Ethereum (ETH) Poised to Break $4,000 and Beyond as Whales Accumulate

December 5, 2024

Ethereum (ETH) price is now 19% below its all-time high, with the potential to reach $4,000 for the first time since March 2024. Key metrics, including a rising 7-day MVRV and increased whale accumulation, highlight growing bullish sentiment around ETH.

If ETH breaks through the $4,000 level, it could begin a surge toward its previous high of $4,867, though failure to sustain this rally might result in a retest of key support levels.

Ethereum 7-day MVRV has climbed to 6.1%, up significantly from 0.28% just two days ago. This sharp increase reflects growing unrealized profits among short-term holders, indicating heightened market optimism. Historically, when ETH’s 7-day MVRV approaches these levels, it has often led to corrections.

However, there have been instances where MVRV levels extended to 7% and even 13% before any significant pullback, suggesting the current rally could have more room to run.

MVRV (Market Value to Realized Value) measures the ratio of an asset’s market value to its realized value, providing insights into whether holders are in profit or loss. Higher MVRV signals increased unrealized profits, which can lead to selling pressure, while lower values suggest undervaluation.

With ETH 7-day MVRV still below 7%, the data indicates potential for further price appreciation before a correction occurs, provided sentiment remains bullish and selling pressure does not intensify prematurely.

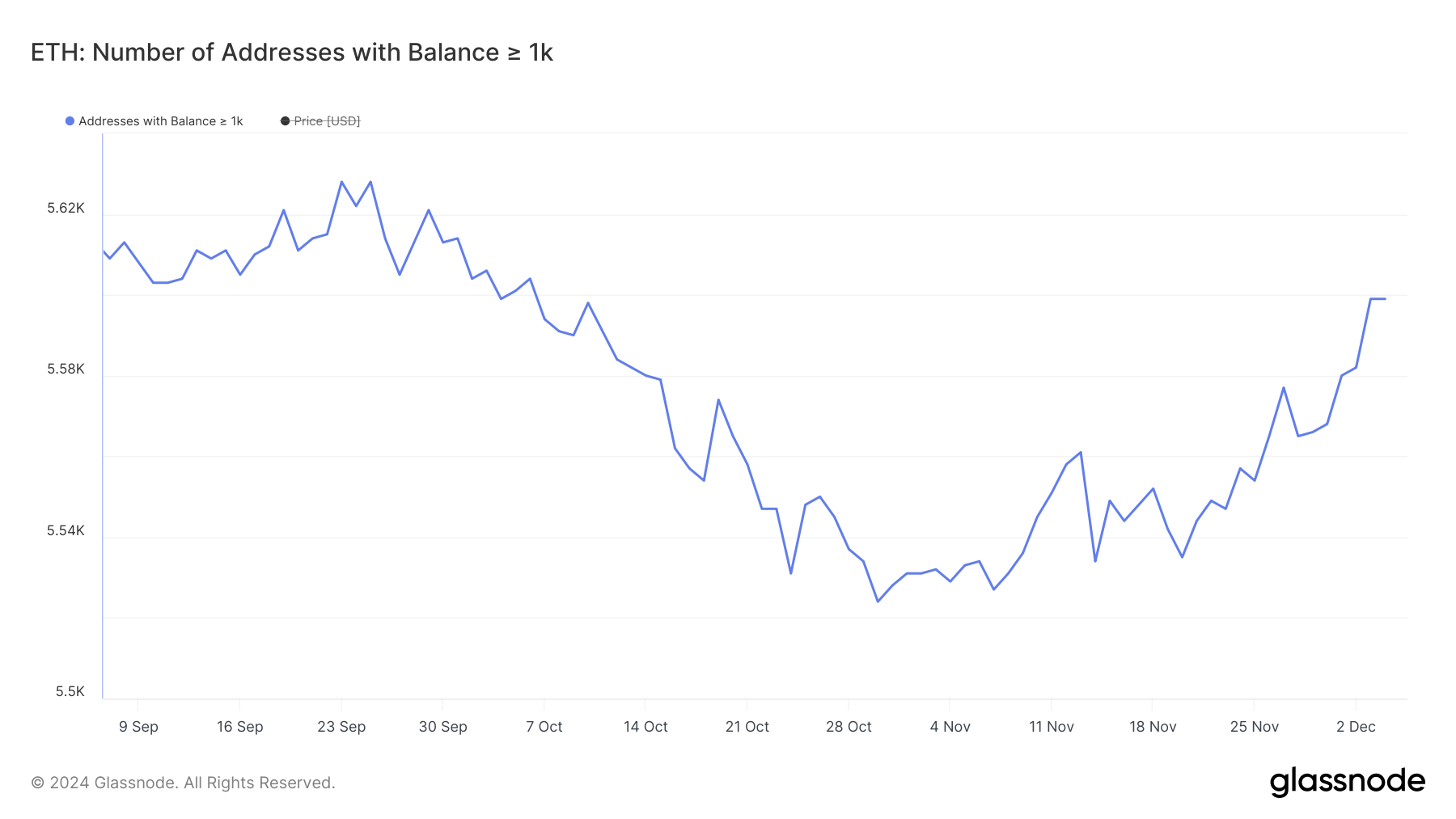

The number of wallets holding at least 1,000 ETH hit a 3-month low of 5,524 on October 30 but has since reversed its trend, showing renewed accumulation. By November 3, this metric climbed to 5,599, the highest value since October 6.

This increase suggests that large holders, or whales, are re-entering the market, potentially signaling growing confidence in Ethereum price.

Tracking whale activity is critical because these large holders often have the power to influence market trends due to the significant volumes they control.

The recent uptick in wallets holding at least 1,000 ETH could indicate a bullish sentiment among major investors. That will possibly support further price increases. If this accumulation trend continues, it may provide a foundation for sustained upward momentum in ETH price.

Ethereum price current uptrend is shown by its EMA Lines, and if it can break into the $4,000 level, it could start a new surge. Then, it could test its previous all-time high of around $4,800, as explained by Juan Pellicer, Senior Researcher at IntoTheBlock.

“Ethereum is showing strong potential to break the $4,000 level, supported by key drivers such as record institutional inflows into Ethereum ETFs, substantial whale accumulation, and heightened interest in staking-enabled ETF products. At the same time, rising layer 2 transaction volumes and increasing DeFi TVL are setting the stage for Ethereum challenging its old high of $4,867 in the near term,” Pellicer told BeInCrypto.

On the other hand, if the current uptrend isn’t strong enough and the ETH price can’t break or sustain above $4,000, it could test support zones around $3,688, $3,500, and even $3,255.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Search

RECENT PRESS RELEASES

Related Post