Ethereum: the optimistic prospects of Bernstein

December 5, 2024

Recent analyses by Bernstein, a renowned asset management company, have highlighted Ethereum (ETH) as an investment opportunity with a favorable risk-reward profile.

Gautam Chhugani, global director of digital assets of the company, emphasized that the moderate performance of Ethereum in recent months has made it particularly interesting for institutional and private investors.

Summary

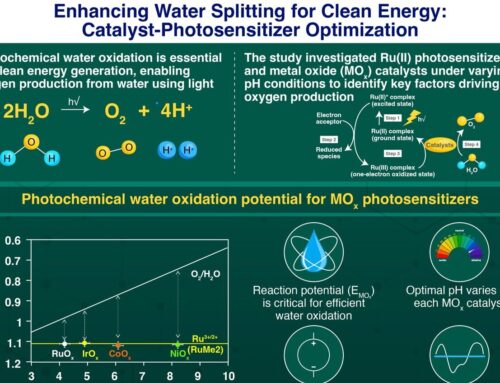

Since the completion of the transition to a proof-of-stake (PoS) model, Ethereum has integrated a burning of fees mechanism that has helped stabilize the overall supply.

According to Chhugani, the transition to PoS has not only improved the energy efficiency of the network but has also made the supply of ETH less volatile compared to the past.

This stability has been a determining factor in attracting new stakeholders, who see in Ethereum an asset with solid fundamentals and long-term prospects.

A crucial aspect highlighted by Chhugani is the yield generated from transaction fees on Ethereum, amounting to about 3% annually for stakers. This represents a reliable source of income, made possible by the decentralized ecosystem of the network.

Currently, about 28% of the total supply of ETH is locked in staking contracts, a figure that reflects investors’ confidence in the platform. Additionally, a further 10% of ETH is tied up in lending and deposit contracts on blockchain and on layer-2 networks, strengthening the infrastructure of the ecosystem.

Another element that could positively influence the demand for Ethereum is the growing spread of exchange-traded fund (ETF) based on ETH.

According to Chhugani, these financial instruments are gaining popularity and, if properly regulated by the SEC, could also include staking yields, making investment in ETH even more appealing for the institutional public.

The increase in the adoption of ETFs represents a strategic opportunity for Ethereum, as it provides access to a larger market and offers greater liquidity for the asset. This could further consolidate Ethereum’s position as a leading player in the cryptocurrency sector.

Another data point that strengthens Bernstein’s thesis is Ethereum’s dominance in the cryptocurrency landscape: currently, the network represents about 63% of the total value locked (TVL).

This metric is a fundamental indicator of the health and financial robustness of the Ethereum ecosystem, which is confirmed as the most used platform for decentralized applications (dApp), decentralized finance (DeFi), and other crypto innovations.

The strong TVL ratio demonstrates a growing interest from institutional investors, who see in Ethereum a reliable platform with sustainable growth potential over time.

The current dynamics of Ethereum, characterized by a high staking rate, a stabilized supply, and the increase of ETFs, suggest optimistic prospects for the future of the asset. The steady yield of transaction fees and the dominance in TVL reflect a growing ecosystem, capable of attracting both institutional and private investors.

“`html“`

With a strong and continuously evolving ecosystem, Ethereum confirms itself as one of the most promising digital assets in the crypto landscape.

The insights from Bernstein offer a clear view of the potential of ETH, thanks to the transition to proof-of-stake, staking yields, and the rise of ETFs.

The combination of these factors reinforces the idea that Ethereum will remain a fundamental pillar in the bull market of cryptocurrencies, with positive prospects in both the short and long term.

Search

RECENT PRESS RELEASES

Related Post