Ethereum Price Forecast: ETH shows signs of recovery as bulls step in to quench US investors selling pressure

December 20, 2024

- Ethereum exchange reserve’s continuous decline and high buying activity indicate that prices could soon stabilize.

- Coinbase Premium Index and Ethereum ETF outflows show US investors are at the forefront of the sell-side pressure.

- Ethereum is showing signs of recovery but risks a sharp decline if prices breach the $3,014 support level.

Ethereum (ETH) price is showing signs of recovery on Wednesday as buyers are returning to the market to buy the dip. One expert predicts that prices could stabilize as we approach the holiday season due to the absence of institutional activity.

After sustaining declines of over 12% since the Federal Reserve’s (Fed) hawkish rate cut decision for 2025, Ethereum appears to be stabilizing around the $3,400 level.

The price stability could be due to investors buying the dip, as evidenced by the sustained outflows across exchanges. The Ethereum exchange reserve chart below shows a downtrend, indicating investors have been withdrawing ETH from exchanges.

Ethereum Exchange Reserve. Source: CryptoQuant

“Ethereum trading volume is up 45% over 24h and almost 70% of that is buying activity,” James Toledano, COO at Unity Wallet, told FXStreet.

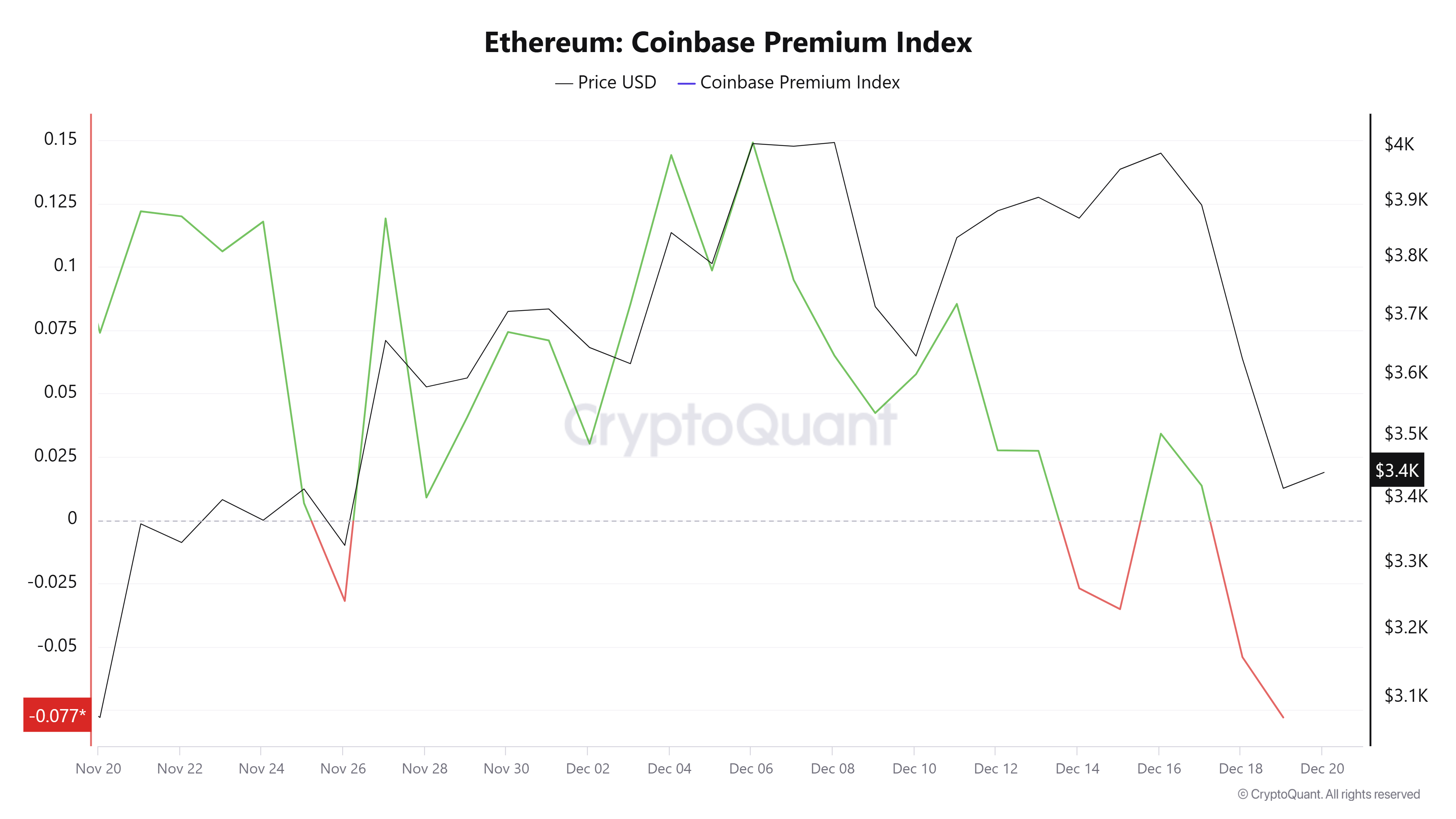

Despite some investors shoring up prices by buying the dip, US investors have remained at the forefront of the sell-side pressure, as evidenced by the Coinbase Premium Index. This indicator, which measures the price difference between crypto pairs in Coinbase Pro and Binance, has been plunging lately, signaling strong selling pressure among US investors.

Ethereum Coinbase Premium Index. Source: CryptoQuant

A similar trend is visible in Ethereum exchange-traded funds (ETFs). The products posted outflows for the first time since November 21 after recording net outflows of $60.5 million on Thursday — ending their 18 consecutive trading days of net inflows, per Coinglass data.

This selling pressure from US investors is expected, considering their proximity to the Fed, which triggered the market sell-off in the first place.

As the Christmas holidays draw close, Toledano expects prices to stabilize due to the absence of major institutional activity.

“A relatively quiet period is possible unless unexpected news reignites volatility. But given that on January 20, pro-Bitcoin Trump will be back in the White House, I think we can expect a lot of price movement again very soon,” he added.

Ethereum saw $226.45 million in liquidations in the past 24 hours, washing long and short positions worth $182.4 million and $44.05 million, out of the market, per Coinglass data.

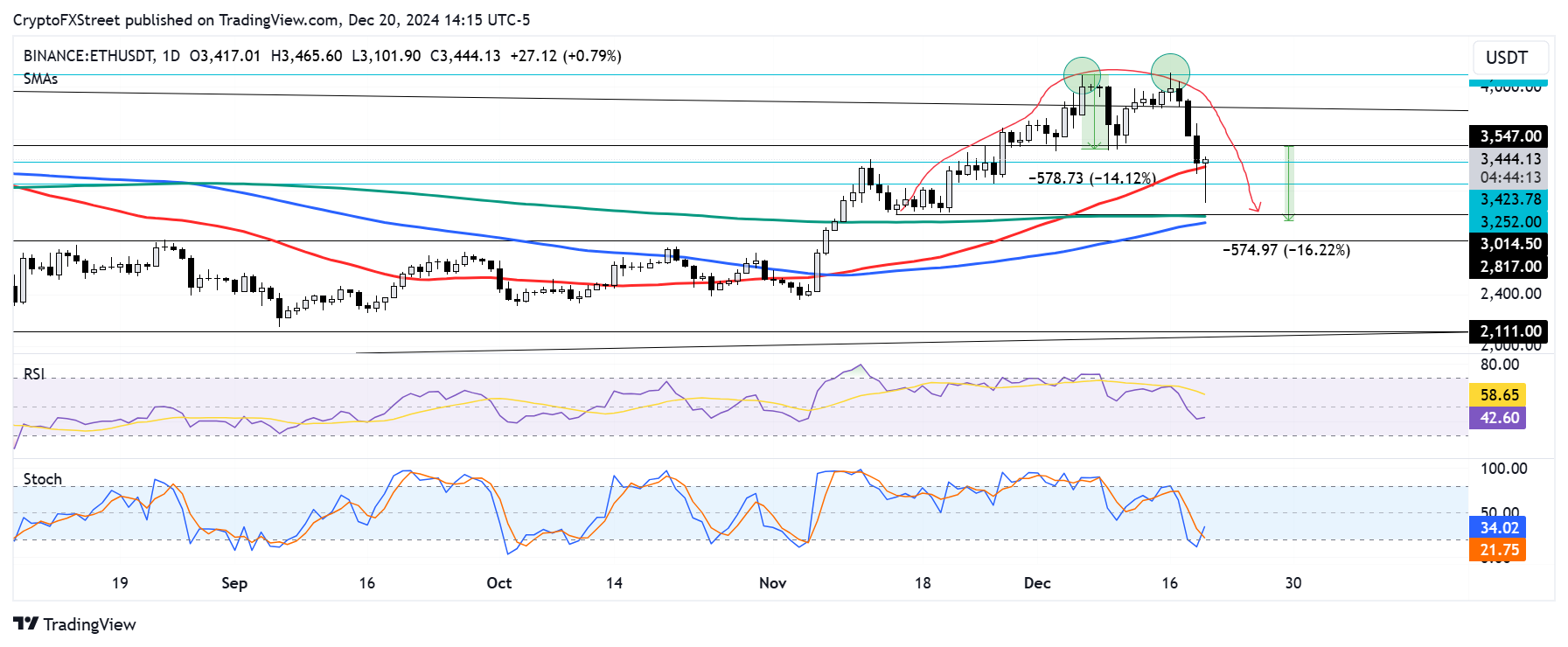

After posting a double top move on Monday, ETH briefly declined to $3,108 on Friday — just shy of the target predicted by an earlier forecast.

ETH/USDT daily chart

The top altcoin quickly recovered as buyers and sellers battled at the support level near $3,400. This support level is strengthened by the 50-day Simple Moving Average (SMA), just below it.

Meanwhile, the $3,014 support level — strengthened by the 100-day and 200-day SMAs — could prove crucial amid the recent bearish sentiment in the market. A high volume breach of this level validates a rounding top pattern that could send ETH’s price toward the $2,000 psychological level.

The $2,817 key level, a major support level for nearly four months between April and July, could provide support in the case of such declines.

The Stochastic Oscillator (Stoch) momentum indicator has recovered from the oversold region, indicating bulls have stepped in to buy the dip.

A daily candlestick close above $3,550 will invalidate the thesis.

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum’s roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.

Share:

Cryptos feed

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Search

RECENT PRESS RELEASES

Related Post

-638703205245360236.png)