Are Investment Fees Putting Your Retirement at Risk?

December 28, 2024

(Image credit: Getty Images)

High commissions and charges, like investment fees, are maddening, whether hidden or out in the open. These pesky charges also come with a financial cost. Anyone who’s ever bought a concert ticket or made a plane reservation knows that firsthand. But what retirement savers often overlook is how investment fees can add up over time and eat into their investment performance, shrink their account balance, and even delay retirement. In fact, higher investment management fees could potentially set your retirement back by four years, according to the 2022 Mercer Retirement Readiness Barometer. Mercer’s analysis found that an individual investor paying the median level of fees (in this case, 1.9%) would not be retirement-ready until age 70, well above the traditional retirement age of 65.

In today’s world, we all need every dime of our 401(k) or IRA account balance. So, paying attention to investment fees or commissions charged by mutual funds, wealth advisors who provide financial advice, or brokerages is crucial. It’s as essential as getting your asset allocation right and building a diversified portfolio to grow your money over time without taking outsized risks.

“You can’t control the markets or where interest rates are heading, but for the most part, you can control the costs that you pay (for your investments and portfolio),” said James Martielli, head of investment & trading services at Vanguard. This fund firm has long espoused the benefits of low-cost investing. Minimizing costs is one of Vanguard’s four principles for investing success, which also includes setting clear investment goals, keeping a balanced and diversified mix of investments, and maintaining discipline (e.g., staying the course) over the long haul.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail.

Profit and prosper with the best of expert advice – straight to your e-mail.

Types of investment fees

Of course, it’s impossible to avoid investment fees. There’s no free lunch. Here are the costs you are most likely to encounter. Don’t be afraid or embarrassed to speak up if you don’t understand a fee or know how you are charged.

Expense ratios. No doubt, expect to get nicked by fund “expense ratios.” These fees compensate stock pickers who are trying to identify the next Nvidia. They also pay for the investment pros managing index mutual funds or exchange-traded funds (ETF) that replicate a passive index, which mimics a broad market gauge like the S&P 500. You can find the expense ratio by searching the internet on the ticker or fund name, which should retrieve a fund overview.

Loads or sales commissions. If you don’t opt for no-load mutual funds, which don’t charge a sales commission, expect to pay a sales charge used to remunerate brokers or financial advisors for their fund-picking services. I recommend you read Understanding Mutual Fund Share Classes for more on these fees.

Advisory fees. If you use a financial adviser, you’ll also pay an advisory fee. These may be based on your assets under management, such as 1% of all the assets they manage for you. Or you may find advisers who charge a flat fee.

Workplace retirement plan fees. Your 401(k), 403(b) or 457 plan might also have a quarterly or annual maintenance fee and administration fees deducted from your account balance. Be sure to ask your plan administrator or HR department for help if you can’t find or don’t understand these fees.

Transaction fees. For example, if you’re trading in your IRA, there could be transaction costs or commissions to buy and sell stocks and, in some cases, mutual funds. Online brokerages like Fidelity may have lower or no transaction fees on ETFs.

Fees compound too

The more fees you pay, the less your money is put to work in investments. Remember, what you keep is your account balance after investment costs are deducted. “These fees may seem small, but over time they can have a major impact on your investment portfolio,” an investor bulletin from the Securities and Exchange Commission’s Office of Investor Education and Advocacy warned.

“Fees can really be a drag on performance, and a lot of time, investors may not even realize there are fees associated with the individual investment choices they’ve made,” Matt Bullard, regional VP for managed solutions at Fidelity Investments, noted in a blog post, “Are fees holding your portfolio back?”

Just as your 401(k) contributions and gains compound over time, so do fees and trading costs. The result: costs add up over your lifetime. “The longer the time horizon, the more pernicious the effect,” said Martielli.

How much do fees harm my retirement investments?

OK, so how big a drag can expenses have on your retirement bottom-line? It turns out that even small costs can add up to large drags on your account balance over time, a simple investment simulation from Vanguard shows. Let’s say you have a starting balance of $100,000 (no additional contributions are made), earn 6% on your money each year and reinvest your gains.

Here’s a quick look at how your starting account balance of $100,000 would grow over 30 years given different investment costs, from Vanguard’s Principles for Investing Success.

Swipe to scroll horizontally

| 0.10% | $557,383 |

| 0.70% | $465,899 |

| 1.30% | $389,846 |

| 2.00% | $317,081 |

The takeaway: Higher costs can significantly depress a portfolio’s growth. At the end of those three decades, owning the lowest-cost portfolio would result in an account balance that is $240,302 higher than the highest-cost portfolio. And there’s even a $91,484 difference between the lowest-cost portfolio (0.10%) and the second-lowest-cost portfolio (0.70%).

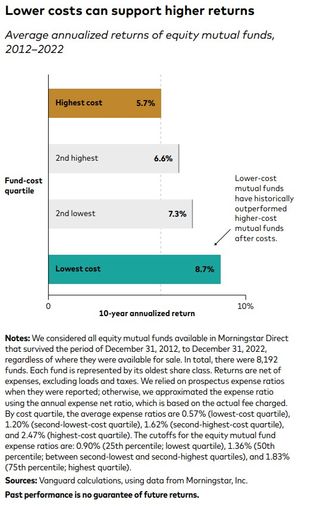

Lower costs can also support higher returns, the Vanguard study shows. The fund company looked at equity mutual fund returns over a 10-year period from 2012 to 2022, taking expense ratios into account. As shown in the chart below, the funds with the lowest fees (or ones in the lowest-cost quartile with average expense ratios of 0.57%) posted average annualized returns of 8.7%. Contrast that with the 5.7% annual return for funds in the highest-cost quartile (expense ratio of 2.47%). The conclusion from Vanguard based on this analysis is that lower-cost mutual funds (both active and passive) have historically outperformed higher-cost mutual funds after costs.

(Image credit: Vanguard)

Investment fees are declining

There is good news on the investment fee front, however. Fees have fallen in recent decades. The average expense ratio for equities (stock) mutual funds declined for the 14th straight year in 2023, according to the Investment Company Institute, an association representing the mutual fund industry. From 1996 to 2023, the average equity mutual fund’s expense ratio has dropped by 60%.

Drilling down further, the average expense ratio at the end of 2023 for stock mutual funds fell two basis points to 0.42%, and the average expense ratio for bond mutual funds held steady at 0.37%, according to ICI data.

Less-expensive investment options are also seeing fees decline. The costs for exchange-traded funds (ETFs) that track broad stock indexes like the S&P 500 and trade infrequently, for example, declined one basis point to 0.15%. The average expense ratio for index bond ETFs remained unchanged at 0.11%.

The fee compression includes both actively managed funds (or ones run by professional stock pickers whose goal is to top market benchmarks) as well as index funds that mimic or match the returns of the index they track. The average expense ratio of actively managed funds declined from 1.08% in 1996 to 0.65% in 2023. However, index funds are still the lower-fee option. ICI data show that Index fund expense ratios dipped from 0.27% in 1996 to 0.05% in 2023.

The fix? Invest in low-cost index funds or ETFs, or actively managed funds with consistent performance that charge lower fees than their competitors.

Let’s look at another example of how lower fees, all things being equal, will net you a larger nest egg. Let’s say you invested $10,000 in a fund that produced a 10% return before expenses and had annual operating expenses of 1.5%. After 20 years, you would have $49,725, according to a Fidelity analysis. In contrast, if you had invested in a fund with expenses of only 0.50%, “then you would have ended up with $60,858 – an 18% difference.”

Should I buy the cheapest ETF or mutual fund?

It’s important to point out that just because an actively managed fund has a higher expense ratio than an index fund doesn’t mean it can’t deliver better after-fee returns. Index funds can only match an index’s return, while a fund run by a stock picker might deliver market-beating returns that offset any drag from costs.

“Fees are only an issue in the absence of value,” says Fidelity’s Bullard. “If you believe in active management — that there are people out there who are skilled and smart and have access to research that may help enable them to beat the indexes — you may be willing to pay a little more for that. Some funds may be worth paying an above-average cost for.”

And when comparing actively managed funds, the one charging a lower fee isn’t necessarily better than the one charging a higher expense ratio. “Just because a mutual fund has low fees doesn’t mean it’s a good fund,” according to the Ramsey Solutions blog post, Everything You Need To Know About Investment Fees.

Yes, fees matter

“Look for a fund that has a reasonable expense ratio with a long-term track record of excellent returns and good management in place. That’s a winning combination,” advises Ramsey Solutions.

The bottom line, even for actively managed funds, is that fees matter.

“The higher the cost hurdle, the more difficult it is to outperform,” says Vanguard’s Martielli.

Read More

Profit and prosper with the best of Kiplinger’s advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Search

RECENT PRESS RELEASES

Crypto Crystal Ball 2025: Could Ethereum Updates Finally Bring Mass Adoption?

2024-12-30T15:17:59-08:00December 30, 2024|

Could Ethereum reach $4,500 by Q1 2025? Analyst predicts a major breakout

2024-12-30T15:17:56-08:00December 30, 2024|

MicroStrategy Buys Bitcoin Again, Stock Falls

2024-12-30T11:20:06-08:00December 30, 2024|

Bitcoin, Virtuals Protocol, Bitget, and more: Cryptocurrencies to watch this week

2024-12-30T11:20:04-08:00December 30, 2024|

My friend Jimmy Carter will be remembered long after other presidents are forgotten. Here’s why

2024-12-30T11:19:31-08:00December 30, 2024|

Related Post