Germany closing factories at home, opening them in China

November 27, 2024

Germany’s domestic energy policies and economic environment are driving its biggest industrial players away from home and toward more favorable conditions in China. Escalating energy costs, massive subsidies for renewable energy and stringent regulations have created an environment in Germany that is increasingly hostile to industrial growth.

As a result, many of Germany’s most established companies are downsizing at home, shedding thousands of jobs, while investing heavily in China. This shift underlines the profound impact of current policies on Germany’s industrial landscape, with long-term implications for the local economy and employment.

Asia Times examines here the key factors and the companies that are reshaping their operations abroad.

High energy costs in Germany: The result of ideological policies

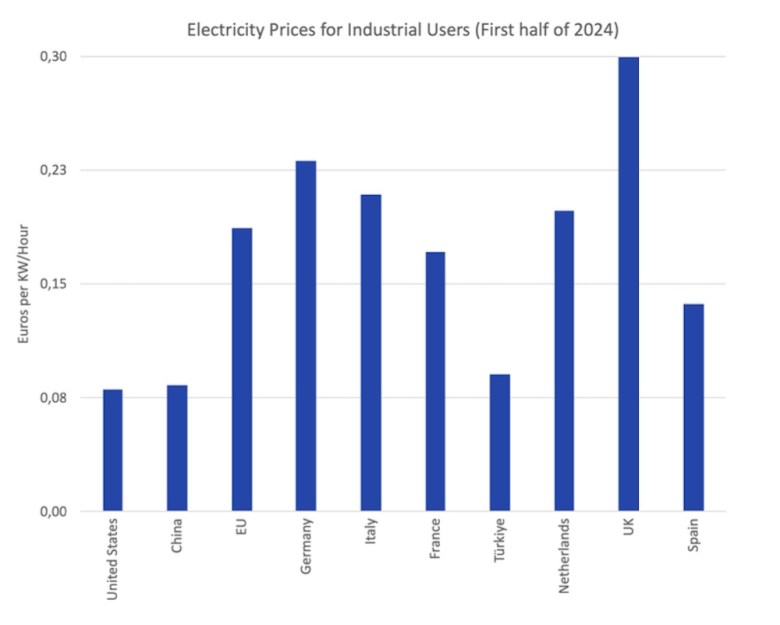

Germany’s energy policies have driven industrial electricity prices to levels that are among the highest in the world, second only to the UK. By 2023, the average price for industrial users will have reached almost US$250 per MWh; even this cost level is unsustainable without substantial government subsidies, which have now reached unprecedented levels.

Germany’s reliance on renewable energy sources such as wind and solar, combined with the phasing out of nuclear power, has increased the country’s reliance on imports and caused severe price volatility, ultimately putting pressure on both industry and taxpayers. These high prices have forced many companies to consider scaling back operations in Germany in favor of expanding abroad, particularly in China.

Industrial energy consumption down by more than 16% in 2 years

In 2023, energy consumption in Germany’s industrial sector fell to 3,282 petajoules, a decrease of 7.8% compared to 2022. This decline followed an already significant reduction in 2022, when industrial energy use fell by 9.1% year-on-year to 3,558 petajoules. Taken together, these reductions represent an overall decrease in industrial energy use of about 16.3% over the two-year period.

Energy supply in Germany: Increased import dependence

Germany’s domestic energy production has also shifted, with renewable energy sources reaching a record 61.5% of total energy production in early 2024. However, this shift has led to a 23% increase in electricity imports in the first half of 2024, highlighting Germany’s reliance on foreign energy sources to supplement its variable renewable production.

The variability of renewable energy supply, coupled with high domestic prices, poses risks for businesses that require stable and affordable electricity. Germany’s continued reliance on renewables is also expected to increase import dependency, further discouraging companies from expanding domestically.

Massive subsidies for renewables

In 2024 alone, Germany will provide 20 billion euros in subsidies to renewable energy producers. These payments ensure that renewable energy suppliers receive guaranteed minimum prices, despite sharply falling market prices.

This centrally planned system, in which the government steps in to pay renewable energy producers when wholesale prices fall, has placed a heavy burden on the state budget, leaving less financial room for other critical investments.

In fact, the original budget for subsidies in 2024 was 10.6 billion euros (US$21 billion), but as energy prices have fallen, the projected need has doubled. These rising subsidy costs are adding to fiscal pressure and complicating budget negotiations, especially given the government’s commitment to adhere to the debt brake.

The role of lost Russian gas and the Nord Stream pipelines in Germany’s industrial decline

The cessation of Russian gas imports has had a profound impact on Germany’s energy landscape, disrupting its industrial base and driving up energy costs. Russian natural gas was a cornerstone of Germany’s energy supply, providing reliable and affordable energy for decades. However, the geopolitical fallout from the war in Ukraine and the sabotage of the Nord Stream pipelines in September 2022 severed this critical energy link.

The attacks rendered Nord Stream 1 completely inoperable, and one of the two pipelines of Nord Stream 2 was also damaged. Only one section of Nord Stream 2 remains operational but unused. Russian President Vladimir Putin recently reiterated that this operational pipeline could resume deliveries immediately if Germany was willing to engage with Russia politically and economically.

In a recent phone call with German Chancellor Olaf Scholz – their first in two years – Putin stressed that restarting gas flows through Nord Stream 2 was “a matter of pressing a button”, signaling Russia’s readiness to supply gas if Germany cooperated.

The abrupt loss of Russian gas forced Germany to replace it with much more expensive liquefied natural gas (LNG) imports, mainly from the United States. These inflated costs have undermined Germany’s global industrial competitiveness.

Putin’s proposal to reactivate the remaining Nord Stream 2 pipeline underlines the strategic leverage Russia still holds over Europe’s energy supply. By offering a potential lifeline to Germany’s ailing economy, Putin aims to influence Germany’s political stance on the Ukraine conflict. Despite the potential economic benefits of resuming gas imports, Germany has refrained from responding to the proposal.

Falling domestic investment in Germany

Rising energy costs and regulatory challenges have led to a significant decline in domestic investment. Private gross fixed capital formation is about 10% below pre-covid levels.

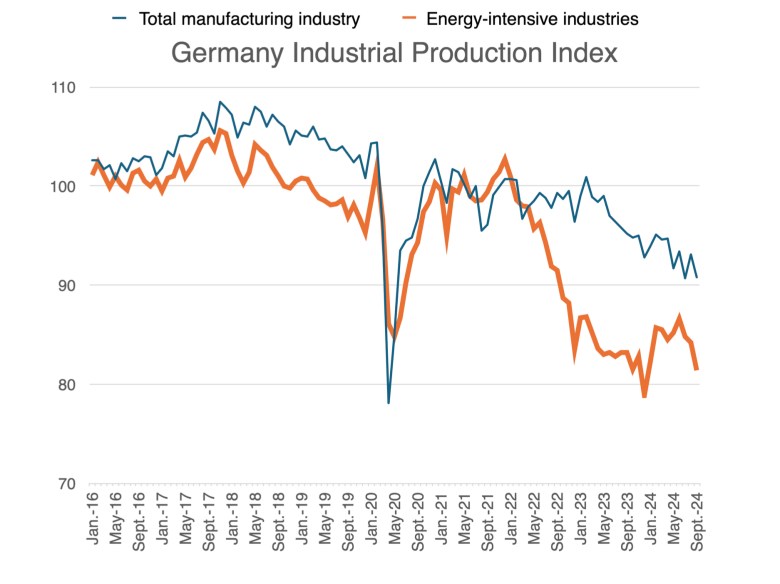

The situation is even worse for industrial production: Since 2021, Germany’s production level has fallen by more than 9%. The decline has been even sharper in energy-intensive industries. There, production levels have fallen by more than 18% in less than two years, pointing to significant problems in sectors heavily dependent on affordable energy.

This decline coincides with increased energy costs and the ongoing shift towards renewable energy sources, which may have affected the cost structure of these industries. The trend points to potential deindustrialization pressures, particularly for sectors that are unable to adapt to rising operating costs.

The unsustainable cost environment in Germany is leading many companies to cut jobs at home while expanding in China.

Germany’s biggest companies cutting jobs in Germany and investing in China

- Volkswagen: Facing potential job cuts of up to 30,000 in Germany, Volkswagen has made significant investments in China, including 2.5 billion euros ($2.6 billion) to expand EV production in Hefei and a further 700 million euros in EV technology partnership with Xpeng.

- Bosch: Announced plans to cut 7,000 jobs in Germany as it increases investment in China’s e-mobility and automated driving sectors.

- SAP: Plans to cut 9,000 to 10,000 jobs in Germany while reallocating resources to high-growth markets abroad.

These cuts are part of a wider trend as industries in Germany face increasing financial pressures and regulatory burdens. The Association of the Bavarian Economy (vbw) estimates that the automotive sector in Bavaria alone could lose 106,000 jobs by 2040, highlighting the far-reaching consequences of Germany’s industrial challenges.

Hildegard Müller, president of the German Association of the Automotive Industry (VDA), warns that up to 190,000 jobs across the sector could be at risk by 2035, reflecting the risks associated with Germany’s deindustrialization.

In response to these developments, Scholz’s government has initiated urgent talks with industry leaders. However, industry experts argue that these discussions lack the long-term strategic vision needed to address fundamental issues such as high costs, regulatory pressures and labor costs. Without significant structural reforms, the German automotive sector risks a further decline in global competitiveness.

Soaring German investment in China: Record levels

Despite calls from German policymakers and the EU to reduce dependence on China, German companies continue to set record levels of investment in the country. German investment in China has reached unprecedented levels in recent years, driven mainly by the automotive and chemicals sectors.

In the first half of 2024 alone, German foreign direct investment (FDI) in China reached 7.3 billion euros, surpassing the 6.5 billion euro total for the whole of 2023. EU investment in China is increasingly driven by Germany and its automakers, with German FDI accounting for 57% of total EU investment in China in the first half of 2024, 62% in 2023 and a record 71% in 2022.

Key investment projects:

- Volkswagen: In addition to its 2.5 billion euro investment in Hefei, Volkswagen has increased its joint venture stake in JAC Motor from 50% to 75%. This move underlines Volkswagen’s long-term commitment to local vehicle production in China, a market crucial to its growth in electric vehicles.

- BMW: BMW’s investment in Shenyang not only expands its production,but also its research and development capabilities, aligning with local demand and avoiding the high energy costs in Germany.

- BASF: The chemical company’s 10 billion euro plant in Guangdong is another example of large-scale localization. By operating in China, BASF minimizes regulatory and energy costs in Germany while meeting China’s demand for advanced chemical products, particularly in the automotive sector.

These projects reflect a strategy of localized production that helps companies manage costs and meet Chinese market demands without the complexities and costs of exporting from Germany.

Expansion of EU greenfield investment led by Germany

EU greenfield investment in China reached a record 3.6 billion euros in the second quarter of 2024, the highest quarterly level to date. German automakers account for a large part of this growth, accounting for around half of all EU investments in China since 2022.

While average quarterly M&A activity declines by 30% between 2022 and the first half of 2024, greenfield investments by EU firms have steadily increased, with Germany’s automotive and chemicals sectors leading this trend.

Between 2022 and the first half of 2024, 65% of all EU FDI in China will come from Germany, up from 48% between 2019 and 2021. The top five European investors in China in 2023 were German companies, underlining Germany’s key role in EU-China investment.

In contrast, countries such as France, the Netherlands and Denmark will each contribute only 7-8% of EU FDI during this period, while the remaining 23 EU Member States together will account for only 12%.

Localizing supply chains and mitigating geopolitical risks

Amid rising energy prices and regulatory uncertainties, German companies are also restructuring their supply chains to mitigate risks. Events such as the Covid-19 pandemic and the Suez Canal disruption have highlighted the vulnerability of global supply chains, prompting companies to localize their operations within key markets. German companies are responding by increasing direct production in China, which offers both cost advantages and reduced exposure to global supply chain disruptions.

Friedolin Strack of the Federation of German Industries (BDI) notes that companies are increasingly “reorganizing their supply chains on a regional basis” in China. German automakers such as Volkswagen and BMW are localizing their EV supply chains to remain competitive in an environment where Chinese EV manufacturers are gaining market share. By investing in localized production, German companies are not only managing costs but also insulating themselves from global uncertainties.

Reducing German exports to China through local production

The shift to localized production has led to a 5.7% decline in bilateral trade between Germany and China in the first seven months of 2024. German exports to China fell by 11.7% year-on-year, as companies increasingly serve Chinese consumers directly through local production.

This decline in exports is particularly noticeable in the automotive sector, where German companies are manufacturing vehicles directly in China rather than exporting them. This trend could affect Germany’s trade balance as fewer German-made goods are sent abroad while localized production in China continues to grow.

China’s unique advantages for German companies

While the German government and the European Commission advocate diversification away from China, alternative markets lack China’s infrastructure, market scale and cost efficiency. Countries such as Vietnam and Thailand, while considered as diversification options, cannot match China’s industrial networks, skilled workforce and market size.

Since 2022, more than 50% of all EU investment in China has come from German companies, mainly in the automotive and chemical sectors. Major projects, such as Volkswagen’s partnership with Xpeng and BASF’s production facility, underline Germany’s strategic focus on China as a key market for long-term growth and competitiveness.

Strategic reorientation driven by domestic policy and global competition

The decision by German companies to limit investment at home and expand in China reflects the profound impact of Germany’s current energy policy and regulatory pressures. High costs, variable energy supply and regulatory challenges have made Germany a difficult environment for large-scale industrial investment, while China offers stability, cost-efficiency and market growth potential.

As Germany seeks to maintain its industrial base, these trends suggest the need to address domestic structural issues. Without reforms to lower energy costs and reduce regulatory burdens, the shift of German investment to China is likely to continue, with long-term implications for Germany’s trade balance, industrial output and economic resilience. Not even EU tariffs will play a major role.

Search

RECENT PRESS RELEASES

Related Post