Analysts: Ethereum Could Outperform Bitcoin in January 2025

December 26, 2024

Ethereum (ETH) may outpace Bitcoin (BTC) in January 2025, according to analysts predicting a potential altcoin market surge.

MN Capital founder Michael van de Poppe anticipates that ETH’s relative strength against BTC, measured by the ETH/BTC ratio, could break through 0.04—a level not seen since December 2024. This development is fueling expectations of a bullish movement for Ethereum, possibly catalyzing an “altcoin run.”

Historical Performance Signals Positive Momentum

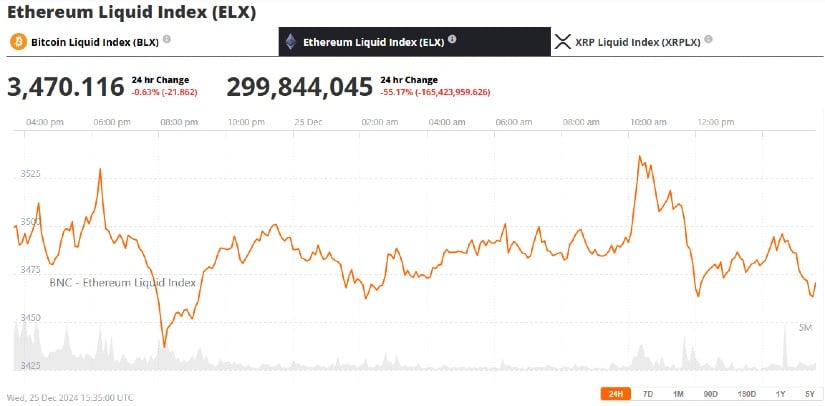

Ethereum (ETH) price chart. Source: Ethereum Liquid Index (ELX) via Brave New Coin

Ethereum’s track record in Q1 highlights its potential for significant gains. According to Coinglass data, ETH has averaged a 92% increase in Q1 since 2017, with January alone delivering an average of 23% growth. This historical precedent provides a strong foundation for optimism regarding early 2025 price activity.

Bitcoin (BTC) price chart. Source: Bitcoin Liquid Index (BLX) via Brave New Coin

Additionally, Ethereum’s current market behavior suggests upward potential. As of late December, the ETH/BTC ratio climbed 3.26% over 30 days, while ETH hovered around $3,472. Bitcoin, on the other hand, traded slightly below its record-breaking six-figure milestone at $98,805, as reported by CoinMarketCap.

Institutional Adoption and ETF Trends

Spot Ether exchange-traded funds (ETFs) are attracting growing institutional interest, further bolstering Ethereum’s appeal. Nate Geraci, president of The ETF Store, commented that net inflows into ETH ETFs are on pace with gold ETFs, signaling a shift toward Ethereum among institutional investors. He anticipates accelerated inflows as 2025 progresses.

This trend holds particular importance given the dynamic nature of the cryptocurrency market. Spot ETFs provide investors with a simplified avenue to gain exposure to assets like ETH, promoting wider adoption and increased market liquidity. Analysts suggest that the growing traction of ETH ETFs could eventually outpace that of Bitcoin ETFs, driven by Ethereum’s diverse applications and versatile ecosystem.

Catalysts for an Altcoin Rally

An increase in Ethereum’s relative strength might lead to Bitcoin price consolidation, redirecting inflows toward Ethereum and altcoins within its ecosystem. Tokens such as Shiba Inu (SHIB) and Mantle (MNT), which recently posted gains of 7.1% and 3.3% respectively, could benefit from this shift.

Source: X

Ethereum’s network advancements also position it as a leader among altcoins. Upgrades under Ethereum 2.0 aim to improve scalability, energy efficiency, and transaction speeds, enhancing its attractiveness to both developers and investors. These technological improvements may reinforce Ethereum’s market dominance and stimulate broader ecosystem growth.

Staying Informed Amid Cryptocurrency Volatility

While Ethereum’s prospects are promising, analysts emphasize the need to consider potential risks. Macroeconomic uncertainties, regulatory developments, and market volatility could impact cryptocurrency performance. For instance, tightening global monetary policies or unfavorable legislative changes might temper bullish momentum.

Nevertheless, long-term Ethereum advocates remain optimistic. Pseudonymous trader Brent recently described ETH as “the most under-owned asset in the world,” suggesting its untapped potential. Similarly, Into The Cryptoverse founder Benjamin Cowen predicts that ETH’s underperformance against BTC may soon reverse, paving the way for stronger price action over the next six to twelve months.

Ethereum’s combination of historical performance, increasing institutional adoption, and ecosystem advancements suggests it could outperform Bitcoin in early 2025. Analysts foresee a favorable market environment that may spur an altcoin rally and redefine cryptocurrency trends. As with all investments, stakeholders are encouraged to remain vigilant and informed, ensuring their decisions align with market conditions and individual risk tolerance.

Search

RECENT PRESS RELEASES

Related Post