Ethereum Flips Bitcoin: Data Shows ETH HODLing Now Stronger

December 31, 2024

On-chain data shows that the HODLing sentiment on the Ethereum network has grown over 2024 while that sentiment on Bitcoin has lost strength.

75% Of All Ethereum Addresses Are Long-Term Holders

In a new post on X, the market intelligence platform IntoTheBlock has talked about how Ethereum and Bitcoin compare against each other in terms of long-term holders.

Related Reading: Bitcoin Smart Money: Analyst Reveals How Bitfinex Whales Signal Market Moves

The “long-term holders” (LTHs) refer to the addresses that have been carrying their coins since more than a year ago, without having involved them in a single transaction.

It’s a statistical fact that the longer an investor holds onto their coins, the less likely they become to sell their coins at any point, so the LTHs, who hold for appreciable periods, can be assumed to be quite resolute entities.

Below is the chart shared by IntoTheBlock that shows how the proportion of LTHs has changed for Bitcoin and Ethereum over the past year.

Looks like ETH has surpassed BTC in terms of this metric | Source: IntoTheBlock on X

As displayed in the graph, Bitcoin started 2024 with a higher proportion of its addresses qualifying as LTHs than Ethereum. In the first few months of the year, however, a shift started to take place as ETH’s HODLer percentage went up while BTC’s headed down.

It didn’t take long before the second-ranked cryptocurrency in terms of market cap pulled ahead of the first-ranked in this indicator. Ethereum began the year with less than 60% of its investors falling in the LTH group, but with the growth in HODLing sentiment that has occurred throughout the year, the figure stands at 75% today.

At the same time, Bitcoin’s LTH percentage has continuously dropped, but the scale of the decline hasn’t amounted to much. Over 62% of the cryptocurrency’s investors are currently sitting on tokens dormant for more than a year.

The fact that more investors are becoming diamond hands on the Ethereum network can naturally be positive for the asset’s price, as it suggests there are fewer holders willing to part with their tokens. Bitcoin’s decline, on the other hand, indicates a weakening of resolve, which may end up being bearish.

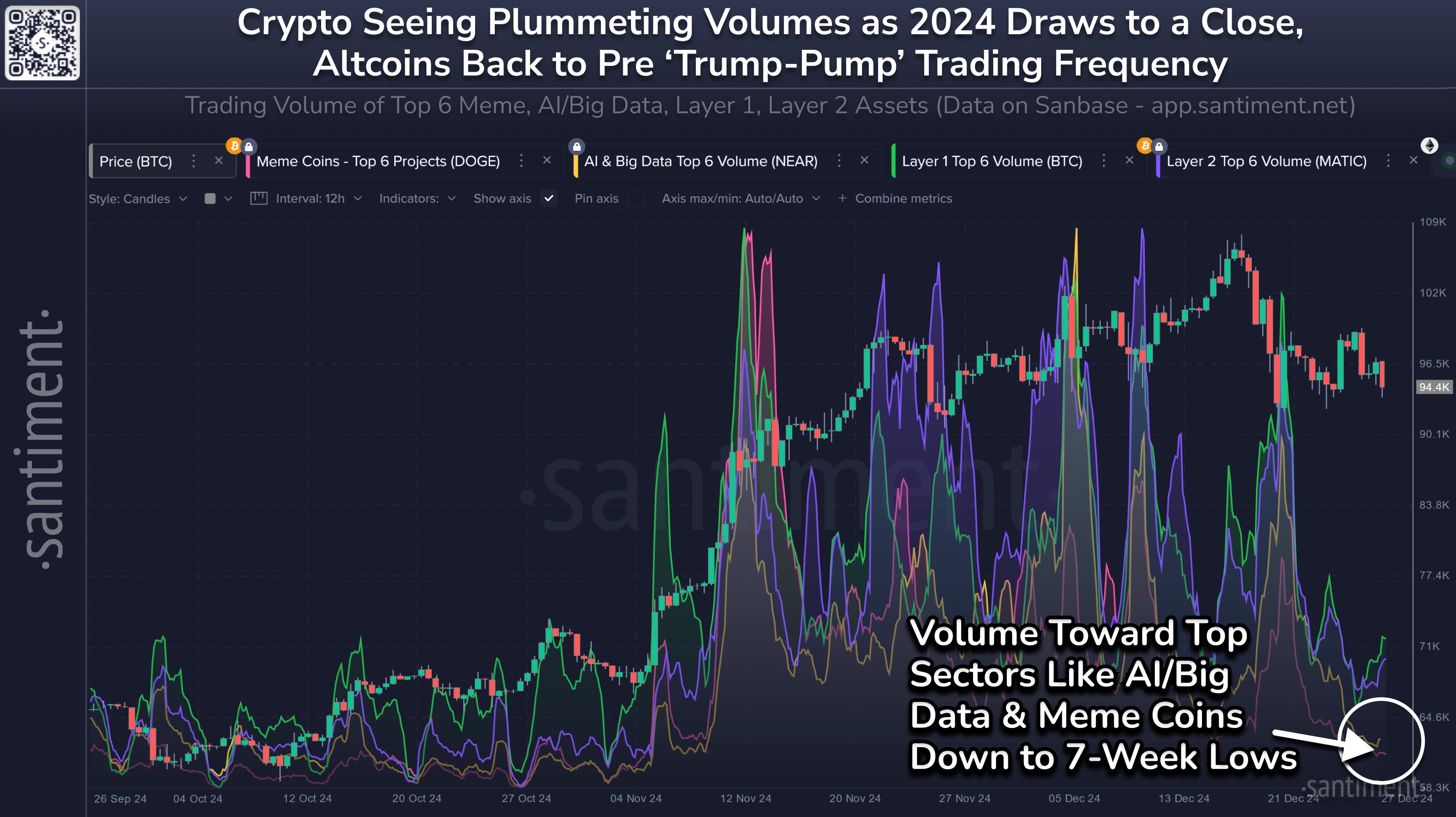

In some other news, the cryptocurrency market is heading towards the end of 2024 on a cold note in terms of trading volume, as the on-chain analytics firm Santiment pointed out in an X post.

The trend in the trading volume for the various segments of the digital asset sector | Source: Santiment on X

In the above chart, data for the combined trading volume of the different market segments is shown. It appears that all sides of the market, including large caps like Bitcoin and Ethereum, have seen a recent decline in trading activity.

Related Reading: Bitcoin Erases Christmas Gains: Social Media Sentiment May Have Foreshadowed This

Historically, a low amount of interest in the market has generally meant a flat trajectory for the prices of the various coins.

BTC Price

Ethereum has been consolidating sideways since its crash earlier in the month, as its price is still trading around $3,350.

The price of the coin seems to have been following a downtrend in recent days | Source: ETHUSDT on TradingView

Featured image from Dall-E, Santiment.net, IntoTheBlock.com, chart from TradingView.com

Search

RECENT PRESS RELEASES

Related Post