Chinese companies use Biden’s climate law to expand their solar dominance

November 1, 2024

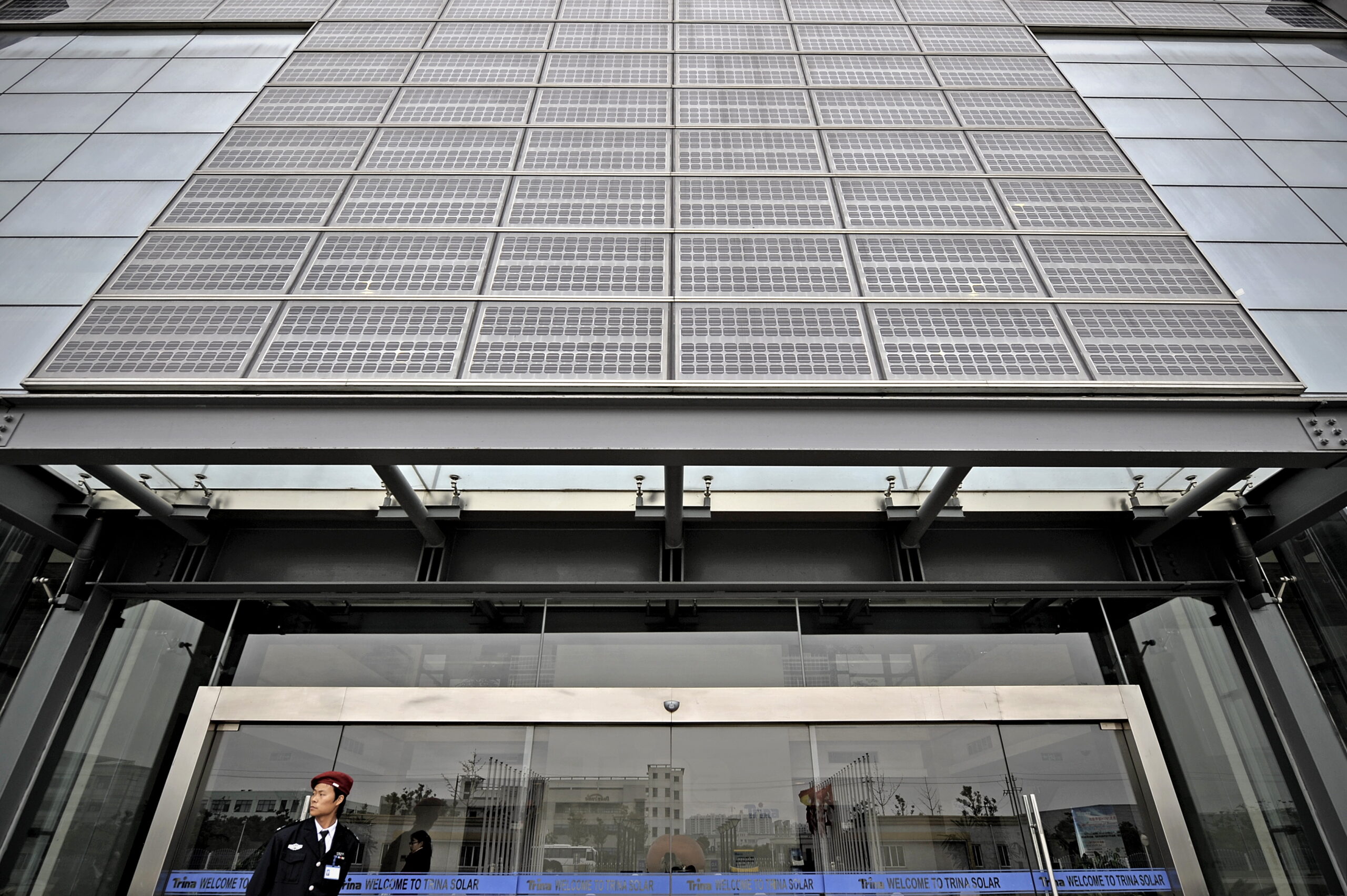

A year ago, the Biden administration accused one of China’s largest solar manufacturers of evading American tariffs. Now the company is building a massive panel factory in Texas — and it could receive more than $1 billion in tax subsidies under President Joe Biden’s signature climate law.

The strategic move by Trina Solar marks an emerging dilemma for U.S. officials: Should America reward the companies of one of its biggest adversaries for creating domestic jobs and expanding clean energy?

Giving billions in taxpayer money to Chinese businesses could drive down the cost of solar energy, create jobs and cut greenhouse gas emissions. But it could also sideline American manufacturers that are struggling to compete with cheap Chinese-made imports and sink U.S. efforts to build clean energy technologies at home.

Trina’s factory is exactly what White House officials envisioned spurring when Biden signed the Inflation Reduction Act in 2022 — except that it is owned by a Chinese company. Even worse, to the company’s critics, the Biden administration itself has accused Trina of skirting U.S. tariffs on China by routing its shipments through Southeast Asia.

A White House official, speaking on the condition of anonymity, noted the climate law contains no provisions preventing Chinese solar companies from receiving tax credits under the IRA.

But leaders in Wilmer, where the facility is under construction, welcome Trina’s plans to employ 1,300 local people and offer an annual payroll of $80 million.

The city’s nonpartisan mayor, Sheila Petta, called the company’s arrival “a blessing.”

“The people with Trina have been marvelous,” she said. “I’ll be honest with you, I wish I had a few more companies like that.”

Not everyone agrees. The prospect of China benefiting from Biden’s climate law has triggered fierce debate on Capitol Hill, where there are mounting calls to bar Chinese companies from receiving IRA money. The issue has also fractured the U.S. solar industry, pitting manufacturers worried about cheap Asian imports against developers and installers that rely on inexpensive equipment from overseas.

It comes amid a razor-thin race between Vice President Kamala Harris and former President Donald Trump, both of whom have voiced concern about China inundating U.S. markets with goods such as solar panels.

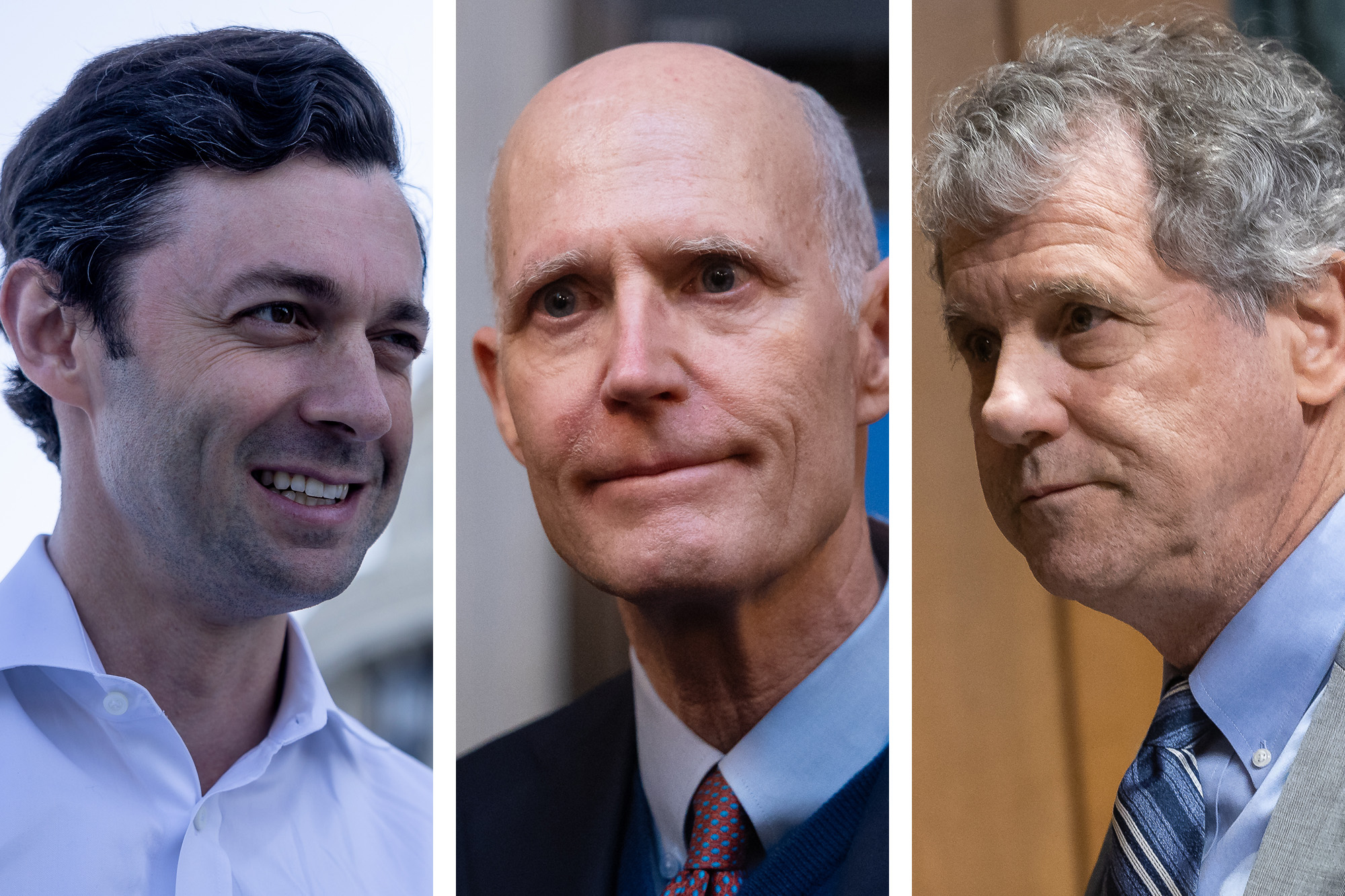

“Communist China has been working to circumvent U.S. laws and undermine American manufacturers in the solar industry for years under the Biden/Harris administration, harming our national security and energy independence,” Sen. Rick Scott, a Florida Republican, said in July, when he filed a bill with two Democrats to bar Chinese solar manufacturers from receiving IRA tax credits.

It wasn’t supposed to be this way. When Biden and congressional Democrats passed the IRA, they hoped it would unleash a “Made-in-America” clean energy revolution. The law lavishes subsidies on companies to build factories that make solar components, in an effort to revitalize the country’s manufacturing base and wrest control of clean energy supply chains away from China.

Only now, Chinese companies are coming to America.

Trina could net almost $1.8 billion in American tax subsidies over the next seven years if it gets the Texas factory fully running by the beginning of 2025, according to analysts at the consultancy BloombergNEF.

It is hardly alone. Eight companies linked to China have spent more than $1.2 billion to build 23.6 gigawatts of module capacity since the IRA passed, according to interviews with manufacturers and a review of Energy Department figures by POLITICO’s E&E News. About 14.5 gigawatts is already online, accounting for nearly a third of U.S. panel-making capacity. A further 7 gigawatts is under construction.

Neither the Trump nor Harris campaigns responded to requests for comment. But the issue received a brief mention during the vice presidential debate last month, when Harris’ running mate, Minnesota Gov. Tim Walz, asserted that “the largest solar manufacturing plant in North America sits in Minnesota” thanks to the IRA.

He appeared to be referring to a module factory outside of Minneapolis owned by the Canadian company Heliene. (It’s not the largest plant on the continent.)

But it drew an immediate rebuttal from Ohio Sen. JD Vance, Trump’s running mate.

“The real issue is that if you’re spending hundreds of millions or even billions of dollars of American taxpayer money on solar panels that are made in China, No. 1, you’re going to make the economy dirtier,” Vance said.

The exchange highlights the stakes for the solar industry. The degree to which IRA funding goes to foreign manufacturers could affect the number of U.S. solar installations and new jobs — both of which are vital to fostering public support for clean energy, analysts said.

“You’ve got to have a larger sprinkling of benefits from these projects, not just to reduce emissions, but also tangible jobs and local investments because that’s what’s really going to hold the politics together,” said David Victor, a professor at the University of California San Diego who studies the energy transition. “It was that promise that was why the IRA, I think, got done in the first place.”

Some U.S. manufacturers think more trade protections are needed to realize the political and economic benefits of the law. A coalition of solar equipment makers filed a petition with federal trade regulators in April, arguing that Chinese firms were engaged in illegal trade practices and asking for additional tariffs. The Commerce Department agreed in a preliminary decision announced last month and issued an initial round of penalties.

“We have these generational, once in a lifetime investments in solar manufacturing made possible by the Inflation Reduction Act, and we have to have the enforcement to back it up so that those investments are not undercut by unfair and illegal trade,” said Tim Brightbill, a lawyer representing the American Alliance for Solar Manufacturing Trade Committee, the coalition seeking additional tariffs.

But many renewable energy developers and industry analysts worry that attempts to block Chinese companies from U.S solar markets could backfire, stunting an industry that has grown under Biden’s climate agenda.

They say the U.S. should pursue a strategy it employed in the 1980s, when policymakers forced Japanese automakers to set up factories in the U.S. before selling cars to American motorists.

“There is this kind of global innovation system that I think has been one of the primary reasons why we’ve had this miracle of the cost of solar falling so much,” said Gregory Nemet, a professor at the University of Wisconsin who wrote a book on the solar supply chain. “To put up walls and to put up barriers, I think we’re going to squander some of that.”

An American renaissance — with China’s help

Few companies illustrate the trade-offs facing the U.S. more than Trina. The Changzhou-based company ranked fourth in global panel shipments in 2023 and was one of five companies with links to China cited by the Commerce Department last year for evading American tariffs.

Like many Chinese firms, most of Trina’s shipments to the U.S. come from Southeast Asia. In 2023, almost 80 percent of U.S. solar module and cell imports came from Cambodia, Malaysia, Thailand and Vietnam, according to the National Renewable Energy Laboratory.

In its ruling last year, Commerce said Trina was making solar components in China and shipping them to Thailand for “minor processing” to evade American tariffs enacted during the Obama administration.

Trina is appealing has appealed the department’s ruling.

Yet the decision may have had little impact on solar imports. The Biden administration issued a two-year moratorium on the penalties that Trina and other companies faced. That gave them time to move their supply chains outside of China. In Trina’s case, the company avoided paying any penalties in part because it opened a factory in Vietnam to make wafers, a key component of solar units.

Trina was penalized, however, in a separate trade decision by Commerce. The department determined that a number of solar companies operating in Southeast Asia had received unfair subsidies. It levied a 0.14-percent tariff on Trina shipments into the U.S., a minimal amount compared with the 23.06 percent penalty Commerce handed down to other companies.

A month after Commerce announced its decision last year, Trina unveiled a plan to open the module factory in Wilmer. The Texas community of 7,000 people is on Interstate 45 south of Dallas — a hub of corporate distribution centers for companies such as Procter & Gamble, Nike and Whirlpool. Trina would be the city’s largest manufacturer, said Petta, the mayor.

The 1.3 million-square-foot facility will have a production capacity of 5 gigawatts annually when it becomes fully operational next year — enough to power 500,000 homes a year.

The factory puts Trina at the center of an American renaissance in solar manufacturing. In August, the National Renewable Energy Laboratory estimated that nearly 90 percent of U.S. module capacity, or 35 gigawatts, has come online since passage of the IRA two years ago.

First Solar, an Arizona-based company that makes a thin-film panel as an alternative to common crystalline silicon models, is on a building spree. It recently upgraded two of its three solar plants in Ohio, completed a facility in Alabama and is building another factory in Louisiana. In Georgia, the South Korean panel-maker Hanwha Qcells has built two factories. One is also expected to begin producing subcomponents such as wafers and cells next year.

And Heliene, the Canadian panel-maker with a factory in Minnesota, has announced a partnership with an Indian company to build a cell manufacturing facility near Minneapolis. The plant is expected to receive wafers from a planned factory in Tulsa, Oklahoma, that’s being built by the Norwegian company NorSun.

“We’re doubling down,” said Heliene CEO Martin Pochtaruk. The combination of U.S. trade protections and mounting support among congressional Republicans for elements of the IRA have made investments “more feasible,” he said.

Chinese companies agree. JinkoSolar quintupled the size of an existing panel factory in Florida. Runergy recently opened a 2-gigawatt factory in Alabama. And Hounen Solar started making modules at a 1-gigawatt factory in South Carolina.

As for Trina, the company has long planned to establish a foothold in the U.S. to better serve its American customers. But the cost of making panels in the U.S. was prohibitive, said Steven Zhu, who leads Trina’s North American operations.

The IRA changed that.

“We bring the jobs, we bring the money, we bring the technology, we bring a lot of things to the market in order to help this market to be grown,” Zhu said. “Our customers appreciate that. Our suppliers appreciate that also. And maybe some of our competitors are not very happy about it.”

Indeed, they are not.

The global price of solar panels plummeted to 10 cents per watt in the third quarter, lower than the cost of producing some modules, according to NREL. Prices in the U.S. are higher, around 33 cents per watt, because American tariffs shield the market from some cheap Chinese panels.

“Unfortunately, China’s playbook for solar is the same as it is in electric vehicles and semiconductors and batteries, which is where the government to heavily subsidize the industry to develop massive overcapacity, and then to ship that overcapacity around the world, and in particular to the United States” said Brightbill, of the American Alliance for Solar Manufacturing Trade Committee. “We need a different approach.”

The group includes Korea’s Qcells, Swiss solar manufacturer Meyer Burger and First Solar.

Calls for additional tariffs have prompted protests from renewable energy developers, who say the U.S. is unlikely to jump-start its solar industry and meet its climate goals without help from China.

Invenergy, a Chicago-based renewable developer, entered the manufacturing sector after the pandemic snarled supply chains. But it did not have experience making panels, so it sought help from its Chinese supplier LONGi, said Art Fletcher, the head of domestic content at Invenergy.

The two companies formed a joint venture called Illuminate USA, and recently started producing panels at a new factory outside Columbus, Ohio. Invenergy is the majority owner.

“We as a country have offshored the majority of this technology for the last 25-30 years,” Fletcher said. “We have been focused on consuming the end products, but we haven’t been focused on manufacturing itself.”

Some U.S. manufacturers say the Chinese-built factories are a Trojan horse that would enable Beijing to maintain its dominance over the global solar industry, suffocating competitors.

Module assembly is the last step in the solar manufacturing process, and many of the components that go into the panels are made in China. The country controls at least 80 percent of global manufacturing of ingots, wafers and cells, according to the International Energy Agency.

That means Chinese factories in the U.S. would likely use imported components, giving Beijing even more control over the solar supply chain, said Mike Carr, who leads the Solar Energy Manufacturers Coalition, a trade group that has called for additional tariffs on Chinese components.

“You can’t just take at face value that they’re assembling modules in the U.S,” Carr said. “If there is no alternative to Chinese upstream components, like polysilicon and wafers, then you just don’t have a viable supply chain in the U.S. There is a strategic imperative to have a U.S.-based supply chain that can provide all the fundamental components.”

‘We don’t want to lose ’em’

In July, Democratic Sens. Sherrod Brown of Ohio and Jon Ossoff of Georgia joined Scott in introducing legislation to prevent Chinese companies from qualifying for a manufacturing tax credit known as 45X.

While the IRA contains provisions prohibiting Chinese electric vehicle makers from receiving tax credits, it doesn’t stop Chinese companies from collecting subsidies for making solar panels.

It’s unclear if the bill by the three senators will pass. Brown, who is facing a difficult reelection campaign, did not answer questions about the measure’s impact on joint ventures between American companies and Chinese partners.

“Senator Brown knows that China will do anything to undermine the American solar industry and its workers, including trying to infiltrate the American solar supply chain and take advantage of tax credits meant for American manufacturers,” spokesperson Kevin Donohue said in a statement.

The White House did not respond to requests for comment. Texas’ two Republican senators did not comment on Trina’s manufacturing plant near Dallas, nor its plans to accept IRA subsidies. A spokesperson for Sen. John Cornyn noted that he voted against the IRA when asked if Cornyn supports efforts to bar Chinese companies from receiving money under the climate law.

Sen. Ted Cruz did not respond to requests for comment. But Cruz did hail the opening of Canadian Solar’s 5-gigawatt factory outside Dallas last year, calling it an “incredible investment” that “will create 1,500 good-paying jobs in Texas.” Canadian Solar is headquartered in Ontario, but 80 percent ofits employees are based in China. The Commerce Department cited the company for circumventing U.S. tariffs last year.

The 45X tax credit pays factory owners based on each component that’s produced. A solar module, for instance, can receive 7 cents a watt, or $70,000 per megawatt, though the payment will get smaller beginning in 2029.

Trina’s 5,000-megawatt Texas factory stands to receive $1.775 billion from 2025 through 2032 if it operates at a 78 percent utilization rate, according to Antoine Vagneur-Jones, head of trade and supply chains at BloombergNEF. At a 60 percent utilization rate, Trina would net more than $1 billion, he said.

Prohibiting Chinese companies from receiving the credits could blunt American efforts to develop a solar supply chain, Vagneur-Jones said.

“It doesn’t bode well for catching up if you’re not willing to invite them over and learn from them,” he said.

In Ohio, Illuminate’s factory generated pushback from residents who expressed worries about China’s influence in their community. Local leaders largely dismissed those concerns, saying they came from a vocal minority.

“We’re keeping an eye on it, but we’re not going to chase away business when they’ve done nothing wrong and they’re partnering with us,” said Mike Compton, the mayor of Pataskala.

Petta, the mayor of Wilmer, Texas, said her community seems supportive of Trina’s factory and its promised jobs windfall.

“If they had any concerns, they have not said anything to me or my council,” Petta said. “We don’t want to lose ’em. Like I said, they are a great company.”

This story also appears in Energywire.

Search

RECENT PRESS RELEASES

Related Post