Ethereum (ETH) Price Momentum Weakens Despite Whale Confidence

December 25, 2024

Ethereum (ETH) price has climbed 48.19% so far in 2024, though it lags behind Bitcoin 123% gain this year. Despite ETH’s strong performance, its recent uptrend appears to be losing momentum, as the ADX indicates weakening trend strength.

Whales are accumulating more ETH, reaching the highest number of large holders since September. Key resistance at $3,523 will be crucial in determining whether ETH can extend its rally toward $4,100 or face a pullback to test lower support levels.

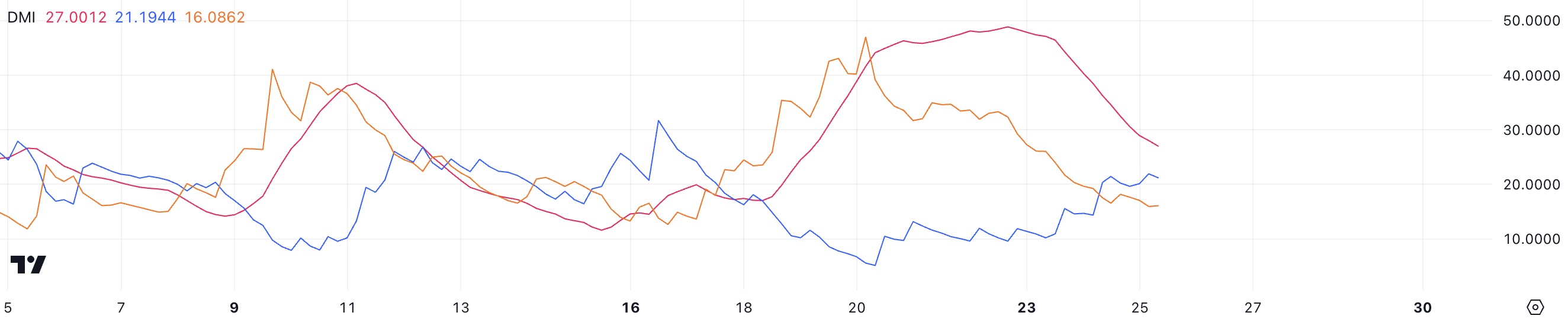

Ethereum Directional Movement Index (DMI) chart shows its Average Directional Index (ADX) currently at 27, down sharply from 46 just two days ago. This decline indicates that the strength of ETH recent uptrend is weakening, even as the price consolidates following a 9% rise over the last three days.

While the ADX suggests reduced momentum, the D+ (positive directional indicator) at 21.1 remains higher than the D- (negative directional indicator) at 16, confirming that buying pressure still outweighs selling activity, though with less intensity than before.

The ADX is a widely used indicator that measures the strength of a trend on a scale of 0 to 100 without specifying its direction. Values above 25 indicate a strong trend, while those below 20 signal a weak or nonexistent trend.

With Ethereum’s ADX now at 27, the uptrend remains moderately strong, but the declining value highlights a pause in momentum as the market consolidates. This suggests that ETH’s price is stabilizing, potentially setting the stage for either a continuation of the uptrend or a shift in sentiment if sellers gain traction.

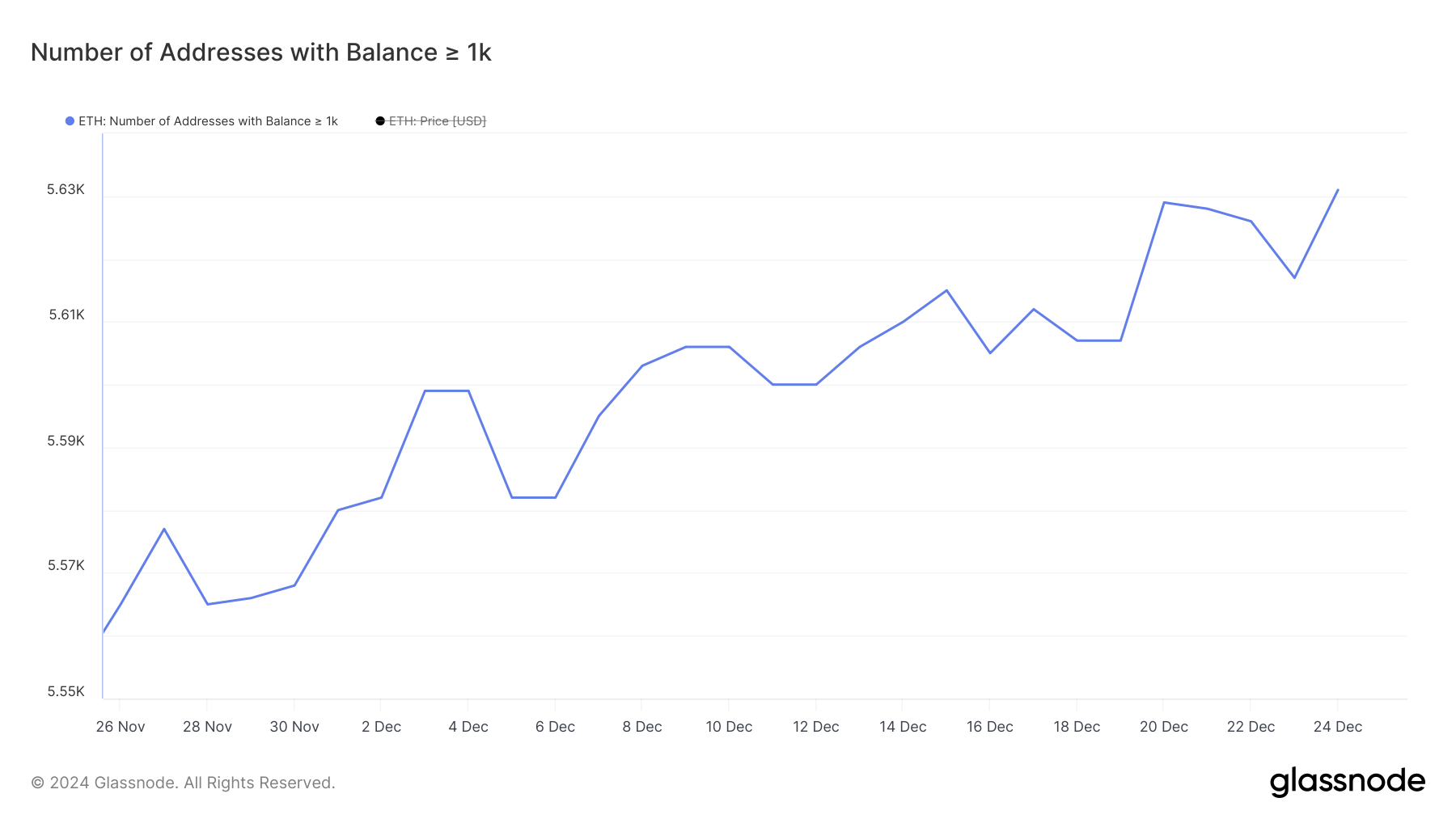

The number of whales holding at least 1,000 ETH has reached its highest level since September, currently sitting at 5,631. This marks a recovery from 5,565 recorded on November 26, signaling increased interest and accumulation by large holders.

Such a rise in whale activity indicates growing confidence among major investors, often considered a bullish signal for Ethereum’s price trajectory.

Tracking whale activity is crucial because these large holders can significantly influence market trends due to their substantial positions. An increase in whale addresses often suggests accumulation, which can support price stability or fuel upward momentum.

With the highest number of Ethereum whales since September now recorded, this accumulation could signal that large investors are positioning themselves for potential price gains, hinting at bullish sentiment in the short term. This growing whale interest might provide a foundation for Ethereum’s price to maintain strength or even rise further if the trend continues.

Ethereum’s resistance at $3,523 is a critical level for its short-term price movements. If this resistance is broken, ETH could test $3,763 next.

Should the bullish trend persist, Ethereum price could continue climbing to $3,987 and potentially test levels around $4,100 again, signaling a strong continuation of upward momentum.

On the other hand, if ETH fails to break above $3,523, the price could face a pullback, testing the support at $3,256.

If this support does not hold, ETH price might drop further to $3,096, indicating increased selling pressure.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Search

RECENT PRESS RELEASES

Related Post