Ethereum Long-Term Holders’ Liquidations Hit 2-Year High, Losses Loom

December 30, 2024

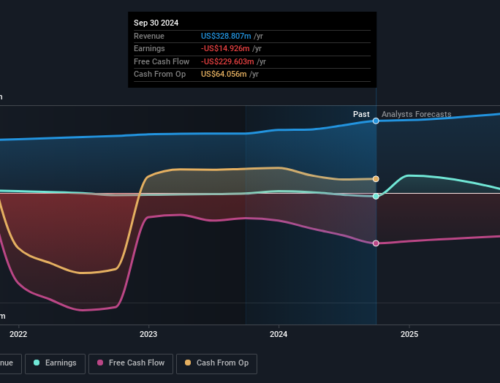

Ethereum continues to face challenges as it struggles to reclaim the $3,500 level, a critical threshold for reaching $4,000.

Worsening market conditions are compounding the altcoin’s difficulties, reducing the likelihood of a near-term recovery and leaving investors uncertain about the price trajectory.

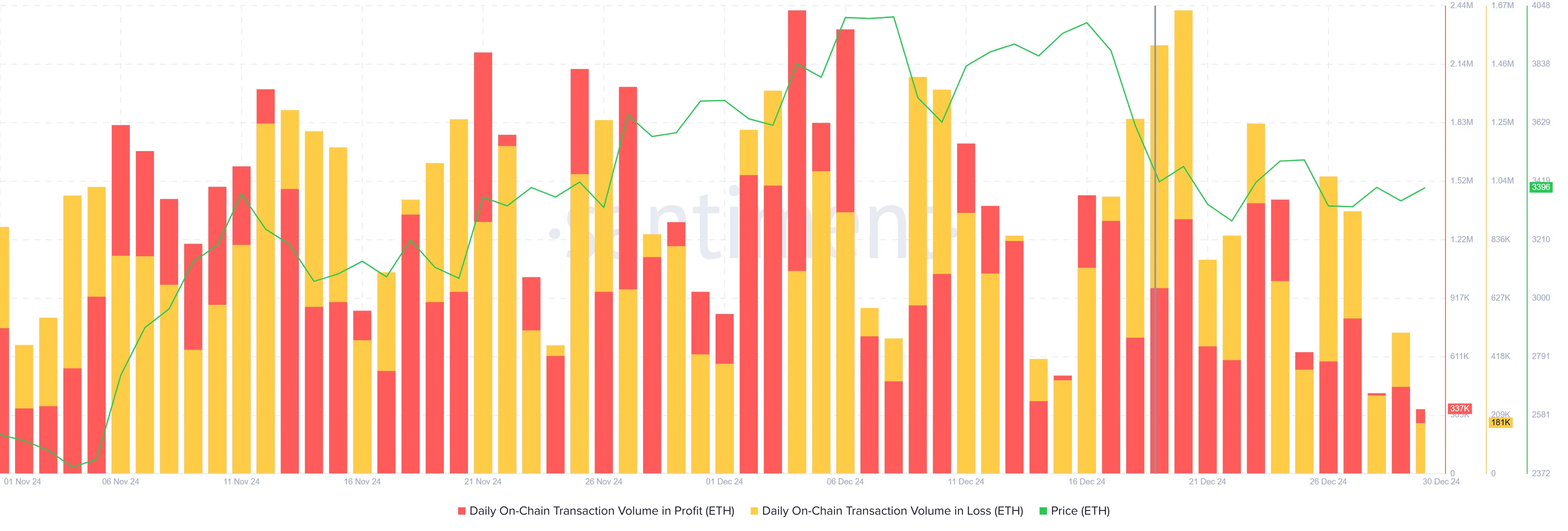

Recent Ethereum network transactions have been dominated by losses rather than profits. Many investors are panic selling their holdings, particularly short-term ones, in an attempt to secure gains or reinvest during dips. However, these actions often result in missed opportunities, exacerbating the downturn.

This behavior highlights the broader lack of confidence among investors. The tendency to exit positions prematurely is contributing to increased volatility, making it harder for Ethereum to regain its footing and stabilize above crucial support levels.

Ethereum’s Liveliness indicator is at a two-year high, signaling significant activity among long-term holders (LTHs). This metric increases when LTHs liquidate their holdings, which is typically a bearish sign for price stability.

The continued rise in Liveliness despite declining prices indicates that LTHs are prioritizing profit-taking over supporting recovery. Such behavior undermines market confidence and puts additional pressure on Ethereum’s price, potentially leading to further declines.

Ethereum is currently priced at $3,402, holding above the support of $3,327 but failing to break the $3,524 resistance. This consolidation has persisted for nearly two weeks, reflecting the uncertainty in the market and the lack of strong bullish signals.

Given the prevailing conditions, Ethereum is likely to continue consolidating or experience a drop. A decline could push the altcoin to test the $3,000 level, extending the losses for investors and delaying any significant recovery.

Alternatively, flipping $3,524 into support could invalidate the bearish outlook. Achieving this milestone would pave the way for Ethereum to reach $3,721, allowing the cryptocurrency to recover losses and restore confidence among its holders.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Search

RECENT PRESS RELEASES

Related Post