Better Bitcoin Stock: MicroStrategy vs. KULR Technology @themotleyfool #stocks $MSTR $MCD $META $MSFT $TSLA $AMZN $BA $GM $CRM $BTC $KULR

January 3, 2025

MicroStrategy (MSTR 3.59%) and KULR Technology (KULR -14.37%) both recently generated a lot of buzz with their big investments in Bitcoin (BTC -0.21%). Microstrategy, which started buying Bitcoin in 2020, had accumulated 279,420 Bitcoins as of Nov. 10. Those holdings are worth $26.2 billion, or 35% of its enterprise value of $75.3 billion, and have largely overshadowed its core software business.

KULR, a developer of thermal management solutions for lithium-ion batteries, plans to spend 90% of its surplus cash on Bitcoin. It made its first purchase of 217.18 Bitcoins on Dec. 6. Those holdings are worth $20.4 million and equivalent to 2% of its enterprise value of $851 million.

Image source: Getty Images.

During the past 12 months, MicroStrategy’s stock rose 380% as KULR’s stock skyrocketed almost 1,800%. Let’s see why KULR outperformed MicroStrategy — and whether it will remain the better investment over the next few years.

MicroStrategy is an all-in bet on Bitcoin

MicroStrategy went public back in 1998, and it was considered a slow-growth developer of analytics software during most of the following two decades. It initially grew by locking in big customers including McDonald’s, but its growth cooled off as it saturated its market and faced tough competition from cloud-based competitors including Salesforce, Amazon, and Microsoft.

That’s why it abruptly shifted gears four years ago and started hoarding Bitcoin. That strategy has paid off so far — it spent only $11.9 billion, or an average of $42,692 per Bitcoin, for its current holdings. Bitcoin trades at about $94,000 now.

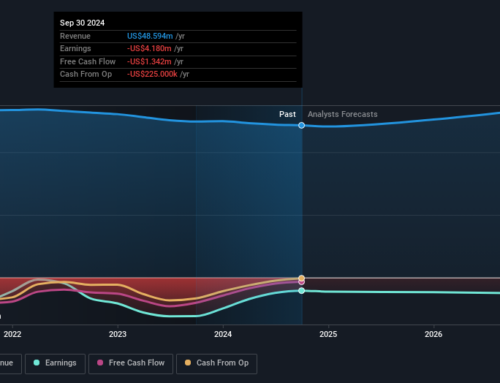

But MicroStrategy’s core software business is still struggling to grow. Its revenue dipped 1% in 2023, and analysts expect another 5% drop for 2024 as it faced tough macro headwinds. In 2025, analysts expect its revenue to grow 2% as the macro environment warms up, it expands its cloud-based subscriptions, and it rolls out more generative AI services.

On the bottom line, the company is not expected to report profit for the foreseeable future as its Bitcoin costs gobble up revenue. It’s also increased its number of shares outstanding by more than 120% over the past five years to fund its Bitcoin purchases. The bulls hope the growth of its Bitcoin holdings gradually make its software business irrelevant, but it’s still an all-in bet on Bitcoin that could face serious problems if Bitcoin’s price pulls back.

KULR’s core business still has a bright future

KULR’s recent bet on Bitcoin isn’t generating any unrealized profits yet. It paid about $21 million, or an average price of $96,557, for its current Bitcoin holdings.

Yet KULR’s core business arguably has a lot more growth potential than MicroStrategy’s aging software business. Its fiber-based products dissipate the heat of lithium-ion batteries with thermal interface materials, lightweight heat exchangers, and other ways to stop damaging overheating.

KULR initially developed those technologies for NASA before expanding across the aerospace and defense sectors. Its current partners and customers include SpaceX, Tesla, Meta Platforms, Boeing, and General Motors. Its products are customizable for a wide range of configurations, which makes them well suited for tiny spaces with strict size and weight limitations. It went public as an OTC stock back in 2018, but it grew rapidly and was eventually listed on the New York Stock Exchange in 2021.

KULR’s revenue soared 146% to $9.8 million in 2023, but analysts expect it to take a breather and grow just 4% to $10.2 million in 2024. In 2025, they expect its revenue to jump 77% to $18.1 million as it narrows its net loss from $15.5 million to $12.9 million. That growth should be mainly driven by its new government contracts. KULR isn’t an all-in bet on Bitcoin like MicroStrategy, but it’s also increased its share count by more than 160% during the past five years to fund its expansion.

The better buy: KULR

Neither of these stocks is a bargain right now. With an enterprise value of $75.3 billion, MicroStrategy trades at 120 times sales. KULR, which has an enterprise value of $851 million, trades at 59 times sales.

If I had to pick one of these Bitcoin-driven stocks over the other, I’d buy KULR because its core business is growing faster, it’s better diversified, and it looks more reasonably valued relative to its long-term growth. MicroStrategy’s stock could soar if Bitcoin hits fresh highs, but it might be smarter to simply buy Bitcoin instead of investing in its unbalanced business.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Leo Sun has positions in Amazon and Meta Platforms. The Motley Fool has positions in and recommends Amazon, Bitcoin, Meta Platforms, Microsoft, Salesforce, and Tesla. The Motley Fool recommends General Motors and recommends the following options: long January 2025 $25 calls on General Motors, long January 2026 $395 calls on Microsoft, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Search

RECENT PRESS RELEASES

Related Post