Australia’s NEM to add 150GW of solar PV, wind and energy storage by 2043

October 30, 2024

The projected increase comes as the Australian Energy Market Operator (AEMO) on Monday (29 October) revealed that over 45GW of solar PV, wind and energy storage projects are looking to connect to the NEM.

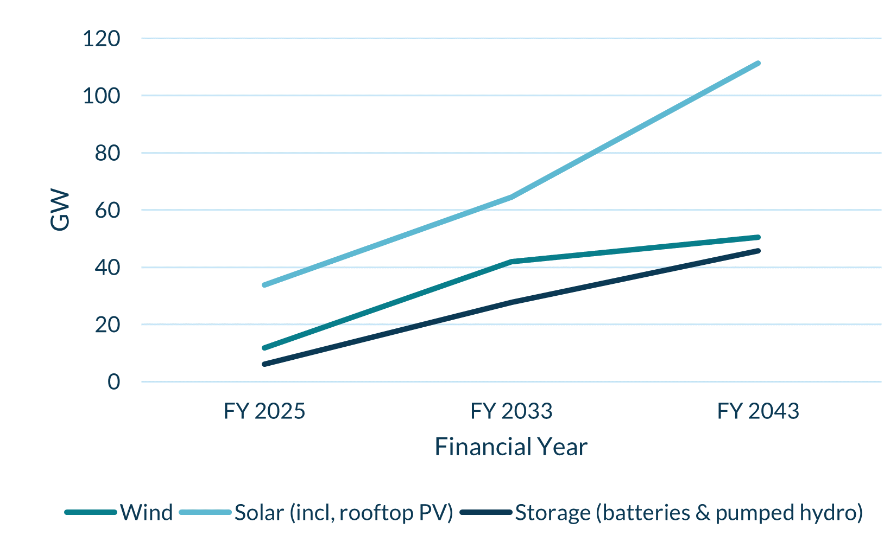

Cornwall Insight predicts that solar PV technologies, including rooftop and utility-scale solar, will lead Australia’s renewable energy future, with the research group expecting 78GW to be added over the next two decades. Wind energy, which is still a fairly nascent technology in Australia, is expected to reach 39GW, whereas energy storage will reach 40GW.

For energy storage, AEMO’s recent report indicated that 14.6GW of projects were in the NEM grid connection process at the end of Q3 2024, an 87% year-on-year increase for the technology.

Several federal and state support mechanisms introduced at the federal and state levels support Cornwall Insight’s projected rise in variable renewable energy capacity and energy storage capabilities.

Federal-level support for renewable energy and energy storage

One of the biggest support mechanisms introduced by the federal government is the Capacity Investment Scheme (CIS), which has already borne fruit in the first tender, receiving interest from 40GW of solar PV and wind energy.

At the time, Australia’s minister for climate change and energy, Chris Bowen, said: “The first auction of the CIS, which will support 6GW of new power, has received more than 40GW of project registrations, showing there is a strong pipeline of renewables ready to go with the right policy settings.”

This scale of interest certainly paints a picture of Australia’s renewable energy landscape, proving that the appetite is there to help support the nation’s goal of becoming a “renewable energy superpower” due to the country’s vast natural resources.

Earlier this month (21 October), Bowen revealed his ambition to capitalise on this growing interest and increased the next CIS tenders, earmarked for mid-November 2024, to 10GW of solar PV, wind and energy storage. Of this figure, 6GW has been dedicated to energy generation, whereas 4GW will be dispatchable power.

“This market interest confirms for me that the pipeline of good quality renewable energy projects is strong. We have very strong investment appetite for delivering more renewables quickly,” Bowen said when announcing the increase.

State-level incentives prove positive for growing renewable energy capacity

Not only are support mechanisms proving successful at a federal level, but states have introduced a variety of auctions and policy incentives to bolster their renewable energy and energy storage capability.

Cornwall Insight’s report highlights three such schemes: the Victorian Renewable Energy Target, the New South Wales Electricity Roadmap and the Queensland Renewable Energy Target.

The Victorian Renewable Energy Target (VRET) provided successful applicants with long-term contracts that create investment certainty to build new energy generation projects. The first VRET auction saw two solar PV plant projects from Enel Green Power Australia and Fotowatio Renewable Ventures with a combined generation capacity of 133MW win and 674MW of wind capacity across three projects.

The second VRET auction round saw six successful solar PV projects, four including battery storage. The six winners will add 623MW of solar PV capacity and 365MW/600MWh of battery energy storage systems (BESS), with the batteries helping to add dispatch ability to the output of the four solar farms they will be paired with.

In the neighbouring state of New South Wales, the Electricity Roadmap was introduced in 2020 under the Electricity Infrastructure Investment Act and covers a 20-year plan to deliver Renewable Energy Zones (REZs) where red tape and licensing times will be cut for renewables transmission infrastructure. Australia’s first REZ, New South Wales’ Central-West Orana, was the first to transition into the delivery phase in August 2024.

As reported by PV Tech in 2022, the state government received bids for over 5.5GW worth of wind and solar generation projects and over 2.5GW of storage systems, something that was deemed an “overwhelming response from the market” at the time by former New South Wales energy minister Matt Kean.

Further north, the Queensland Renewable Energy Target has also provided a successful platform for the state’s energy transition. The target includes 50% of Queensland’s electricity generation sourced from renewable energy by 2030, 70% by 2032 and 80% by 2035. This target provides urgency for the energy transition and has certainly proved positive in attracting utility-scale solar PV projects in the region.

It is worth noting that the recent election result, which saw the right-wing political party Liberal National Party (LNP) of Queensland, led by David Crisafulli, become the governing body, could cause uncertainty in the state’s future. The new premier had previously stated that its renewable energy targets “were not possible” and that a renewed focus could be on securing long-term grid resiliency with extensions of coal-fired power plant contracts.

Uncertainty in closing of coal-fired power plants

Perhaps a more damning revelation from Cornwall Insight’s recent research surrounds the hotly debated topic of coal-fired power stations in the country and when they will close.

AEMO predicts that coal-fired power in the country will be fully withdrawn by 2038. Clean Energy Council (CEC) CEO Kane Thornton exclusively told PV Tech at the recent All-Energy Australia 2024 event that that was the “same timeframe that we [the CEC] are working towards”.

However, Cornwall Insight predicts that coal-fired power, set to be overtaken by rooftop solar PV by the end of 2024, could be extended beyond the 2038 timeframe with question marks over whether the necessary capacity can be delivered in time.

According to the research group, while the AEMO forecasts strong growth in offshore wind, the sector remains nascent in Australia, with project delivery assumptions still untested.

Concerns around workforce shortages and other factors also led Cornwall Insight to project a longer operating life for coal plants than the AEMO, as the “necessary renewable energy infrastructure will not be built quickly enough to replace lost capacity”.

Thomas Fitzsimons, senior modeller at Cornwall Insight, emphasised that the NEM is set to go through a “significant transformation” over the next two decades.

“The projected increase in solar, wind and storage capacity across the NEM will see larger states follow South Australia’s lead as pioneering, high-renewable penetration systems,” Fitzsimons said.

“While our projections are positive, there are still a number of hurdles that need to be overcome if the energy transition is to go smoothly, not least workforce shortages. Labour constraints limit the rollout of the new technologies (including offshore wind) and the unglamourous but essential network reinforcement projects which Australia needs.

“We have to be realistic. That said, with robust government policies and well-structured investment frameworks to broaden the technologies on offer in the NEM, the path to a greener future will become clearer and more attainable.”

Search

RECENT PRESS RELEASES

Related Post