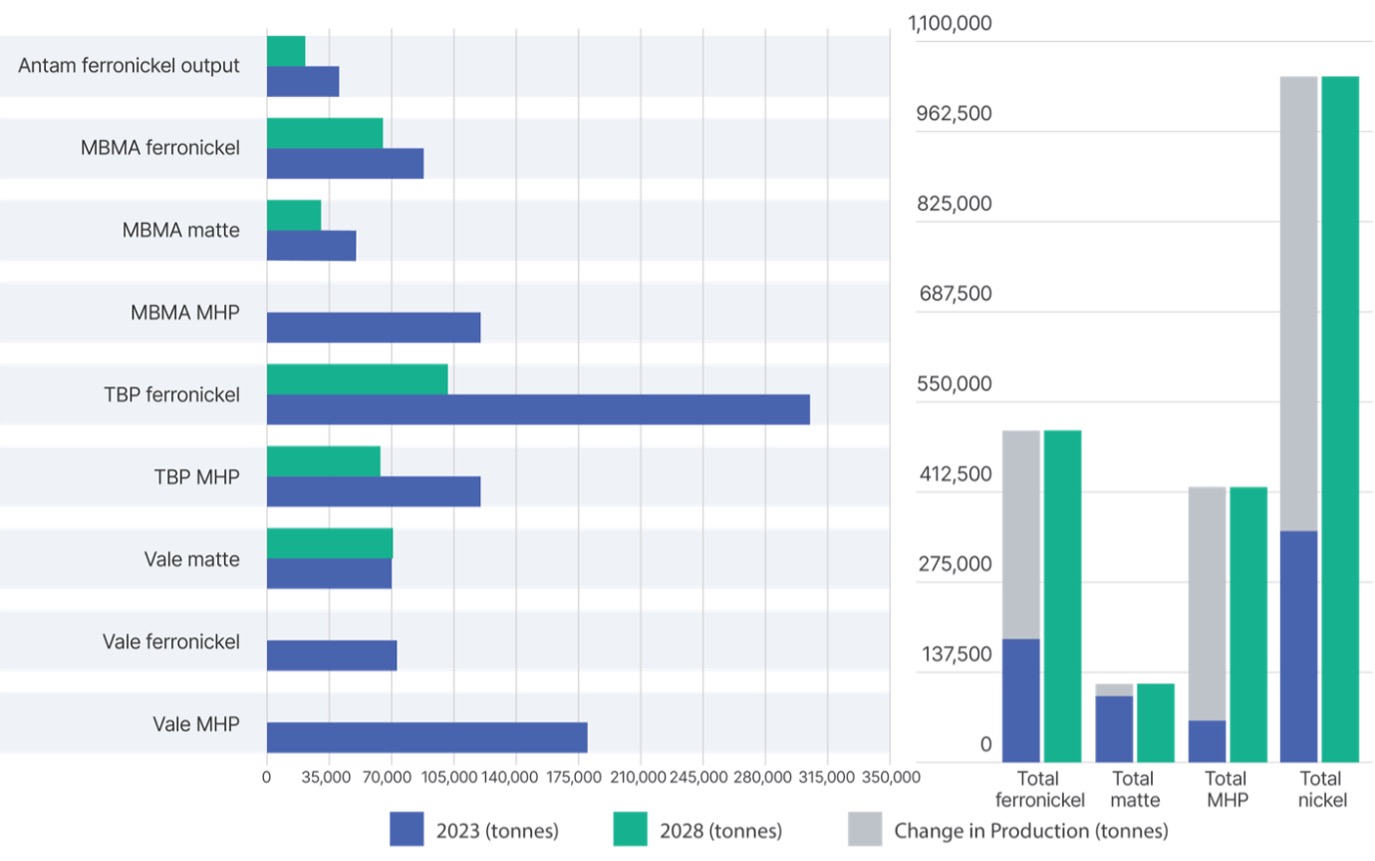

By 2028, the four listed nickel companies plan to expand aggregate processed nickel output to 1.05mt. 420,000 tonnes of the total will be the lower GHG intensity nickel product based on the HPAL process (see Appendix A), while 507,000 tonnes of ferronickel and 120,000 tonnes of nickel matte will use higher GHG intensity processes. Figure 1 provides the breakdown of projected nickel ore conversion by company and process.

Figure 1: 2023 Production and 2028 Target for Indonesian Nickel Companies

Source: Company reports; IEEFA estimates.

According to IEEFA estimates, the targeted nickel output could produce 38.5mt of GHG emissions in 2028. This represents 4.5% of Indonesia’s total CO2 emissions of 861.5mt in 2023. It is also estimated that if the companies can achieve Vale’s standard of 28.7 tCO2/tNi by using hydropower, GHG emissions could be reduced by 42% to 22.3mt. If nickel companies are to reduce the GHG intensity of production, hydropower or other renewable energy sources should be considered.

Table 1: GHG Intensity and Emissions for Indonesian Nickel Companies 2023 and 2028

Source: Company reports; IEEFA estimates.

Search

RECENT PRESS RELEASES

Related Post