MicroStrategy Buys Another 2,138 Bitcoin, Adding to Holdings for an 8th Straight Week

December 30, 2024

BTC

93,334.11

-1.44%

ETH

3,381.49

-0.04%

USDT

0.99858553

-0.02%

XRP

2.06

-4.92%

BNB

696.98

-1.78%

SOL

191.52

-1.90%

DOGE

0.31842727

-1.52%

USDC

1.00

-0.03%

STETH

3,379.75

-0.03%

ADA

0.86230763

-4.35%

TRX

0.25572473

-1.78%

AVAX

36.30

-1.24%

TON

5.55

-3.35%

LINK

20.99

-2.30%

SHIB

0.0₄21530

-2.08%

WBTC

93,166.92

-1.33%

SUI

4.11

-2.47%

HBAR

0.27579669

-4.08%

XLM

0.33467577

-3.96%

BCH

446.18

-0.38%

By James Van Straten|Edited by Sheldon Reback

Dec 30, 2024, 1:07 p.m. UTC

What to know:

- MicroStrategy increased its bitcoin holdings for an eighth consecutive week.

- The purchase was funded through share sales under the company’s ATM program.

Disclaimer: The analyst who wrote this piece owns shares of MicroStrategy (MSTR)

MicroStrategy, the self-described bitcoin (BTC) development company, increased its holdings of the largest cryptocurrency for the eighth consecutive week.

The company, which already holds more bitcoin than any other publicly traded company, bought another 2,138 BTC for $209 million in the week ended Dec. 29, bringing its total holdings to 446,400 BTC.

Once again, Executive Chairman Michael Saylor teased the announcement on Sunday in a post on X. The average purchase price of bitcoin was $$97,837, which raised the average purchase price to $62,428.

The purchase was funded through share sales under the company’s at-the-market (ATM) program, for which they have $6.88 billion left on the ATM program.

MicroStrategy joined the Nasdaq 100 last week and currently ranks 57 with an index weighting of 0.38%.

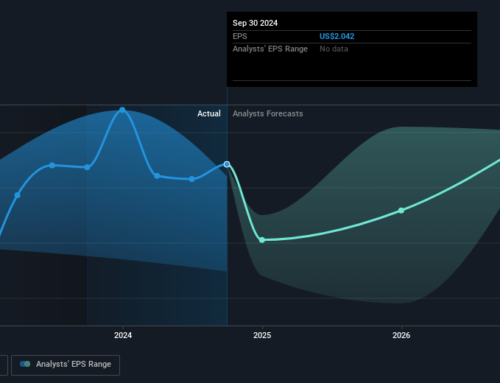

The share price is currently 40% below the record high it hit Nov. 21. It is down 3% in pre-market trading, taking it to around $320 per share.

As the senior analyst at CoinDesk, specializing in Bitcoin and the macro environment. Previously, working as a research analyst at Saidler & Co., a Swiss hedge fund, introduced to on-chain analytics. James specializes in daily monitoring of ETFs, spot, futures volumes, and flows to understand how Bitcoin interacts within the financial system. James holds more than $1,000 worth of bitcoin, MicroStrategy (MSTR) and Semler Scientific (SMLR).

Search

RECENT PRESS RELEASES

Related Post