Tesla Model Y Germany’s Best Selling Vehicle In September, Beating Iconic VW Golf

October 12, 2022

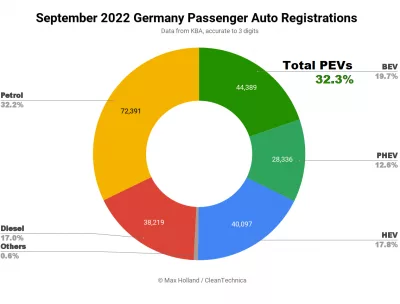

September’s combined plugin result of 32.3% comprised 19.7% battery electrics (BEVs), and 12.6% plugin hybrids (PHEVs). This compares to respective shares of 17.1% and 11.6% a year ago.

Whilst overall auto market volume grew 14% from September 2021, the volume of BEVs grew by a more healthy 31.9% YoY, to 44,389 units. PHEV volume grew by 24% YoY, to 28,336 units.

Petrol-only powertrains saw their 2nd lowest monthly share in the modern era (32.2%), nearly equaling last December’s all time low (32.1%).

Germany’s Best Selling BEVs

With Tesla’s local production at Grünheide now picking up (recently passing 2,000 units per week), the Model Y had a knockout month in September, with a massive 9,846 units registered, the most of any vehicle, of any powertrain. The Model Y even beat the VW Golf’s 7,095 units!

The Model 3 took the #2 spot in the BEV ranks, and the Volkswagen ID.4/5 variants took #3.

Beyond Tesla’s massive September volume, there were a few other notable developments. Hyundai was back to its strongest volume in several months (both Ioniq 5 and Kona), gaining the 6th and 7th spots.

The MG brand put in a good performance relative to recent months. The MG5 almost tripled its previous peak, with 1,013 units, coming in at #12. The new MG4 saw its first registrations in Germany (98 units).

The Polestar 2 was back to decent volume (667 units) after a recent lull, as was the Kia Niro (571 units), following its refresh.

Other first-time registrations were seen for the new Nissan Ariya (116 units) and the all new Smart “#1” (24 units). This is the Smart brand’s first ground-up-designed BEV, and is a small SUV, similar in size to the popular Hyundai Kona.

Let’s take a look at the bigger picture, via the trailing 3 month performance:

Here, the Tesla Model Y also dominates, which is a significant change from its 11th rank in the previous quarter. Back then, the Fiat 500e was leading, the Opel Corsa was #2, and the Volkswagen ID.4/5 was third.

Here’s a summary of the significant improvements in ranking since April-to-June:

- Tesla Model Y up from from 11th to 1st

- Tesla Model 3 up from from 22nd to 4th

- Dacia Spring up from 12th to 6th

- Hyundai Ioniq 5 up from 14th to 7th

- BMW i3 (retiring!) up from 19th to 8th

- Seat Cupra Born up from 18th to 9th

- Audi Q4 e-tron up from 17th to 10th

- Opel Mokka up from 24th to 13th

- Renault Megane up from 32nd to 18th

On the downside, these BEV models lost position:

- Opel Corsa down from 2nd to 10th

- Hyundai Kona down from 4th to 11th

- VW e-Up! down from 6th to 14th

- Skoda Enyaq down from 7th to 17th

- Audi e-tron down from 8th to 16th

- Renault Zoe down from 9th to 20th

- Smart Fortwo down from 10th to 38th

Some of the changes in position are due to temporary decisions about how to allocate scarce supply across the various European markets, so don’t necessarily indicate changes in demand.

Let’s finally look at the manufacturing group rankings for the trailing 3 months:

Here we find Volkswagen Group still at the top just as it was in the April-to-June period. Now, however, Tesla has dramatically recovered to #2 (from #7 previously), nudging down Stellantis, Hyundai Group, and Renault-Nissan Group each by one spot.

BMW Group has stayed at #6, and Mercedes has fallen from #5 to #7.

Outlook

Germany’s auto manufacturers still face immense cost pressure and production barriers, both from much higher energy prices and a now unavoidable and already-present deficit in the amount of natural gas physically available in the country, even as winter approaches.

With no significant new gas supply able to quickly come online, this deficit may persist for a long time (it takes at least a year or two to build LNG terminals). Industries and workers cannot realistically be mothballed for years, wait for gas volumes to resume, and then emerge unscathed.

Towards the end of September, Reuters (and other agencies) reported on tens of thousands of German citizens holding protest marches across the country, including calls to get the Nordstream 2 pipeline operating, to alleviate Germany’s gas and energy shortages.

Within a few days of these marches and calls, the Nordstream pipeline option was “forcibly closed” by explosions, coordinated by what German police are viewing as an as-yet-unnamed state actor. This sabotage unambiguously cuts off what some Germans considered a possible energy solution for national industry’s survival. The foreclosure of this potential source may also affect survival chances of poor and elderly citizens hoping to protect themselves from cold this winter.

Since the German industrial economy is the key pillar of Europe’s economic health, the pipeline destruction is potentially a major economic problem. Who would do such a thing? Whilst the natural reaction is of course to blame Russia, some experienced and connected Western officials have different explanations. Whoever did it, do the Germans (and other impacted Europeans) have any sovereignty remaining to be able to respond?

That seems unlikely. The German government’s international media outlet, DW, has remained inexplicably silent on who may have been behind the attack, not having published a single article about Nordstream for almost two weeks. The same is true across most of the mainstream European media landscape, and politicians across Europe have remained largely silent.

If Germany (and Europe) is this politically weak in not standing up to, and calling out, outside attacks on its critical infrastructure, then presumably there is correspondingly little hope that the German auto industry will receive the governmental support and direction that it needs to emerge from the energy crisis unscathed.

This weakening of Germany industry will obviously put a dampener on the (economically central) national auto industry’s ability to supply EVs to help transition German and European vehicle fleets to electric.

Consumers still able to afford new vehicles will likely still be attracted to the energy savings (and thus cost running savings) potential of EVs compared to combustion cars, so their relative share of vehicle demand should remain high. But supply will likely not be able to keep up, so waiting lists for BEVs will continue to be long, and share of new sales may not increase as quickly as it has over the past couple of years.

I would hope that BEV share might climb from the current ~20% market share to above 25% in December, but we will have to wait and see. What are your thoughts on the prospects for Germany’s auto industry, and the speed of the transition to EV? Please jump in to the comments below to share your perspective.

Search

RECENT PRESS RELEASES

Related Post