Bitcoin’s trajectory shows similarities with previous cycles as long-term holders book profits of $2.1 billion

December 19, 2024

- Glassnode’s weekly report indicated that Bitcoin’s trajectory is similar to previous cycles.

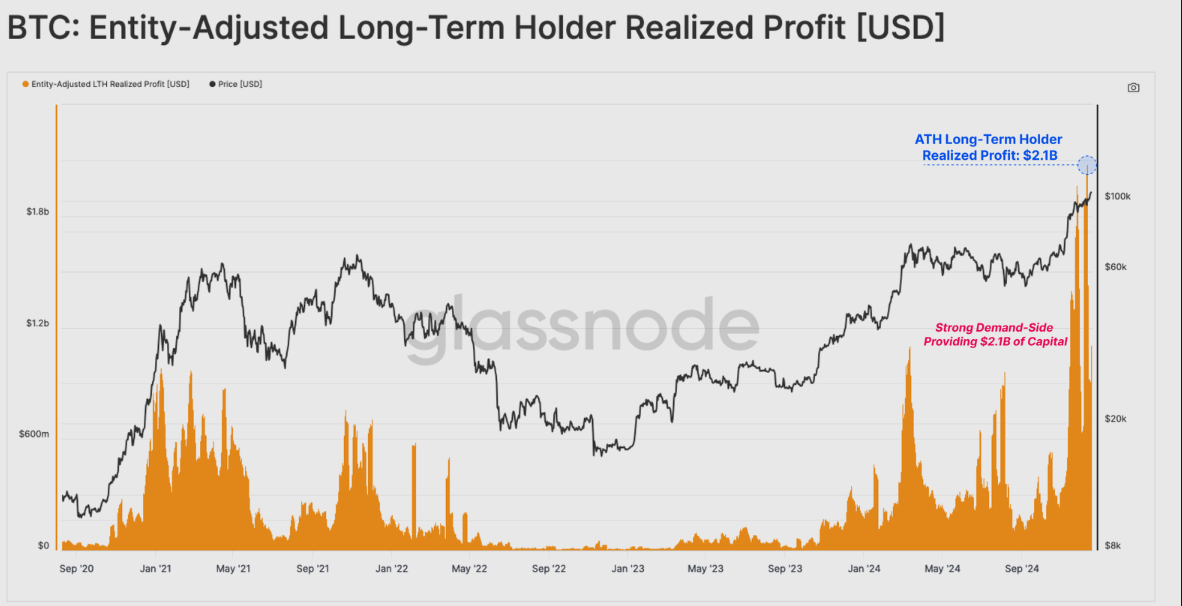

- Long-term holders were active during Bitcoin’s rally to $100K, ramping up realized profits of $2.1 billion in the process.

- Tokens held for six months to 1 year have attracted the most sell-side pressure this year.

Glassnode’s Week on Chain report revealed the similarities between the current Bitcoin uptrend and previous cycles amid changing market conditions. Meanwhile, long-term investors began distributing their tokens at the $100K level, culminating in a new all-time high of $2.1 billion in realized profits.

Bitcoin has witnessed a remarkable year in 2024, surging above the $100K key level, with its yearly returns exceeding 130%.

According to blockchain analytics firm Glassnode’s weekly report, Bitcoin’s current price performance has a striking resemblance with the 2015-2018 and 2018-2021 cycles despite the changing dynamics in its market structure.

Like previous cycles, the selling pressure that accompanies sustained price increases has remained but at a much lower pace. The deepest drawdown in this cycle occurred on August 5, 2024, when prices dropped 32% below their peak.

Likewise, this cycle has been Bitcoin’s least volatile cycle since its launch. “The majority of drawdowns have only seen the price fall -25% below the local high, masking this is one of the least volatile cycles to date,” wrote Glassnode.

This reduced volatility is potentially a result of demand from heightened institutional interest and the introduction of spot Bitcoin exchange-traded funds (ETFs).

The high demand has also helped Bitcoin in its charge above $100K despite long-term holders consistently realizing an average of $2.1 billion in profits per day.

“If we adopt a simplified assumption that every seller is matched with a buyer, this observation provides some insight into the strength of the demand side, who, by contrast, has provided an estimated $2.1B of fresh capital into the market.”

BTC Entity-Adjusted LTH Realized Profits | Glassnode

Glassnode analysts also highlighted that the scale of LTHs profit-taking in the past month surpasses levels observed earlier this year when Bitcoin reached a previous all-time high of $73,000 in March.

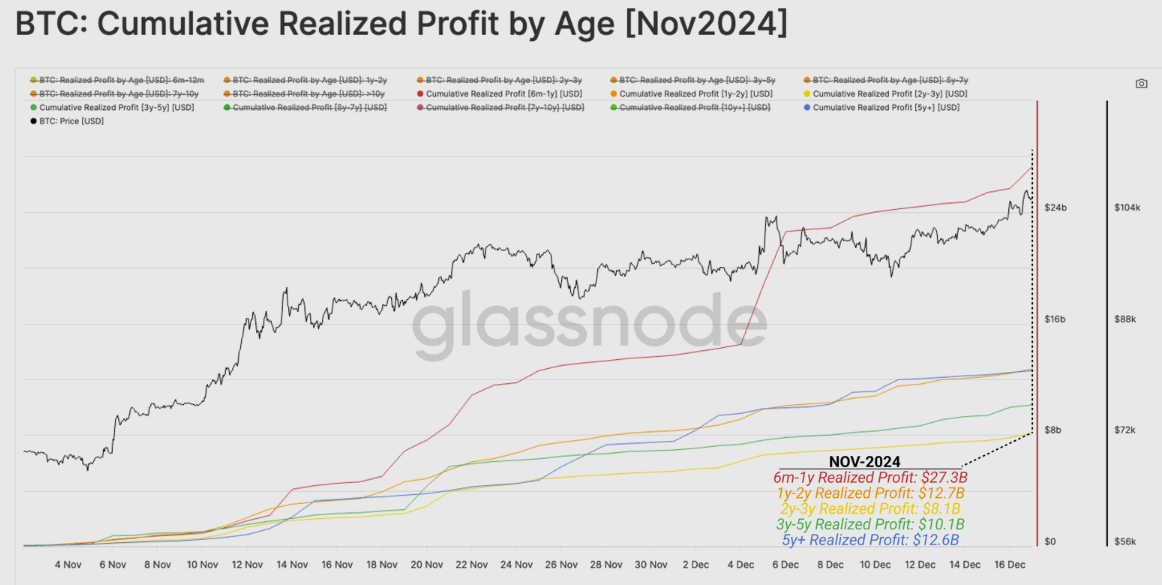

Despite the heavy profit-taking from LTHs, the analysts revealed that most of Bitcoin’s recent sell-side pressure is driven by new market entrants, particularly those who have acquired Bitcoin within the past six months to one year. This cohort has realized profits of $27.3 billion, accounting for 38.5% of the total sell-side pressure.

BTC Cumulative Realized Profits by Age | Glassnode

Glassnode concluded by highlighting the redistribution of coins from old investors, “which typically occurs during the later stages of Bull Markets.”

Share:

Cryptos feed

Search

RECENT PRESS RELEASES

Related Post