Analyzing Ethereum’s market sentiment as 2024 wraps up

December 28, 2024

- ETH’s NVT ratio dropped, meaning that the token was undervalued

- Market indicators revealed that selling pressure on ETH was high

Altcoins’ trading volumes fell sharply in the final days of this year, and Ethereum [ETH] also fell victim to this drop. However, will this spark a bear rally as we count the remaining days of 2024?

Ethereum’s current state

ETH‘s price dropped marginally over the last 7 days. At the time of writing, the altcoin was trading at $3,333.2 with a market capitalization of over $401 billion. In the meantime, Santiment shared a tweet revealing quite a few relevant updates.

According to the same, in the final days of 2024, trading volume fell across all crypto sectors. Overall, there has been a fall of 64% over the past week, compared to the previous week. The tweet mentioned,

“The trading downtrend of trading, particularly among speculative altcoins, is not a surprising development. With the holidays here and traders getting their year-end finances in order, the final week of December is often one of the least active times of each year.”

With all of this said, if whales continue showing their strong accumulation trend, the lack of retail participation may actually lead to at least one final big unexpected 2024 pump. All while retail pays little attention.

Where is ETH heading?

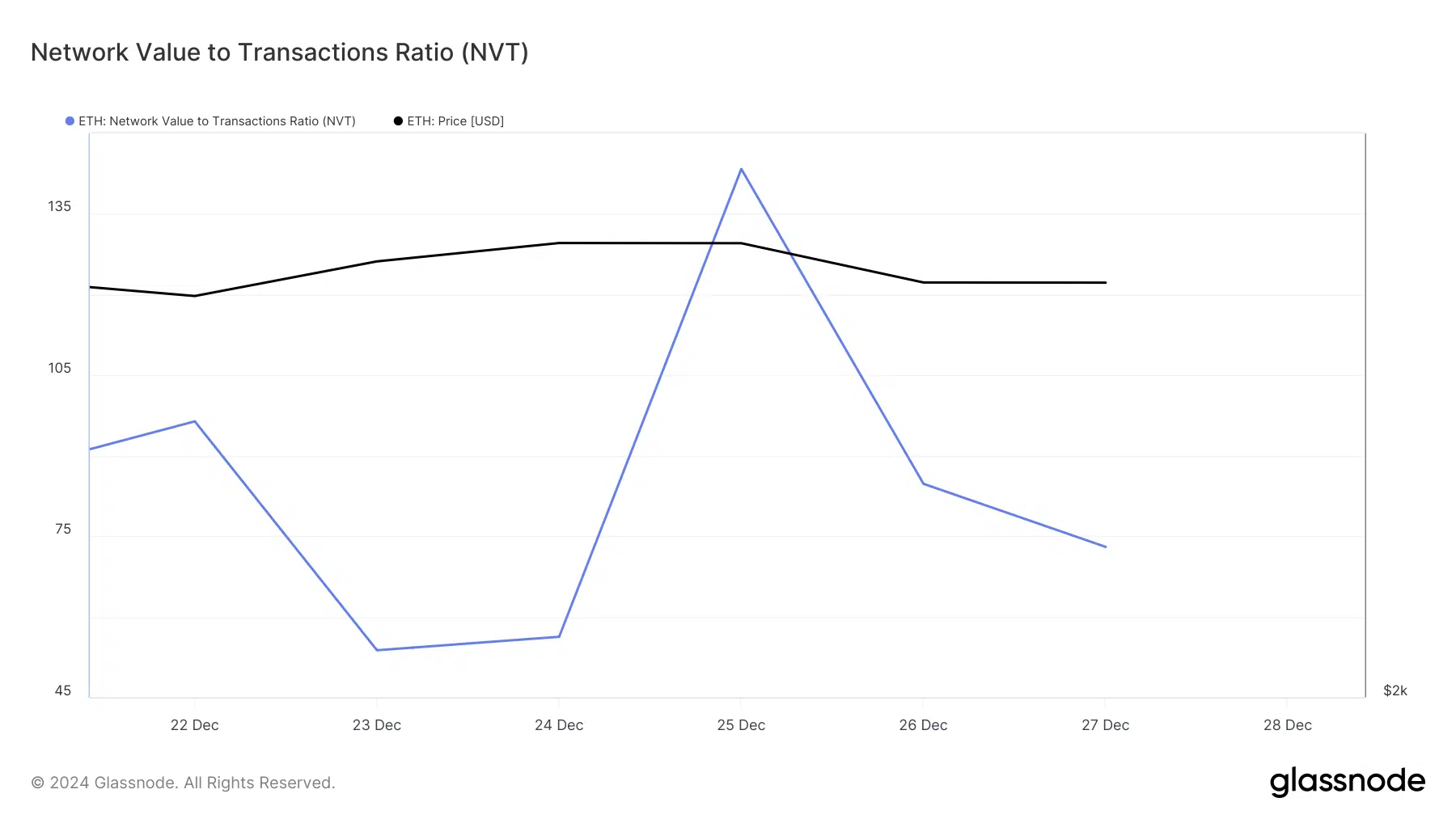

The NVT ratio dipped over the last few days. What this suggested was that Ethereum may be undervalued, hinting at a price hike in the coming days.

Apart from this, ETH’s exchange net flow has also been increasing. This meant that net deposits on exchanges were high, compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

Ethereum’s long short ratio registered a downtick too. This meant that there were more short positions in the market than long positions – A sign of rising bullish sentiment in the market.

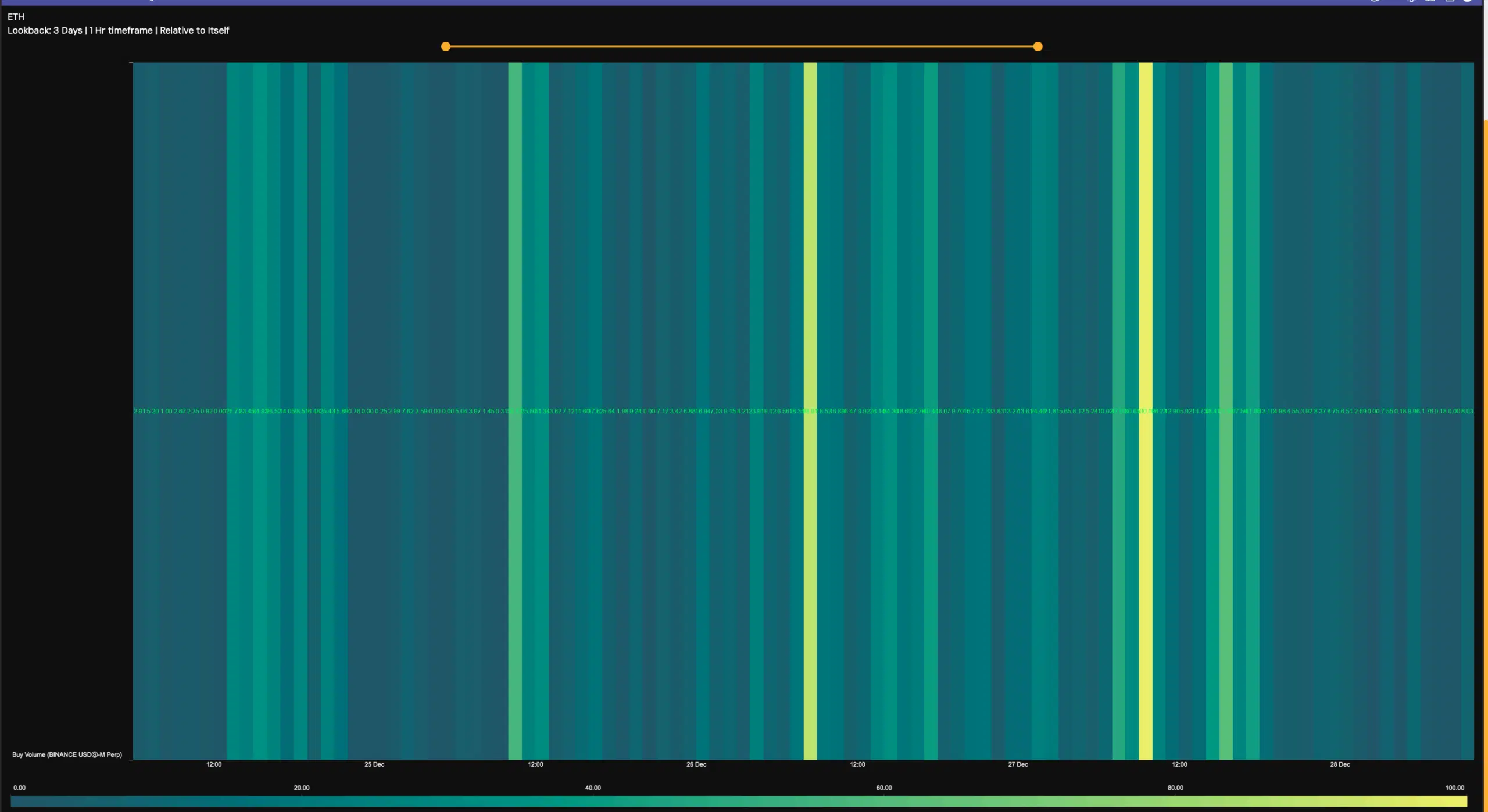

On the contrary, buying pressure on Ethereum increased lately and this can push the coin’s price up. The token’s buy volume touched 100 too. A number closer to 100 means that investors are considering buying a token.

Technical indicators continued to be in the bears’ favor though. The Chaikin Money Flow (CMF) registered a downtick. Similarly, the Money Flow Index (MFI) also moved south. Both these metrics meant that selling activity was rising, which can affect Ethereum’s prices negatively on the charts.

Read Ethereum [ETH] Price Prediction 2025-2026

In case of a sustained downtrend, ETH might drop to $3k again. However, in the event of price hike, investors might expect the token to move towards $4k again.

Search

RECENT PRESS RELEASES

Related Post