Ethereum Price Forecast: ETH could see new all-time high in 2025 as blobs top burn leaderboard

December 31, 2024

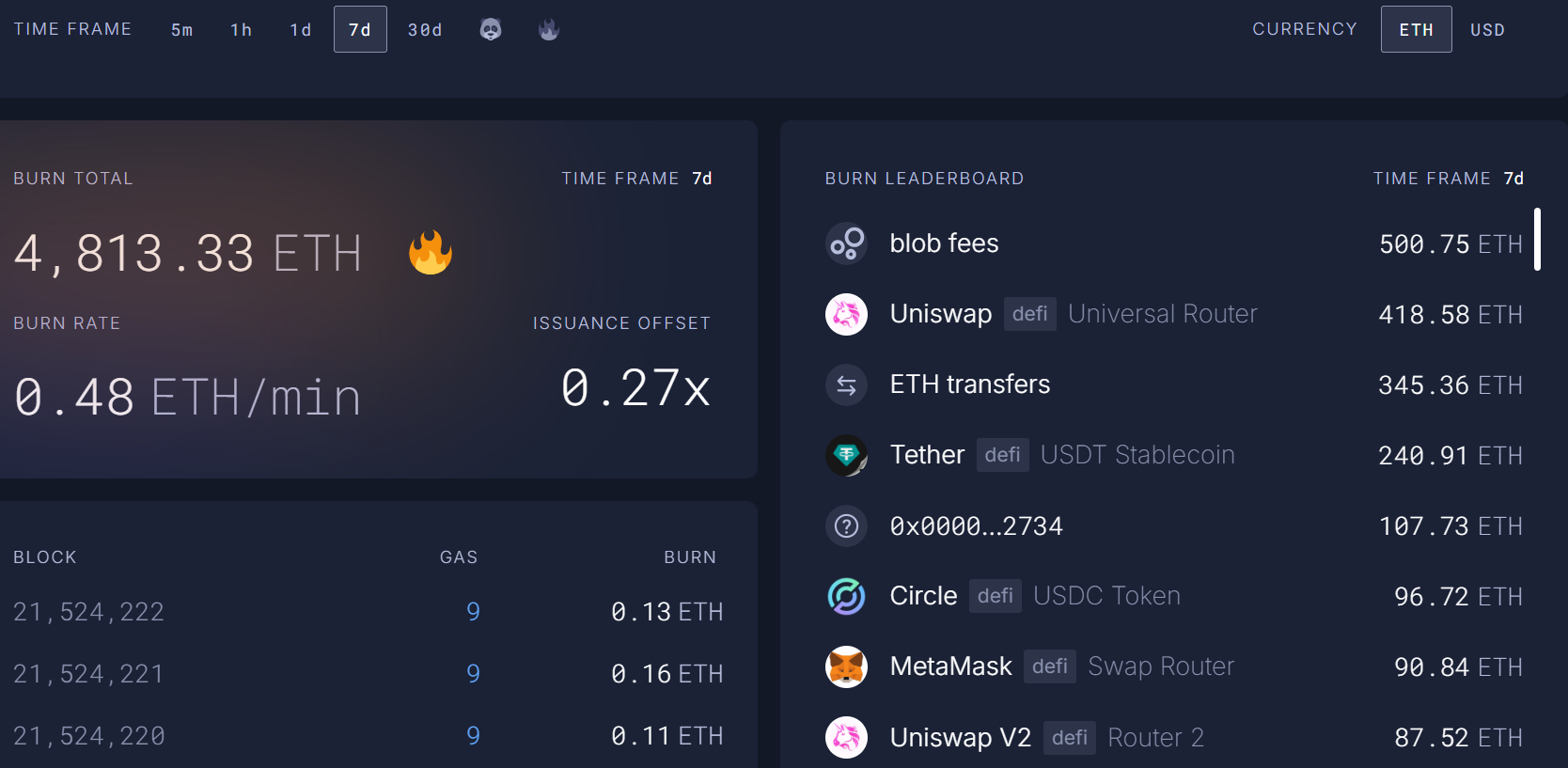

- Ethereum blobs has ranked number one on the ETH burn leaderboard in the past seven days.

- Blob space could flip the script and reinforce Ethereum’s ultrasound money narrative.

- ETH’s next trend could be determined by a move outside the $3,250 and $3,550 range.

Ethereum (ETH) is down 1% on Tuesday following a weeklong consolidation of the general crypto market. The top altcoin could be set for a bullish 2025 if blobs continue their recent trend of burning high amounts of ETH.

Ethereum burn leaderboard reveals that blob fees have burnt over 500 ETH in the past week — the highest, above Uniswap and ETH transfers. This emerging trend is somewhat opposite to the path ETH followed for most of 2024.

ETH Burn Leaderboard. Source: Ultrasound.money

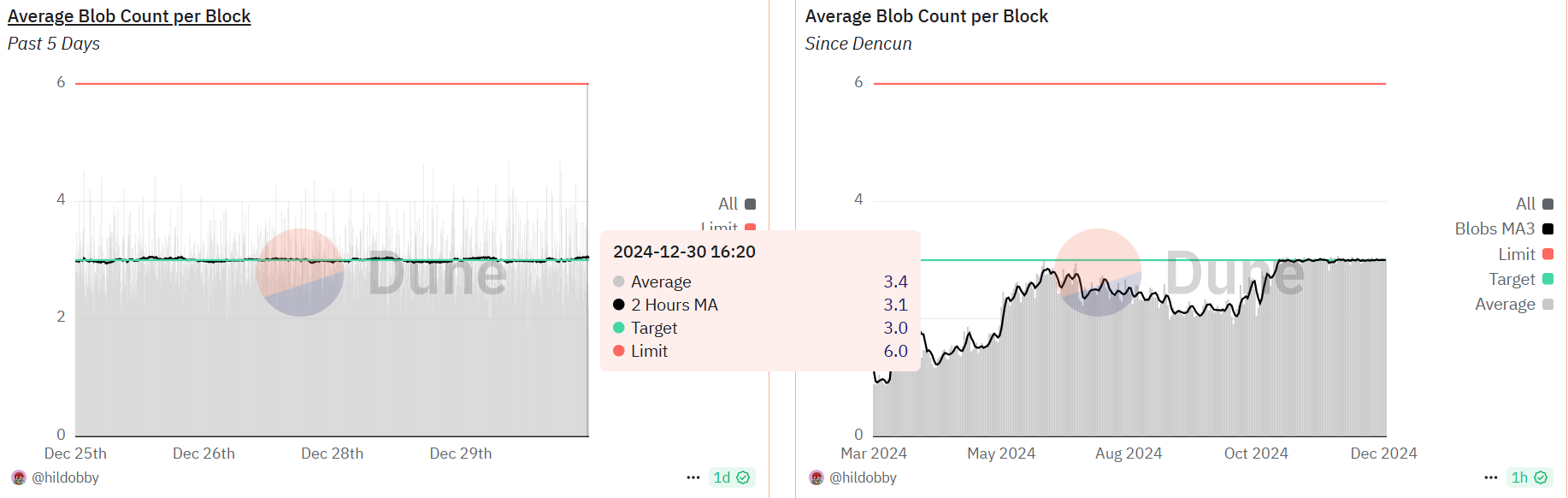

The introduction of blobspace on Ethereum blocks via the Dencun upgrade in March significantly scaled Layer 2s and reduced their transaction fees. However, the fee reduction offset the burn mechanism, which was responsible for keeping ETH deflationary, with its supply rising by over 400K ETH between April and December.

The ETH burn mechanism was introduced in the London hardfork in August 2021 to keep ETH’s supply from growing by permanently removing a portion of transaction fees from circulation.

However, with Layer 2 networks seeing increased volumes recently, the average blob count per block has often exceeded the target of 3.0, causing them to enter price discovery. As a result, L2s pay transaction fees for the extra usage, increasing the amount of ETH burnt daily.

Ethereum Average Blob Count per Block. Source: Dune (@hildobby)

If Ethereum network activity heats up as the holidays near its end and blobs maintain their ETH burn trend, it could lead to a quick flip of the negative sentiment surrounding blobs and, by extension, ETH. Such a change could reinforce the ETH “ultrasound money” narrative and boost its appeal to investors.

Meanwhile, Ethereum exchange-traded funds (ETFs) ended their four-day inflow streak after recording net outflows of $55.4 million on Monday, per Coinglass data.

Ethereum sustained over $31.19 million in liquidations in the past 24 hours, per Coinglass data. The total amount of liquidated long positions accounted for $19.37 million, while short liquidations were worth $11.82 million.

Ethereum has been range-bound in the past 12 days, moving within the $3,250 and $3,550 price range. The consolidation, which mirrors the general crypto market activity, could largely be due to the absence of trading volume, as most traders are on vacation following the Christmas and New Year holidays.

ETH/USDT daily chart

If ETH tilts downward and moves below $3,250 as traders return on January 2, it could bounce off the $3,000 psychological level. Such a move will complete the maximum profit target of a double top pattern, the top altcoin posted on December 6 and 16. A failure to find support at $3,000 could spark heavy selling pressure on ETH.

If ETH tilts upward and sustains a high volume move above the $3,550 level, it could retest the $4,093 major resistance. This resistance is a major level to monitor as 2025 unfolds. A high volume move above $4,093 could see ETH tackle its all-time high resistance of $4,868.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) momentum indicators are below their neutral levels, indicating dominant bearish momentum. A cross above their neutral levels will indicate a potential resumption in ETH’s uptrend.

A daily candlestick close below the $2,817 key support level will invalidate the thesis and could send ETH toward the $2,200 region.

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum’s roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.

Share:

Cryptos feed

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Search

RECENT PRESS RELEASES

Related Post