Binance Bitcoin Netflow Turns Negative Amid Accumulation, As BTC Holds Above $100K

January 7, 2025

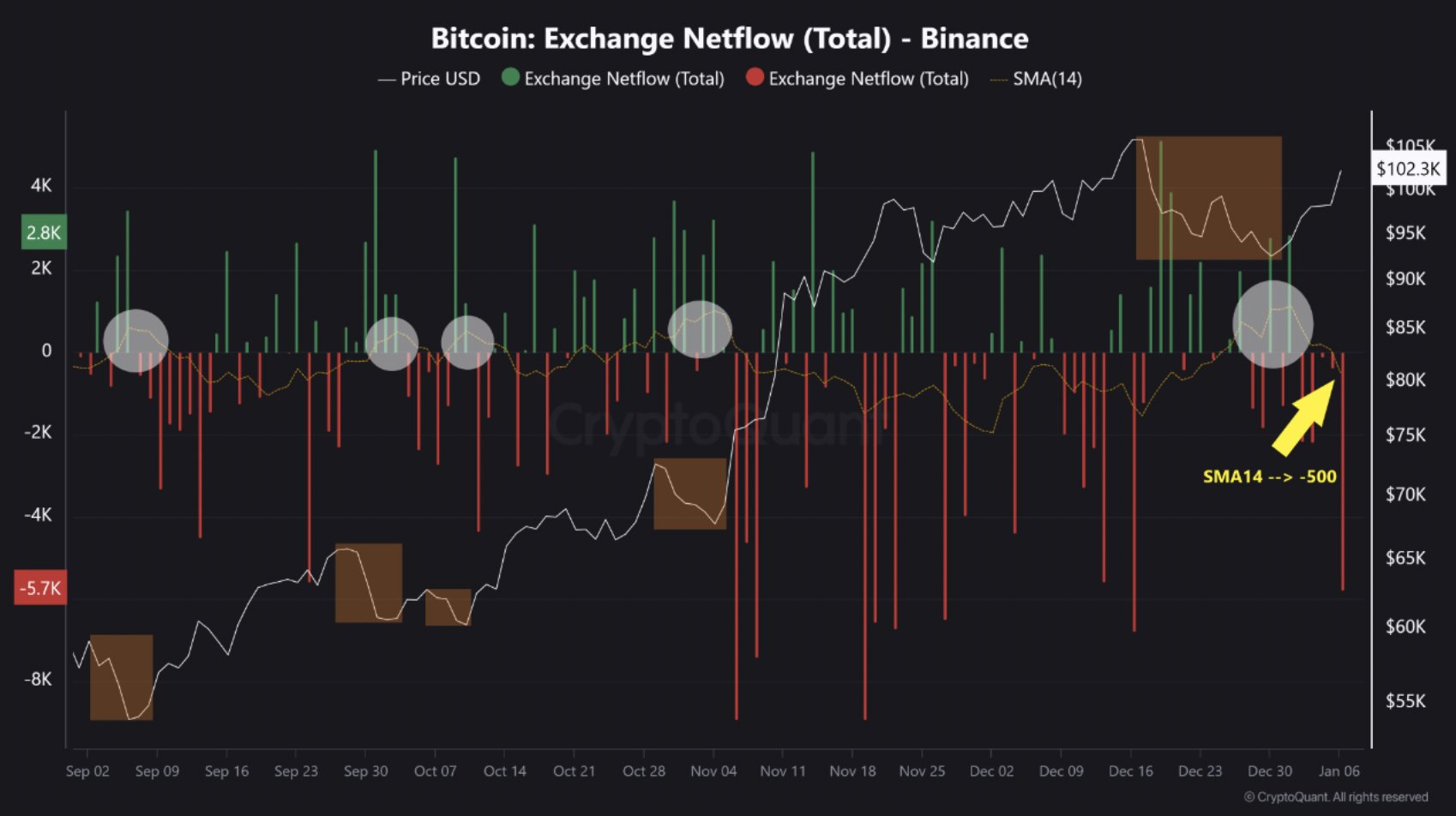

Binance’s two-week simple moving average (SMA) netflow of BTC has turned negative, signaling potential short-term bullish momentum for Bitcoin.

Bitcoin achieved a major milestone yesterday, surpassing the $100,000 mark for the first time since December 19, 2024. This surge followed multiple attempts since January 4, where the crypto faced consistent resistance and retreated by a few thousand dollars each time.

However, bulls later gained the upper hand and propelled Bitcoin to a fresh yearly high of $102,700 on Monday. Notably, the premier crypto is now trading at $100,619, reflecting a 6.74% rise in the past 7 days.

Netflow Data Show Accumulation Trend

Amid the rally, Binance’s netflow data revealed a shift toward accumulation among investors. Analysis by CryptoQuant showed the Binance Netflow SMA 14 turning negative for the first time since December 25, 2024.

Historical patterns suggest that when this metric dips below zero, Bitcoin often experiences short-term bullish movements. On January 6, Binance reported a Netflow of -5,407 BTC, bringing its 14-day SMA netflow to negative 483 BTC.

These figures highlight increased accumulation activity, contrasting previous periods of selling pressure when the metric entered positive territory. According to CryptoQuant, this pattern indicates a potential short-term bullish shift in Bitcoin’s price momentum.

Retail Activity and Buying Opportunities

Parallel data analysis indicated a sharp drop in retail demand, which some analysts interpret as a bullish signal. CryptoQuant’s review of 30-day retail demand variation highlighted that demand surged by over 30% as Bitcoin approached $100,000, aligning with the establishment of a local top at $108,000.

Following a correction, retail demand variation plummeted to -16%, a level historically associated with ideal buying opportunities. While a measured increase in retail participation is generally positive, the sharp decline underscores the shifting dynamics in Bitcoin’s investor base, where retail activity has diminished as quickly as it rose.

Coinbase Premium Index and Derivatives Data

Adding to the bullish sentiment, the Coinbase Premium Index crossed its two-week Simple Moving Average for the first time in nearly a month. This crossover, observed when Bitcoin traded at $98,100, marked renewed U.S. buyer activity and was followed by a 4% price increase to $102,000.

Additionally, derivatives market data reflected heightened trader engagement. As of January 7, open interest climbed by 2.74% to $64.86 billion. At the same time, the long-to-short ratio exceeded 1, indicating a preference for bullish positions.

Search

RECENT PRESS RELEASES

Related Post