How the Energy Transition Will Reshape Business: Opportunities,

October 25, 2024

The conversation around energy is at a crucial inflection point, driven by a potent mix of geopolitics, technological innovation, and public awareness of climate issues. As we face challenges ranging from escalating conflict in the Middle East to the pressures of climate change, the energy transition—our collective move from fossil fuel reliance to clean, sustainable power—has become more urgent than ever. The International Energy Agency’s (IEA) World Energy Outlook 2024 offers a comprehensive view of where we stand today, and where we might go tomorrow. It is a timely reminder that the choices we make now will shape the future of energy security, climate stability, and economic resilience for decades.

A Transition Under Pressure

The energy transition is accelerating, but it is also happening against the backdrop of an incredibly complex world. Over the last two years, energy markets have been rocked by Russia’s invasion of Ukraine, prompting Europe to rapidly shift away from natural gas dependence on Russia. Just as that crisis began to stabilise, new tensions have arisen in the Middle East, affecting key oil-producing regions. These geopolitical events have put energy security under a microscope and highlighted the fragility of the existing system. Yet they also underline the urgency of transitioning to a more resilient, cleaner energy framework.

For businesses, these disruptions are not just geopolitical curiosities—they are reshaping supply chains, cost structures, and investment priorities. Companies that rely heavily on fossil fuels are facing increasing risk from price volatility and supply insecurity. On the other hand, those that are investing in renewable energy, energy efficiency, and electrification are positioning themselves for resilience and long-term growth.

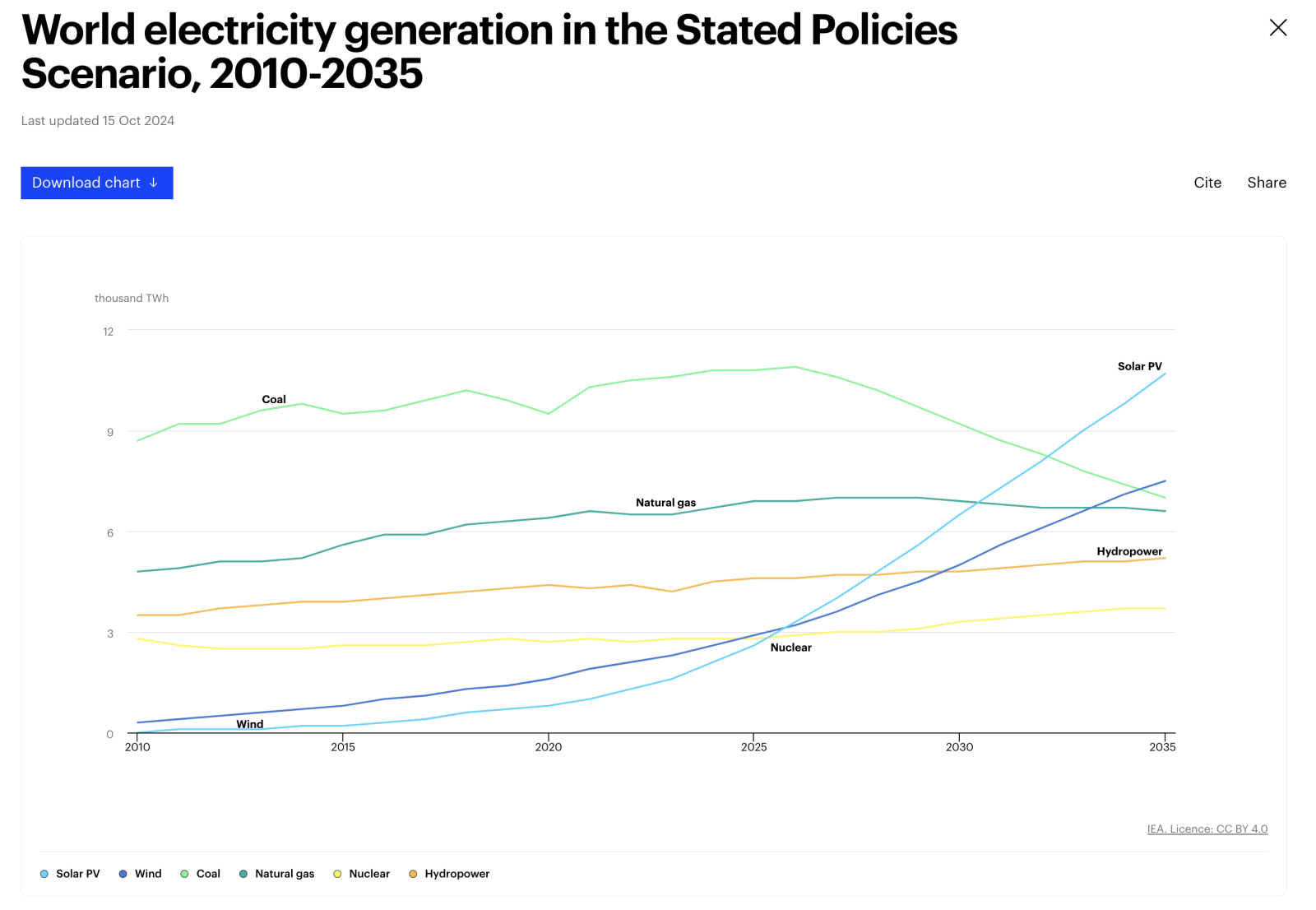

Despite these challenges, significant progress has been made. According to the IEA, clean energy deployment is now at an unprecedented rate. Over 560 gigawatts (GW) of new renewable capacity was added globally in 2023, and clean energy investment is nearing $2 trillion annually—almost double the amount spent on new oil, gas, and coal supply. This surge reflects the cost-competitiveness of renewable technologies, with the costs for wind and solar continuing their downward trend after the temporary supply-chain disruptions experienced post-Covid.

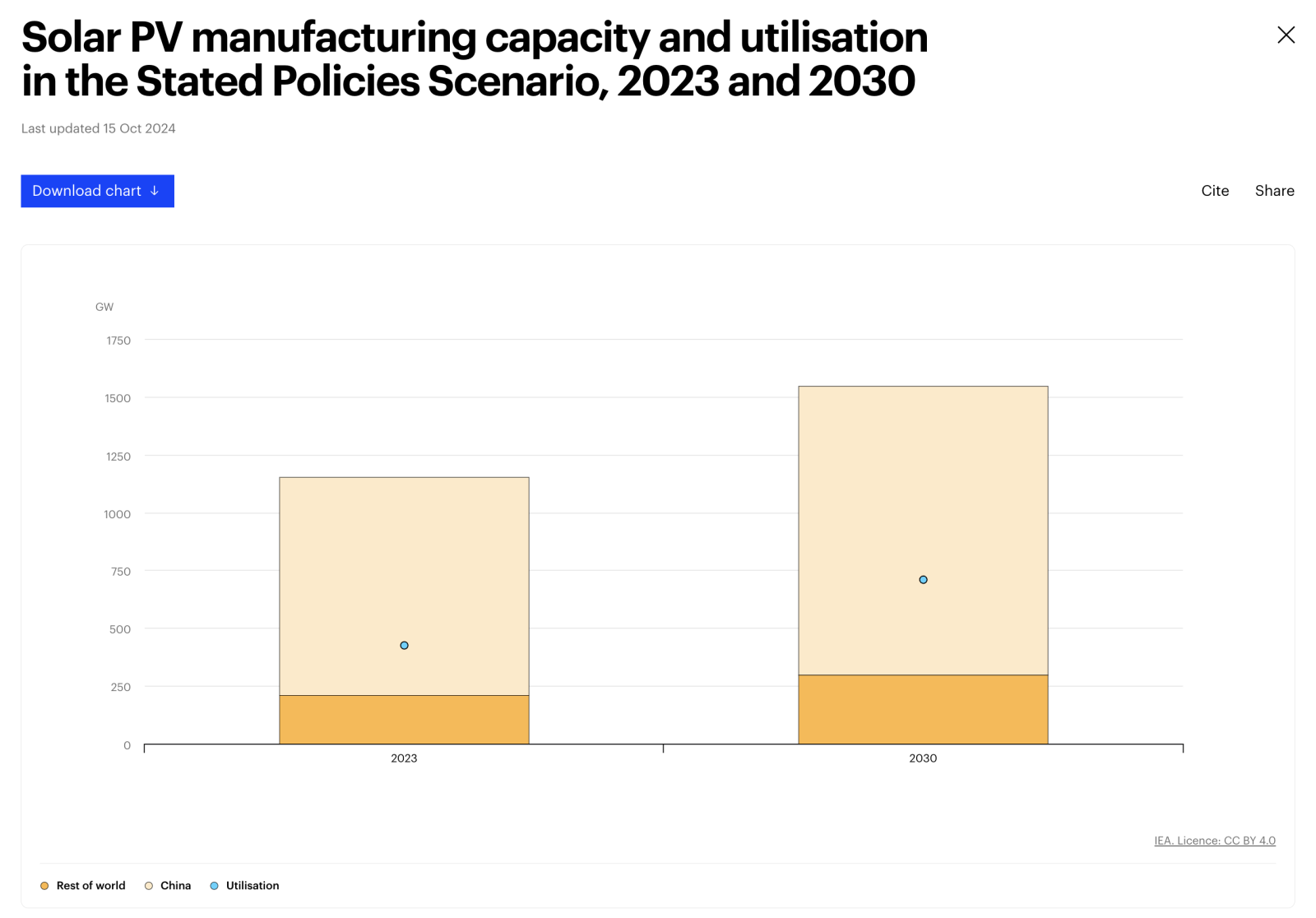

Countries like China are leading this change, accounting for over 60% of the new renewable capacity added worldwide in 2023. Notably, China’s solar photovoltaic (PV) output alone is expected to soon exceed the current electricity demand of the United States, illustrating the scale of ambition and achievement already underway. For other major economies, this transformation comes with both opportunities and challenges. Europe has been forced to reinvent its energy mix quickly, turning towards renewables at a faster pace than anticipated due to the geopolitical upheavals of 2022. Meanwhile, the United States, buoyed by incentives in the Inflation Reduction Act, is seeing significant investments in clean technology manufacturing, aiming for energy independence that also aligns with climate goals.

Trends and Dynamics Shaping the Transition

The energy transition is not just about adding more renewables; it is about reshaping the entire energy system to be more efficient, resilient, and adaptable. For example, the IEA report highlights the rapid acceleration of electrification across sectors like transportation, buildings, and industry. Electrification, when paired with renewable generation, inherently makes energy systems more efficient, because electricity produced by renewables incurs far fewer conversion losses compared to fossil fuel-based generation.

Electric vehicles (EVs) are at the forefront of this shift. They currently represent around 20% of new car sales globally, and this number is expected to rise to nearly 50% by 2030. For organisations, this trend represents both a challenge and an opportunity. The shift towards EVs is expected to significantly reduce oil demand, but it will also require companies to adapt their supply chains, retool manufacturing processes, and develop new partnerships. Fleet operators, in particular, will need to make strategic decisions about vehicle procurement, charging infrastructure, and integration with renewable energy sources.

In parallel, energy efficiency remains an essential element in curbing demand and achieving climate goals. While efficiency might not capture the imagination like solar panels or electric vehicles, its impact is no less profound. Doubling the global rate of energy efficiency improvements could provide more emissions reductions by 2030 than any other single action. The IEA’s report suggests that this particular COP28 goal remains largely unmet under current policy settings. This represents a significant missed opportunity. For businesses, efficiency improvements translate directly into cost savings and competitive advantage. Companies should expect tighter regulations around building codes, more stringent efficiency standards for appliances, and increased incentives for retrofitting existing infrastructure.

Increasing Regulations and Their Impact on Organisations

As we look towards the coming years, increasing regulation is almost inevitable, particularly as regions like the European Union strive to meet their ambitious 2030 climate goals. The EU, for instance, has set targets to reduce greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels. This will require a substantial uptick in regulatory measures, including stricter emissions standards, accelerated timelines for phasing out internal combustion engine vehicles, and tighter energy efficiency mandates for buildings and industries.

These regulations will not just affect energy producers but will ripple through all sectors. Organisations will need to prepare for increased costs related to compliance, such as upgrading facilities to meet new energy performance standards or paying higher carbon taxes. However, proactive companies can turn these regulations into opportunities. By investing early in energy efficiency, electrification, and renewable integration, businesses can not only mitigate regulatory risks but also gain a competitive advantage. In particular, companies that can demonstrate compliance with or exceed regulatory expectations will be well-positioned to benefit from green incentives and favourable financing conditions.

The EU’s Green Deal Industrial Plan also aims to make Europe a global hub for clean technologies, which could mean both carrots and sticks for organisations. On the one hand, there will be increased funding and incentives for clean technology projects. On the other hand, companies will be held to higher standards of sustainability, with closer scrutiny of supply chains, carbon footprints, and even end-of-life processes for products. Those in manufacturing, automotive, and heavy industry should expect imminent regulatory frameworks that will require rapid adaptation.

Globally, we are also likely to see increased adoption of carbon border adjustment mechanisms (CBAMs), which will impose tariffs on imports based on their carbon intensity. This is particularly relevant for sectors like steel, cement, and chemicals, and businesses operating internationally should start factoring in these costs now. For companies that export goods to regions with stringent climate regulations, the financial impact could be significant if they are not already moving towards cleaner production processes.

Investment Needs and the Global Divide

The path to a cleaner, safer energy future is not yet assured. The IEA report underscores the vast imbalance in clean energy investments across different regions. China alone accounts for more than 40% of global investments in clean energy technologies, while other emerging markets—especially those outside of China—remain heavily reliant on fossil fuels due to higher financing costs and policy barriers. Investment in developing economies is crucial, not only for their sustainable growth but also to ensure that the transition does not exacerbate global inequality.

For businesses operating globally, this imbalance presents both risks and opportunities. Companies investing in clean energy in emerging markets may face higher upfront costs but could benefit from long-term gains, especially if they are able to establish themselves early in nascent clean energy markets. To navigate these challenges, blended finance models, partnerships with development banks, and active engagement in policy advocacy can play crucial roles.

Encouragingly, technological progress means that the solutions are often cost-effective even in developing markets. The challenge is access to capital and managing risk. If we can find ways to make financing easier and cheaper for clean energy projects in emerging markets, we could truly supercharge the energy transition. The recent push by global institutions to support green investments through mechanisms like blended finance is an important step in the right direction, but more is needed to address the scale of the challenge.

Perhaps one of the most striking insights from the World Energy Outlook 2024 is that energy security and climate action are not competing priorities—they go hand-in-hand. The growing impacts of climate change, from wildfires to unprecedented heatwaves, are already threatening existing energy infrastructure. A more electrified, renewables-based system, being inherently decentralised, promises not just lower emissions, but greater stability in the face of climate extremes and less exposure to the vagaries of fossil fuel markets. The decentralised nature of renewables makes the system more resilient, as power generation is spread across multiple locations, reducing the risk of widespread outages and increasing adaptability to local disruptions.

For organisations, this dual focus on security and sustainability is a strategic imperative. Businesses that embrace clean energy and energy efficiency are not only reducing their carbon footprint but are also building resilience against future energy shocks. Clean technology—from solar PV to battery storage—is proving increasingly adaptable and scalable. Advances in grid infrastructure, energy storage, and hydrogen production will all play their part in ensuring that the transition benefits everyone, everywhere. The choices made today, by governments, businesses, and individuals, will determine how swiftly and successfully this new energy era unfolds.

If you’re interested in diving deeper into these themes, including the policy frameworks and technologies driving the energy transition, the full IEA World Energy Outlook 2024 report is well worth your time.

The energy transition is not just a response to climate change or geopolitical upheaval—it’s an opportunity to create a better, more resilient future for us all. Organisations that recognise and act on this opportunity today will be the ones best positioned for success in the years to come.

Photo credit Bureau of Land Management on Flickr – this post was originally posted on TomRaftery.com

Search

RECENT PRESS RELEASES

Related Post