NextEra Energy and the AI Energy Boom

October 17, 2024

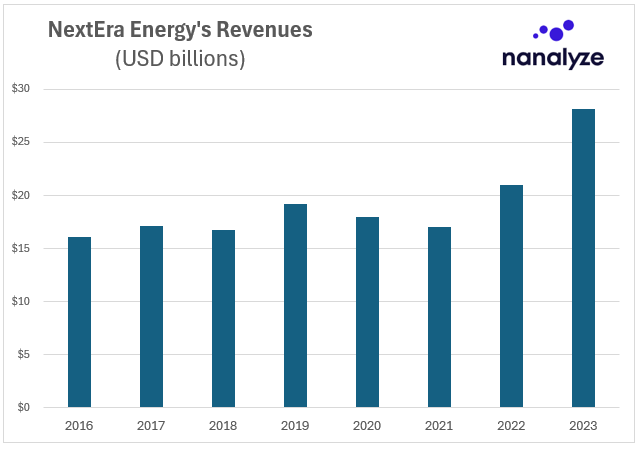

NextEra Energy (NEE) is one of few companies we’re holding for both growth and value reasons. On the one hand, they’re the world’s largest producer of renewable energy and a compelling addition to any disruptive technology portfolio. On the other hand, they’re a dividend champion that has seen dividends grow 11% per year over the past decade. The last time we checked in with NEE revenue growth had stalled. Last year they showed there’s still growth left in the tank.

Today we want to look at NEE’s exposure to the AI power thesis, the risks they might have relating to Florida’s weather, and conduct a general check in with a company that’s shown us some great returns over the years.

NEE, AI, and Nuclear Energy

The AI thesis is straightforward. Elon Musk is predicting an electricity shortage due to increased AI demand and electric utilities stand to benefit from the increased demand for electricity. NEE is the largest electric utility company worldwide which is compelling on its own. Leaders enjoy cheaper access to capital and benefit from economies of scale. Additionally, NextEra is the fourth largest producer of nuclear energy in the United States which raises the question of how much nuclear exposure we’re getting.

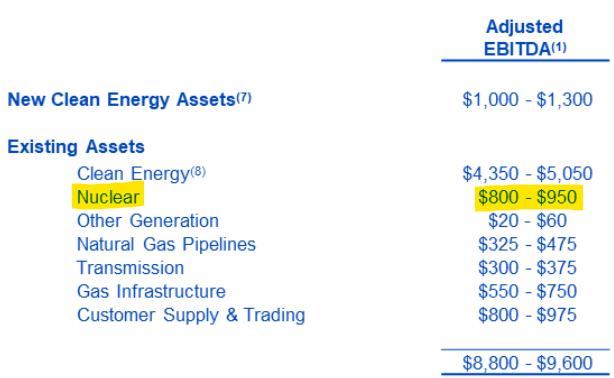

Since we perceive this stock as more value than growth, we’ll want to look at bottom-line contributions. Below is NextEra’s guidance for 2024 (adjusted EBITDA is synonymous with profits).

Using the lower end of the ranges above, you’re getting about 9% exposure to nuclear energy, which isn’t a whole lot. Considering it takes 5-6 years to ramp up new nuclear reactors we wouldn’t expect them to suddenly increase this exposure. In fact, our recent video on nuclear stocks points to there being a lot of hype in this area but not lots of substance. For that we need to see large investment commitments given it costs more than $30 billion to build a new reactor. First, we’ll probably see shuttered reactors reopened.

From a Bloomberg piece this summer:

The demand spike has even led NextEra to consider restarting the Duane Arnold nuclear plant in Iowa, which shut down in 2020 after its biggest customer opted to exit its power-purchase agreement. More than a dozen US reactors have shut since 2013 as operators struggled to compete against cheaper power from natural gas and renewables, but with consumption soaring there’s now talk that some of them could reopen.

In that piece NextEra’s CEO says he expects “an almost 40% rise in US power demand over the next two decades, compared with just 9% over the previous 20 years,” and that “renewable energy will meet most of the consumption boost because new gas-fired plants are much more expensive.” In response to this growing demand for renewable energy NextEra is bringing more capacity online which means the largest producer of renewable energy in the world (outside of state-owned Chinese producers) will only grow bigger. Hyperscalers aim to secure around 75 GW of clean energy by 2030, and NextEra has approximately 300 GW of renewable projects in their pipeline. (Data centers are responsible for 18% of its backlog, according to NextEra.)

Investing in NEE is a play on carbon-free energy which accounts for about 70% of their profits. So, given their heavy exposure to the state of Florida, does the recent inclement weather pose a problem for the company?

NEE and Florida

The investor relations team at NextEra Energy seems out to lunch. An investor deck from 2019 and quarterly decks that look like they were designed by Rain Man mean we’re left trying to sift through mounds of information to determine just how much exposure they have to Florida. (Update: last quarter they reformatted the earnings deck so it looks better. Now they just need to streamline the data.) At the most basic level, Florida Power & Light Company or FPL was responsible for 56% worth of earnings-per-share last year.

As America’s largest electric utility, FPL serves more customers and sells more power than any other utility. They only operate in the State of Florida – the third largest state in the union – and an article by Power Engineering talks about how they’ve been consistently ranked as the nation’s most reliable electric power utility, and that they’re “industry leaders when it comes to serving their customers in extreme weather situations.” Says the piece:

Since the historic storm seasons of 2004 and 2005, FPL has made billions in investments to sustain its grid and enhance customer reliability. It hardened more than 50 percent of main lines serving critical facilities and services, while also installing more than five million smart meters, 120,000 sensors and other intelligent devices to speed up restoration times and clearing trees and vegetation from more than 15,000 miles of line.

Florida’s weather risk seems both notable and manageable. NextEra is a company that’s not only paid a dividend but increased it for 30 years in a row. That financial discipline often points to superior risk management and an understanding of how to manage the unexpected. Florida will continue to have foul weather and NextEra will keep managing it as they have been and continuing to grow the business and dividends. At least that’s the plan.

NEE’s Dividend Growth

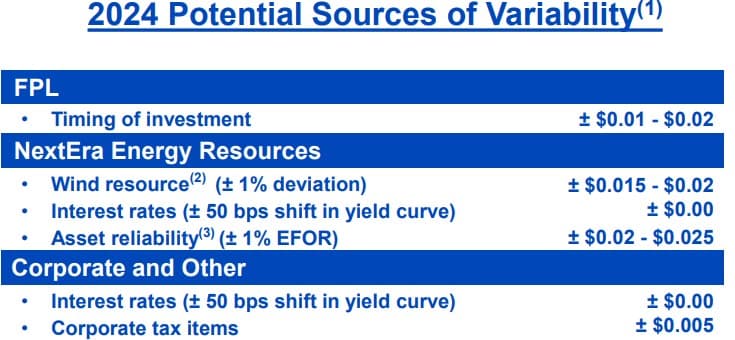

In Q4-2022 NEE said they expected dividend growth to be 10% “through at least 2024.” Then in early 2023 NEE saw revenue and guidance fall short of analysts’ expectations and dividend growth was forecasted to be 10% annually “through at least 2024” again. They didn’t extend that forecast which troubled some dividend growth investors. Then the most recent earnings said to expect dividends to grow roughly “10% rate per year through at least 2026, off a 2024 base.” Since dividend growth is a function of earnings-per-share (EPS), the below sensitivity analysis is of interest, mainly because it shows risks the company has identified and tries to manage through like wind utilization and interest rate changes.

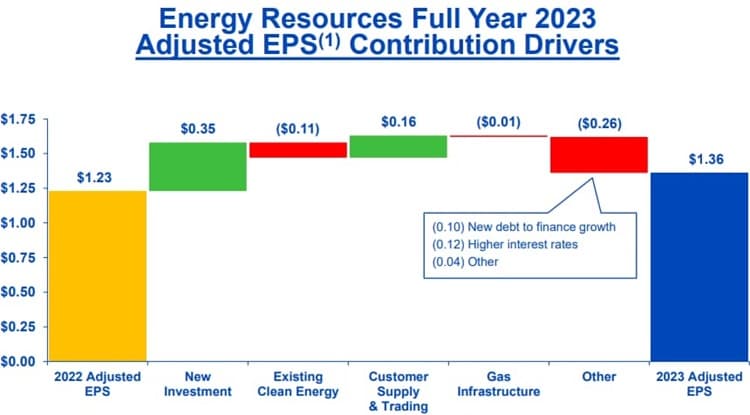

However, based on last year’s results, we don’t see the above factors impacting profitability much. Below you can see the main reasons for the increase in EPS from 2022 to 2023.

Investors want to pay close attention to EPS growth because that’s where dividend growth comes from. And NEE has done a tremendous job of growing their dividend by double digits every year for the past 20 years.

Double-digit growth dividend growth can be very impactful over time. For example, if you invested a lump sum in NEE at a 3% yield 10 years ago, your money would be now yielding 7%. And that’s not even considering your shares would have appreciated by +235% vs an S&P 500 return of +196% over the same time frame. That return is even more impressive when benchmarked against the the largest utility sector ETF which returned just +79% over the past decade.

Historical performance is no indicator of future performance, but the point is this. We’re invested in NextEra because they’re a dividend growth stock with a track record of excellence. Whatever boost in energy demand AI brings to the table is just icing on the cake. And as always, we never fall in love with a stock. Company-specific risk will quickly humble those who start worshipping sacred cows.

NEE Key Metrics

Since we would only ever sell NEE if they stopped increasing their dividends, we don’t pay much attention to their year-to-year activities. However, since earnings-per-share is expected to grow 6-8%, and dividend growth is expected to grow at 10%, something needs to change for the dividend to keep growing in the double digits. Let’s hope the strong demand for renewable energy in the coming decades sorts that out. If so, we’re only concerned if the company gets into trouble.

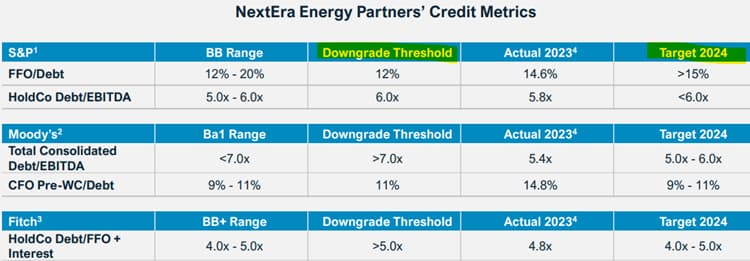

For example, the $60 billion in long-term debt on their books could become an issue quite quickly. Just look at the below table which depicts how tight the tolerances are between a credit downgrade and key credit metrics.

Watching what the credit rating agencies have to say about this sizable amount of outstanding debt will give shareholders some advance notice if things go south. Recently fallen dividend champions like VFC and Walgreen Boots have had dividend cuts that coincide with problems servicing debt.

Conclusion

NextEra Energy is suddenly on everyone’s radar because of the demand for energy AI has created. We’ve been invested in the stock for well over a decade because of their exposure to renewable energy. We came for the green thesis and stayed for the dividend growth. These days there’s only one reason we’d sell NEE stock – if they stopped growing their dividend. Based on today’s findings, and the expected strong demand for electricity AI brings, it seems like NEE’s dividend will be enjoying strong growth for a while.

Search

RECENT PRESS RELEASES

Related Post