Is it Time to get Back into Cannabis Stocks? – The Trend is UP – Let the Charts Speak

September 24, 2023

The Trend is UP – Let the Charts Speak

| KEY POINTS

· Marijuana stocks have incurred significant losses during 2022. · Even if Federal legalization does not happen soon, cannabis stocks are rising. · The American Cannabis Operator Index has rallied 30.9%, more than the general market. · The Global Cannabis Stock Index soared by 21.7%, · The Index reduced its record decline from 70.4% in 2022 to 6.4% to date.

We all know that the cannabis industry has been through very turbulent times. Losses were significant, and investment sentiment was low. Many companies in California shut down operations and/or reduced their canopy. Stocks have traded sideways to significantly lower. Still existing regulatory headwinds have spoiled or delayed a recovery. Nevertheless, there are clear signs of a recovery, and we expect cannabis stocks to rise significantly during 2024.

CATALYSTS

· The DEA to move cannabis from Schedule 1 to Schedule 3 · Rescheduling to Schedule 3 would eliminate 280E taxation. · Increased venture capital funding and partnerships with mainstream companies. · SAFE Banking to eliminate limitations to cash transactions. · Rising flow flower prices.

INVESTMENT OPINION

· You must be invested so as not to miss out. · Do not chase stock prices. · Focus on well-managed smaller operators, especially in California. · Have a long-term investment horizon. · Focus on companies’ results and financials, low operating expenses, and debt burden.

A sound investment strategy for cannabis stocks is to not focus on the hype and noise but instead look at a company’s results and financials. Apply the financial tests that any other publicly traded company is measured by. Colorado and California may be going through the end of the challenging period and entering a new promising growth cycle.

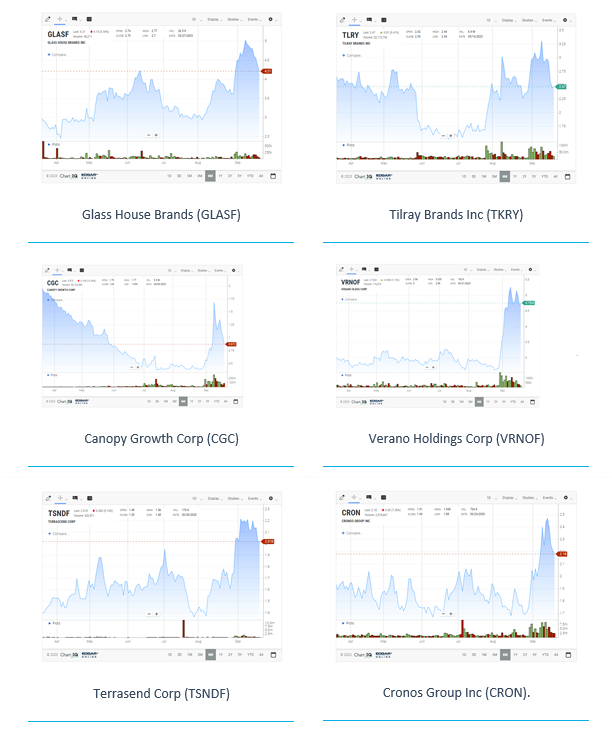

During the last few months, fundamentals have improved, and the earnings of some companies have improved. We believe investors can expect 5x to 10x returns on UNDERVALUED cannabis stocks of solidly managed companies. The ones on the OTC, the ones that are plant touching, the ones with solid financials that could uplist down the road; those companies have the most leverage. Let the Charts show the Recovery and do the Convincing.

Rainer Poertner 4712 Admiralty Way, #173|Marina del Rey, CA 90292|Office 442.287.8059|Cell 310.614.2454 |

Search

RECENT PRESS RELEASES

Related Post