Ethereum To Outperform Bitcoin In Q1 2025 For These 3 Reasons, Whale Trader Says

December 30, 2024

According to a prominent whale trader, Ethereum ETH/USD could be positioned for a successful first quarter in 2025.

What Happened: In a post on X on Sunday, pseudonymous whale trader Eugene Ng Ah Sio emphasized that Ethereum is poised to capitalize on the more pro-crypto environment in the U.S. following Donald Trump’s election victory.

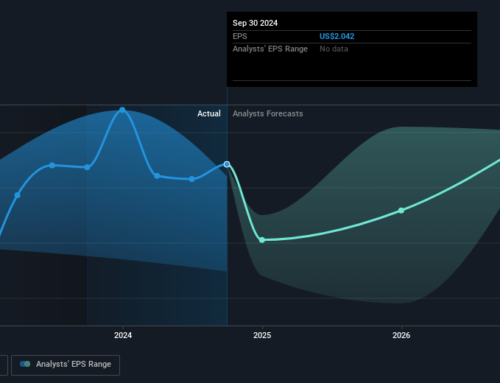

While the crypto bull market has already seen a local peak in December, the trader expects a continued rally where select assets outshine others. Eugene outlined three critical reasons why Ethereum is positioned to break above $4,000 in January and possibly test its all-time high during Q1.

- Price Dynamics and Market Perception: Bitcoin BTC/USD has surged 40% above its previous all-time high, while Ethereum still trades about 30% below its own. With ETFs for both assets now available, retail investors may perceive ETH as “cheaper” and offering greater upside potential compared to BTC.

- Pro-Crypto Policies Under Trump: The incoming administration has shown clear favouritism toward utility-driven, smart contract platforms. Ethereum, as the foundational layer for many DeFi and Web3 projects, stands to benefit from Trump’s Web3 Leadership Fund (WLF), which has consistently backed ETH-focused assets.

- Base Ecosystem Momentum: Among Ethereum’s Layer-2 networks, Base has emerged as a standout. Backed by Coinbase’s extensive distribution and an organically growing AI Agents meta, Base mirrors Solana’s SOL/USD earlier value proposition. With no native token, Base drives demand for ETH as its settlement asset, creating sustained positive flows as activity increases.

Additionally, he believes AI agents, utility fee-generating coins and potential ETF coins are the promising verticals for Q1 2025 and well positioned for continued growth.

Also Read: Ethereum Price Drops 17% In 7 Days: What Is Going On With ETH?

What’s Next: Ng Ah Sio advised his followers to align with prevailing trends rather than adopting contrarian strategies at this stage. He noted the current cycle resembles the localized rallies of 2023-2024, followed by periods of volatile, competitive trading.

While a cycle top may eventually emerge, the trader does not see this happening in the near term. “Hopping along momentum trends is probably the easiest way to make money right now,” he concluded.

Read Next:

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Search

RECENT PRESS RELEASES

Related Post