Green Energy Stocks Sink With Trump Poised to Win US Election

November 6, 2024

(Bloomberg) — Shares in renewable energy firms plunged on Wednesday as Donald Trump won a second term as president of the United States on a platform that promised to boost fossil fuels and undo the green agenda of his predecessor.

Shares in US clean energy companies suffered in pre-market trading in New York, especially solar companies. Sunnova Energy International Inc. was down more than 21%, while First Solar Inc. and green hydrogen equipment maker Plug Power Inc. each fell around 14%.

Across the Atlantic, Danish wind firms Orsted A/S and Vestas Wind Systems A/S also slid, as did Germany’s RWE AG and Italy’s Enel SpA.

“The world has changed in the past 24-hours,” Rob West, chief executive officer at research company Thunder Said Energy, wrote in an emailed note. “Momentum behind many energy transition themes has been slowing in 2024. It is now harder to see a re-acceleration.”

Trump has vowed to end the country’s offshore wind efforts as one of his first measures after taking office. During campaigning, he also promised to lift restrictions on domestic energy production.

A second Trump term would be a stark contrast to the presidency of Joe Biden, who set an aggressive target to decarbonize the country’s power grid, vowed to reach 30 gigawatts of offshore wind by 2030 and introduced sweeping climate legislation that favored renewable energy sources.

Offshore Wind Industry Braces for Trump’s Turbulence: QuickTake

Beyond his policies aimed specifically at the energy sector, Trump plans a wide array of tariffs on imported goods. Regardless of those measures’ direct impacts on renewable energy equipment, economists expect the policies to drive up inflation, which could lead the Federal Reserve to raise interest rates. That would make it more expensive to invest in major renewable power plants that require significant upfront costs often funded by debt.

“We expect to see initial sentiment hit across the renewable sector,” Citigroup Inc. analyst Jenny Ping said in a note, adding there will be “some differentiation between renewable technologies, with those exposed to offshore wind potentially more at risk.”

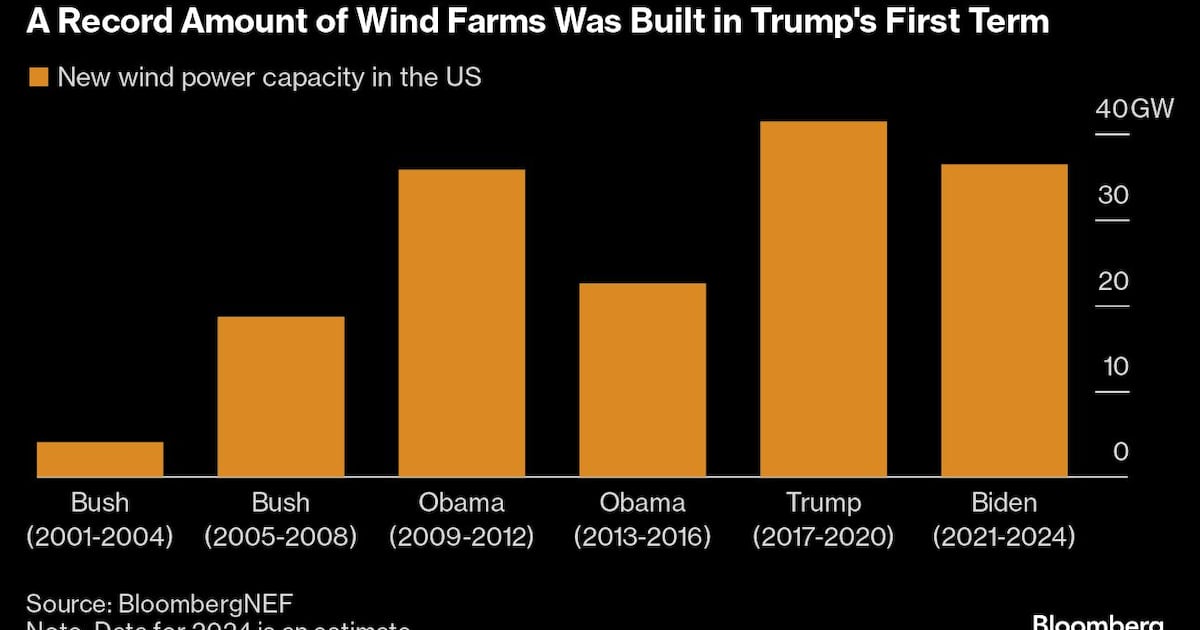

While analysts think it’s unlikely that Republicans will try to repeal Biden’s Inflation Reduction Act, offshore wind farms, which require federal approvals, are particularly vulnerable to executive action. It’s still possible that the renewable power industry could expand significantly under Trump, as it did during his first term in office.

(Updates with additional share moves, analyst comments throughout.)

©2024 Bloomberg L.P.

Search

RECENT PRESS RELEASES

Related Post