A Data Center Fight Touches on a Big Question: Who Assumes the Financial Risk for the AI Boom?

October 17, 2024

Some of the largest companies in the world are fighting with an electric utility over how to allocate financial risk from the growth of data centers.

The case before Ohio regulators helps to make real the scope—and the stakes—of forecasts that data centers will be the leading driver of a surge in U.S. electricity demand.

I will get into the implications for the energy transition. But first, here are the players and what they are saying:

The utility, American Electric Power, has asked the state to adopt rules that would require the owners of new data centers to make long-term commitments to buy electricity that will power the facilities, and pay substantial penalties for canceling those commitments. Without such rules, other AEP consumers would be left to pick up a potentially huge tab, the company has said.

In many cases before the Public Utilities Commission of Ohio, AEP has tremendous clout as one of the 10 or so largest companies in the state by revenue and market capitalization. But this time, it’s one of the little guys, facing off against a coalition that includes affiliates of Amazon, Google, Microsoft and Meta—four of the most valuable companies in the world.

AEP said in its initial proposal in May that companies building Ohio data centers will need 5,000 megawatts of electricity generating capacity to meet their needs by 2030. For perspective, the Columbus metro area has an annual peak demand of about 4,000 megawatts.

Many of the proposed data centers will provide computing power for the use of artificial intelligence in a variety of industries. (The AEP proposal also covers energy projects related to mining cryptocurrency, which is another power-intensive industry, but smaller than data centers in both physical size and electricity demand.)

AEP will need to make investments to increase the supply of electricity, but the company wants to protect itself if some data centers close or use less power than they had planned. To account for this risk, the utility wants to charge the facilities for using a minimum of 90 percent of their contracted capacity, even if their actual use is less. AEP also wants to require an exit fee for data centers that close before operating for at least 10 years; the fee would vary based on the size of the project, and could be hundreds of millions of dollars on the high end.

The companies that operate data centers were not pleased.

“AEP Ohio’s proposal in this case seeks to impose unprecedented discriminatory tariffs and other treatment on data centers, threatening their viability and the broader economic benefits they bring to Ohio,” attorneys for the Data Center Coalition, a trade group, wrote in a June filing. “No utility in the country singles out data centers with such disparate treatment, even those utilities in markets with far more data center development to date than AEP Ohio.”

Translation: This utility in flyover country is really ticking us off.

What has followed is unusual in my decade-plus of writing about energy policy in the region. The Data Center Coalition announced last week that it had reached a “joint stipulation and recommendation” that would revise and reduce the financial requirements. This kind of filing is often similar to a legal settlement, in which parties have worked out their differences and present a unified front to regulators. But this time the signatories almost all came from one side of the issue, including coalition members, such as Amazon, Google, Microsoft and Meta. The agreement didn’t have support from key parties such as AEP, consumer advocates and the regulator’s technical staff.

AEP replied that the filing was a “Hail Mary counterproductive maneuver” and not really a settlement at all.

The commission will consider the proposals and make a decision. There is no timetable for resolution.

Testimony in the case shows how data centers have exploded in their share of electricity demand. In AEP’s Ohio territory, the facilities had demand of about 100 megawatts in 2020, which grew to about 600 megawatts this year, and will grow to 5,000 megawatts by 2030.

That’s just the beginning. AEP said it has received inquiries about additional data center projects that would have combined demand of about 30,000 megawatts.

But the docket offers no answer to a larger question: How does demand for electricity for data centers affect the trajectory of the transition away from fossil fuels?

This is a subject that equity analysts, think tanks, environmental advocates and others have spent a lot of time thinking about this year.

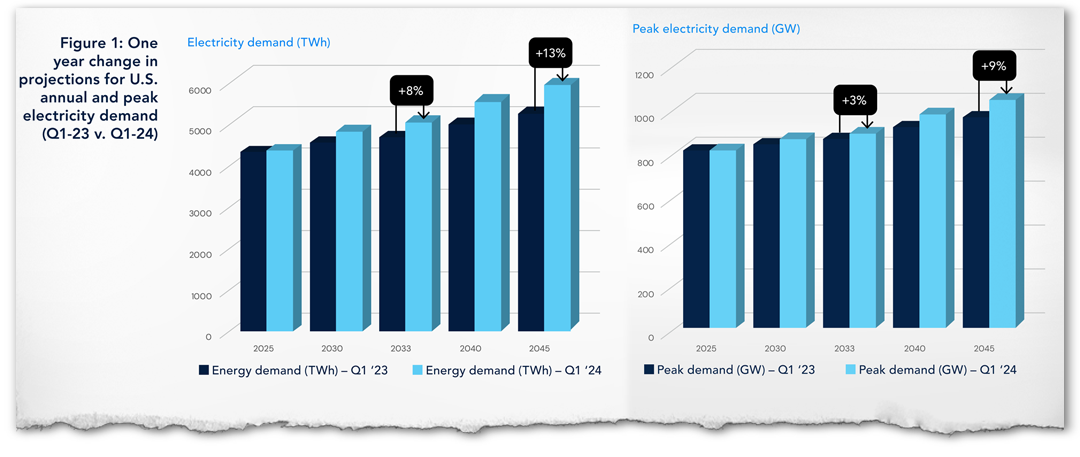

ICF, the Virginia-based consulting firm and technology services provider, issued a report last month projecting that U.S. electricity consumption will increase by an average of 9 percent per year between now and 2028. That would be a huge increase following nearly two decades of slow growth.

Such a rapid increase in consumption will lead to a strain on electricity resources and an increase in prices, with ICF projecting that utilities will see their electricity costs rise by an average of 19 percent by 2028.

“What makes this stark increase in energy demand, particularly peak demand, so challenging is that it simply wasn’t forecasted in most projections until very recently,” said the report.

There are vast amounts of solar, wind and battery storage projects in various stages of development, and they could help to meet rising demand. Some tech companies are looking to nuclear power—Google announced this week that it has a contract with Kairos Power, a business developing small modular reactors.

But renewable energy projects face years of delays because of backlogs in approving new connections to the grid and challenges in getting permits from federal, state and local officials. Nuclear projects have even longer timelines, with Kairos aiming for its first plant to be online by 2030.

“The power sector is rapidly becoming a protagonist in the AI story,” said a report last month from McKinsey and Co., the international consulting firm. “Access to power has become a critical factor in driving new data center builds.”

McKinsey is projecting that data centers will account for 12 to 14 percent of U.S. power demand by 2030, an increase from 3 to 4 percent today. Major data center hubs include Northern Virginia; Santa Clara, California; and Phoenix.

Several of the companies building data centers have corporate goals of using 100 percent renewable or carbon-free electricity by 2030. But many logistical challenges are slowing the push to build carbon-free power sources. As a result, natural gas power plants will fill some of the gaps, and the use of them will increase between now and 2030, McKinsey said.

Ben Inskeep, program director for Citizens Action Coalition, a consumer and environmental advocacy group in Indianapolis, expressed disbelief at the McKinsey report. He noted that the projected growth in electricity demand by 2030 is more than all of the solar and wind projects in the United States in 2023.

“The climate math isn’t mathing here,” he said in a post on X. “This isn’t sustainable.”

I asked him about this, and he said projections of rising electricity demand “illustrate the clear and present danger of data center load growth with respect to addressing the climate crisis.”

This story is funded by readers like you.

Our nonprofit newsroom provides award-winning climate coverage free of charge and advertising. We rely on donations from readers like you to keep going. Please donate now to support our work.

His organization on Tuesday called for a moratorium on new data centers in Indiana to allow for time to set up policies that will make sure consumers don’t end up subsidizing the building boom through higher electricity rates.

I am skeptical of forecasts showing huge increases in electricity demand. I’ve seen before how rising prices help to put the brakes on demand as projects get too expensive to be viable.

But this may be a situation that is less sensitive to price signals. I asked Pavel Molchanov, an analyst for Raymond James, the financial services company, if he thinks high electricity prices could undercut the growth in data centers.

“Data centers tend to be a high-margin business, so I do not think that rising utility rates will literally prevent any of them from being built,” he said in an email. “However, what is true is that data centers have a strong incentive to improve energy efficiency.”

He was co-author last week of a report for his clients that shows which industries are poised to benefit the most. The natural gas industry is near the top of the list.

He also sees a business opportunity for companies whose products and services help data centers use less electricity, such as CoolIT System of Canada and Qarnot of France.

The growth of data centers is a complex story, moving forward in many places and with the potential to transform several sectors. But if we boil it down to the question of whether it’s good for the transition away from fossil fuels, the answer, at this point, is “no.”

Other stories about the energy transition to take note of this week:

Electricity Demand Is Rising Faster Than Expected Globally, IEA Says: Data centers are part of a mix of industries whose appetite for electricity is fueling a faster-than-expected growth in demand, the International Energy Agency said this week. A surge in electricity demand makes it more challenging for countries to reduce carbon emissions, as Brad Plumer reports for The New York Times.

Global EV Sales Soared in September Based Largely on China’s Gains; the United States Makes Gradual Progress: Global sales of electric and plug-in hybrid vehicles rose by 30.5 percent in September compared to the same month last year, led by China surpassing its record numbers from August, according to the research firm Rho Motion. Sales in Europe returned to growth after being down last month and sales in the United States and Canada were up 4.3 percent. The sales growth in Europe is happening as elected officials in France and Germany are scaling back subsidies that support EVs, as Alessandro Parodi and Greta Rosen Fondahn report for Reuters.

Tribal Nations Want Utility-Scale Clean Energy, but Upfront Costs Pose a Barrier: The Inflation Reduction Act includes hundreds of billions of dollars for carbon-free energy projects, but developers need to be ready for years-long waits to get grid connections and some have to pay $5 million to show commercial readiness. Tribal nations feel these obstacles acutely, as Diana DiGangi reports for Utility Dive. The Alliance for Tribal Clean Energy is among the groups working to get modifications to some rules so that tribal nations have an easier time navigating the process.

EV Chargers May Borrow the Gas Station Business Model: One of the biggest business challenges hindering the growth of EV charging stations is that they tend to make tiny profits or lose money. A University of California, Davis professor suggests that charging stations should borrow the business model used by gas stations, which is to sell fuel at a loss and make a profit from selling snacks, drinks and other items, as Nicolás Rivero reports for The Washington Post.

To Meet US Nuclear Goals, Big Reactors Need to Get Built Today, DOE Says: The United States needs to deploy large nuclear reactors in volume and start today if it wants to meet its grid decarbonization goals or nuclear power targets, according to a recently updated report from the U.S. Department of Energy. Eric Wesoff of Canary Media writes that this focus on large reactors is a break from recent thinking that small modular reactors, or SMRs, would lead the way toward a nuclear renaissance.

Inside Clean Energy is ICN’s weekly bulletin of news and analysis about the energy transition. Send news tips and questions to [email protected].

About This Story

Perhaps you noticed: This story, like all the news we publish, is free to read. That’s because Inside Climate News is a 501c3 nonprofit organization. We do not charge a subscription fee, lock our news behind a paywall, or clutter our website with ads. We make our news on climate and the environment freely available to you and anyone who wants it.

That’s not all. We also share our news for free with scores of other media organizations around the country. Many of them can’t afford to do environmental journalism of their own. We’ve built bureaus from coast to coast to report local stories, collaborate with local newsrooms and co-publish articles so that this vital work is shared as widely as possible.

Two of us launched ICN in 2007. Six years later we earned a Pulitzer Prize for National Reporting, and now we run the oldest and largest dedicated climate newsroom in the nation. We tell the story in all its complexity. We hold polluters accountable. We expose environmental injustice. We debunk misinformation. We scrutinize solutions and inspire action.

Donations from readers like you fund every aspect of what we do. If you don’t already, will you support our ongoing work, our reporting on the biggest crisis facing our planet, and help us reach even more readers in more places?

Please take a moment to make a tax-deductible donation. Every one of them makes a difference.

Thank you,

Search

RECENT PRESS RELEASES

Related Post