Crypto Today: Bitcoin taps $100K, AI Tokens surge as Ripple CEO announces US hirings

January 6, 2025

- The cryptocurrency sector valuation increased by $11 billion on Monday to reach an 18-day peak of $3.47 trillion.

- Bitcoin price crossed the $102,480 mark, on course to print a seventh consecutive green candle.

- While Ethereum underperformed, AI-related altcoins like Render (RNDR), FET and Injective (INJ) have entered double-digit gains.

Bitcoin Market Updates: Microstrategy and Metaplanet combine to spark another BTC rally above $100K

- Bitcoin winning start to 2025 entered day 6 on Monday, as BTC prices rose as high as $102,480.

- BTC year-to-date gains reached 10% with fresh inflows pouring in as global corporate markets reopened after the 2024 Yuletide hiatus.

- Microstrategy announced another purchase of $101 million worth of BTC on Monday,

- Japanese digital asset management firm MetaPlanet CEO Simon Gerovich also confirmed plans to expand its total holdings to 10,000 BTC in 2025.

The recent crypto market movements highlight growing investor interest in Layer 2 tokens and crypto AI tokens amid the positive start to 2025.

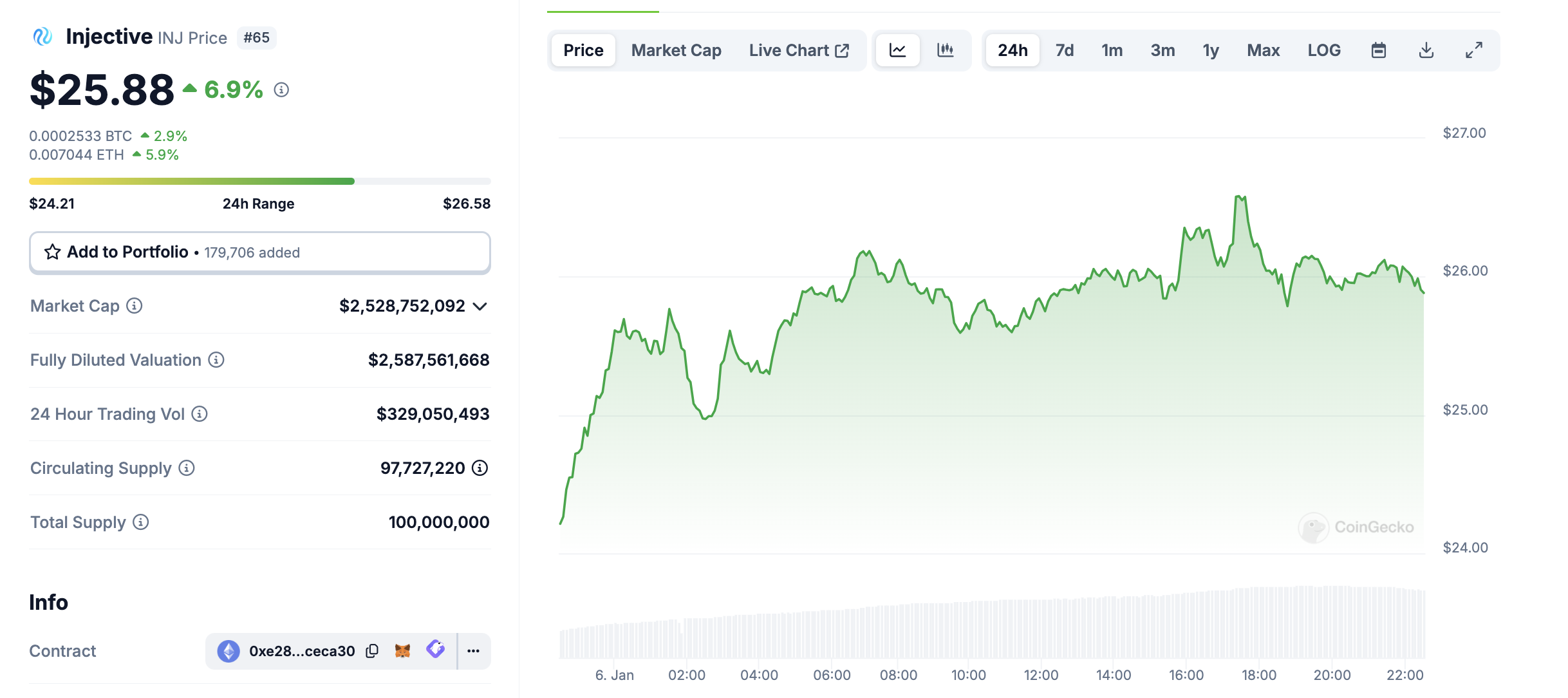

- Injective (INJ) price emerged the standout performer on Monday, rising by more than 12% as it crossed the $25 mark for the first time in 2025.

Injective (INJ) Price Action, January 6, 2025 | Source: Coingecko

Market reports suggest the INJ rally is linked to the proposed implementation of token burn auctions on the Injective layer-1 blockchain.

- Filecoin (FIL) price crossed $6 as it rose 5% today due to its listing on Bithumb, South Korea’s second largest crypto exchange, which spurred increased spot demand and speculative trading.

- Binance Coin (BNB) price also climbed 6%, breaching the $740 resistance, as intensifying trading activity spurs demand for the worlds’ largest exchange’s native coin.

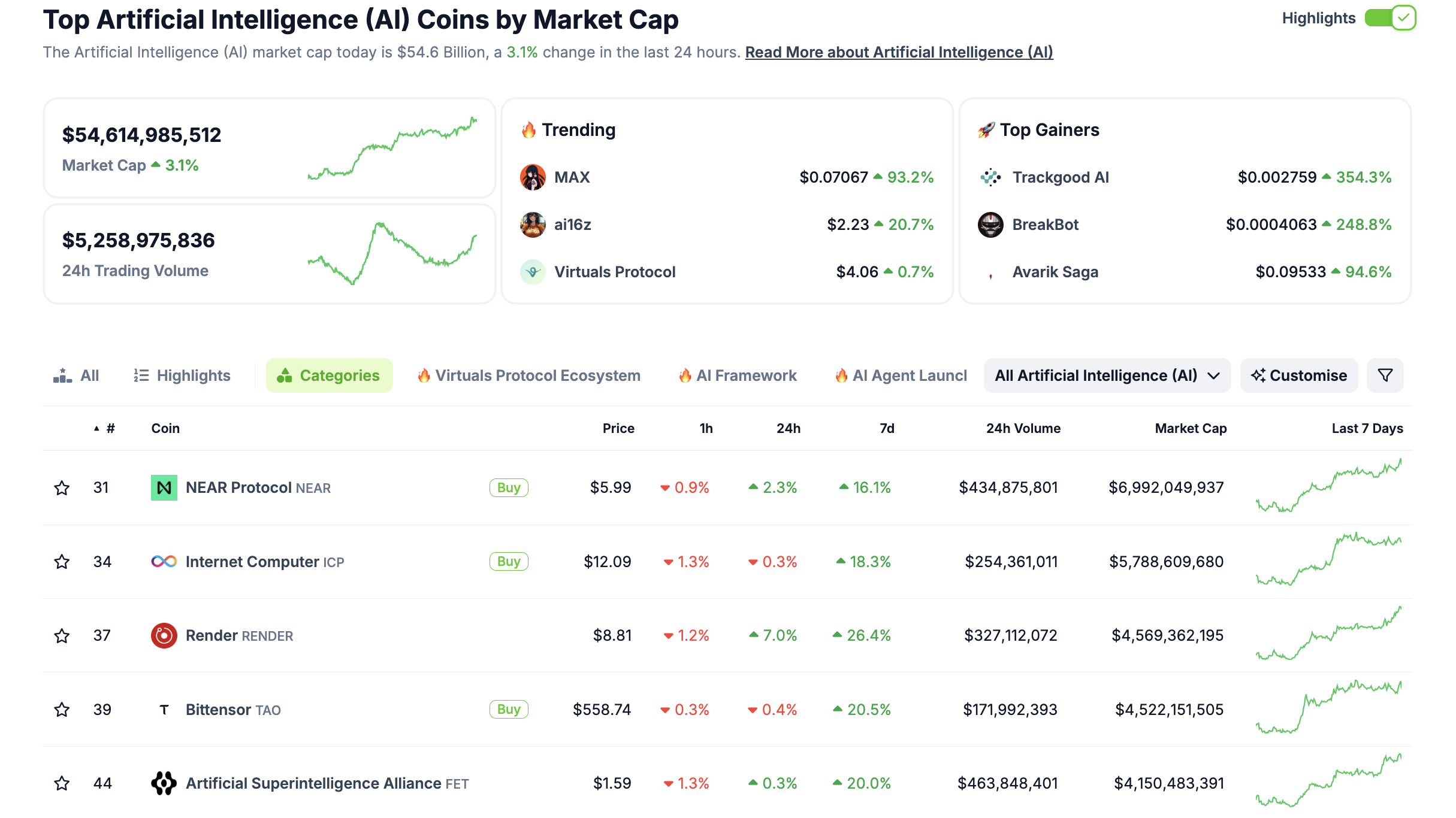

The Crypto AI sector looks set to maintain its spot as one of the more in-demand niches as the crypto industry continues its positive start to 2025.

Early indicators suggest that AI-driven projects could remain dominant throughout the year.

The sector’s market cap has surged past $54.6 billion, marking a 3% increase in the last 24 hours as of January 6.

Crypto AI Tokens Performance, January 6, 2025 | Source: Coingecko

Crypto AI Tokens Performance, January 6, 2025 | Source: Coingecko

The success of OpenAI’s ChatGPT, and advancements in chips maker NVIDIA (NVDA) has spurred global investment in AI technology.

With traditional tech giants and startups alike pouring resources into AI development, this trend is spilling over into the crypto sector, where projects integrating AI functionalities are attracting heightened interest.

Leading the charge are established players like Render (RNDR), Fetch.ai (FET), and NEAR Protocol, which have posted gains of 24.2%, 7.2%, and 12.5% respectively, over the past week.

Render has particularly benefited from its focus on decentralized GPU rendering, a critical component for AI workloads.

Meanwhile, newer players like AI16z, a memecoin combining AI narratives with blockchain, are also gaining traction.

As more crypto projects continue to explore new fronts with integration on AI and blockchain, strategic investors will keep an eye on this sector as one the major growth prospects to watch in 2025.

- Gemini Settles $5 Million CFTC Lawsuit Over Misleading Statements

Gemini Trust Co., the cryptocurrency exchange founded by Cameron and Tyler Winklevoss, has agreed to a $5 million settlement with the Commodity Futures Trading Commission (CFTC).

The settlement resolves allegations that Gemini provided misleading information in 2017 during its attempt to gain regulatory approval for the first U.S.-regulated Bitcoin futures contract.

Without admitting or denying the claims, Gemini opted to settle the case and avoid a prolonged legal battle, signaling its commitment to resolving regulatory disputes.

- Fed Vice Chair Michael Barr to Resign, Highlights Need for Stablecoin Regulation

Michael Barr, Vice Chair for Supervision in the U.S. Federal Reserve has announced plans to step down from his role in late February.

While Barr will continue serving as a member of the Federal Reserve’s Board of Governors, his decision reflects concerns about potential distractions stemming from his supervisory responsibilities.

Barr has been a key advocate for stablecoin regulation, emphasizing the need for clear frameworks to address risks associated with the rapidly growing digital asset sector.

- Ripple Labs CEO Brad Garlinghouse announces US hiring surge amid anticipated Trump Crypto policies

Ripple Labs has reported a sharp rise in US-based business deals and hiring, crediting the anticipated crypto-friendly stance of the incoming Trump administration.

In a recent post on X, Ripple CEO Brad Garlinghouse noted several significant post-election partnerships and revealed a strategic pivot toward concentrating hiring efforts in the United States.

The company’s confidence in the evolving regulatory environment is further evidenced by its $5 million XRP token donation to Trump’s inauguration.

The optimism surrounding the Trump administration’s potential impact on cryptocurrency has coincided with a 300% increase in XRP prices since the election.

Share:

Cryptos feed

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Search

RECENT PRESS RELEASES

Related Post