Ethereum Nears $4,000 Milestone Amid Renewed Market Optimism

December 5, 2024

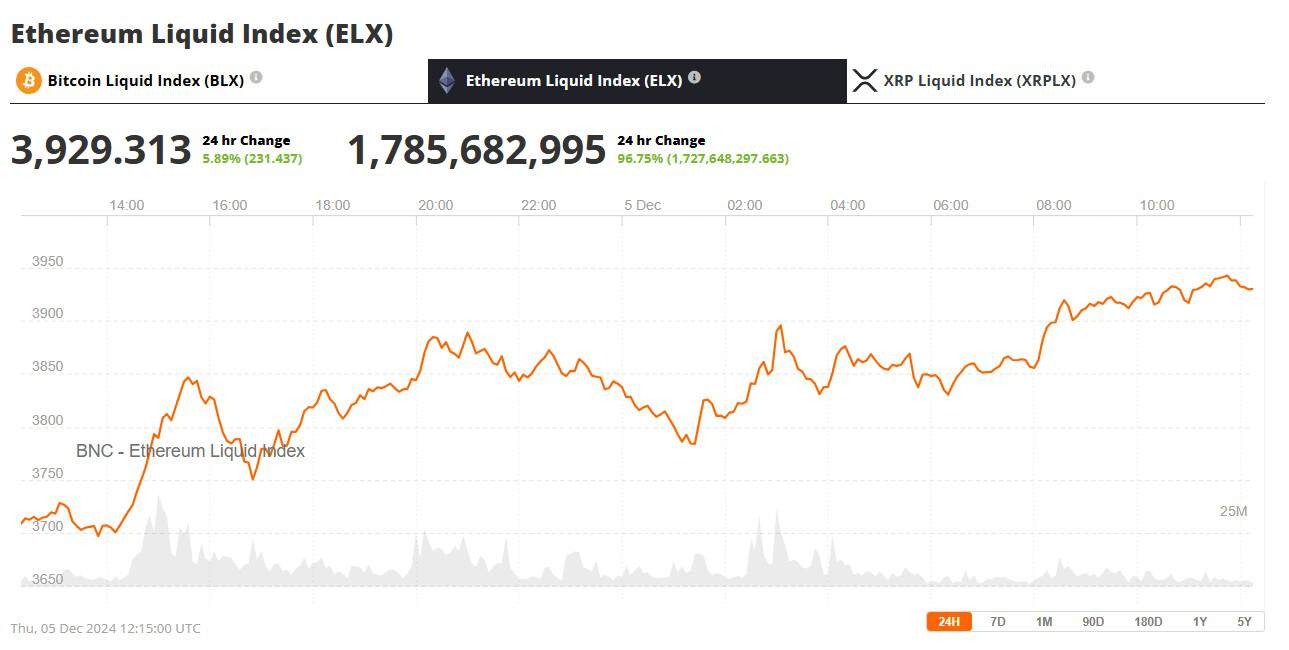

Ethereum, the world’s second-largest cryptocurrency by market capitalization, is approaching the significant threshold of $4,000, trading just above $3,900 as of Thursday morning. The digital asset has been steadily climbing, bolstered by Bitcoin’s recent surge past $100,000 and a wave of positive market sentiment.

Ethereum continues to grind towards its key resistance level of $4000. Source: Brave New Coin Ethereum Liquid Index

The Ethereum price is $3,929, up 5.89% in the last 24 hours and 6.73% over the past week. The daily trading volume has increased by 4% to over $42 billion, indicating heightened investor activity and a bullish momentum in the market.

Analysts Anticipate a Breakout

Crypto analysts are optimistic about Ethereum’s trajectory. IncomeSharks, a well-known crypto analyst, observed that Ethereum’s daily support levels remain robust, suggesting a solid foundation for its current position. “I wouldn’t chase ETH at this level, but for now, daily support is holding,” the analyst noted, indicating a potential downside target of $3,200 but maintaining a near-term price target of $4,000 or higher.

Another analyst, Ali Martinez, highlighted the importance of the $3,300 support level as a potential entry point should Ethereum experience a pullback. Martinez expressed optimism, setting mid-term and long-term price targets at $6,000 and $10,000, respectively.

Technical Indicators Signal Bullish Trends

Ethereum’s recent performance shows the formation of bullish patterns, such as the cup-and-handle chart formation dating back to November 2021. Analyst Venturefounder believes that breaking past $3,800 would confirm this pattern, potentially leading to explosive growth. Based on historical trends, the price target for this breakout could reach $7,346, underscoring the long-term optimism surrounding Ethereum.

The optimism surrounding Ethereum is further supported by significant inflows into Ethereum Exchange-Traded Funds (ETFs). According to data provided by Farside, Ethereum ETFs showed $132.6 million in net inflows on December 3, marking the third consecutive day of positive inflows. This suggests renewed institutional investor interest in the cryptocurrency.

BlackRock’s ETHA ETF recorded inflows of $65.3 million, while Fidelity’s FETH saw inflows of $73.7 million. These substantial investments reflect growing confidence in Ethereum’s prospects among major financial institutions. However, Grayscale’s ETHE experienced outflows of $6.4 million, indicating some variability in investor sentiment across different funds.

Market Context and Future Outlook

Ethereum’s ascent comes amid broader market volatility and Bitcoin’s historic surge past $100,000. As Bitcoin captures global attention, Ethereum is poised to follow suit, benefiting from the overall bullish sentiment in the cryptocurrency market.

Analysts believe that maintaining support above key levels, coupled with strengthening technical indicators, positions Ethereum for substantial growth in the near term. Should ETH successfully surpass $4,000, it may set the stage for the ambitious price targets outlined by experts.

Search

RECENT PRESS RELEASES

Related Post