Nvidia Defends Key Support As This Magnificent 7 Peer Approaches Buy Zone: Here’s What Technical Analysis Says , NVIDIA (NASDAQ:NVDA)

December 31, 2024

As 2024 winds down, Nvidia Corporation NVDA is holding steady near its key 20-day averages. Meanwhile, Meta Platforms META is poised for a potential rebound, above its 50-day average.

What Happened: The technical health of these stocks can be assessed by identifying support and resistance levels, according to Benzinga Pro data.

Nvidia Corp

The technical analysis of daily moving averages indicates that the stock is clinging to the support provided by its 20-day exponential moving average.

The stock ended at $137.49 apiece on Monday. This was just above its 21-day exponential moving average of $137.36 and 20-day simple moving average of $137.37. However, as per Benzinga Pro data, its current stock price was lower than the 50-day simple moving average of $139.96 and higher than its 200-day simple moving average of $117.63.

This implies that the stock is taking support at 20-day levels and the relative strength index of 49.91 suggests the stock’s movement is in the neutral zone.

Meta Platforms

The technical analysis of daily moving averages indicates a bullish uptrend as the stock has moved past its 50-day moving average levels.

The stock ended at $591.24 apiece on Monday. This was above its 50-day simple moving average of $587.91 and 50-day exponential moving average of $588.93. However, as per Benzinga Pro data, its current stock price was lower than the 20-day simple moving average of $609.59, and above its 200-day moving average of $528.11.

This implies that the stock is in an uptrend. On the other hand, the relative strength index of 46.5 suggests the stock’s movement is in the neutral zone.

Why It Matters: As we head into the new year, Jim Cramer in an X post dated Dec.16, warned of a potential market correction for Nvidia on X, citing its recent surge and lack of a “crescendo moment.” He predicted a “vicious” and “fast” reversal. This comes as Nvidia faces an antitrust investigation in China over its 2020 acquisition of Mellanox Technologies.

TF Securities analyst Ming-Chi Kuo expects the investigation to remain unresolved in the near term, drawing parallels to Qualcomm Inc‘s QCOM 15-month antitrust case in China.

JPMorgan raised Meta Platforms’ price target to $725, maintaining its “overweight” rating on Dec. 1. The firm anticipates robust internet sector growth in 2025, driven by a shift in AI focus towards applications and agents. It expects increased AI spending next year from Meta and other tech leaders as they overcome 2024’s compute constraints.

Truist Securities analyst Youssef Squali maintained a ‘buy’ rating on Meta and bumped the target price to $700 per share based on the company’s strong revenue, gross profit margin, and sustained growth potential.

Price Action: Shares of Nvidia are up 0.62% in premarket and 185.43% on a year-to-date basis, outperforming the Nasdaq 100, which was up 28.13% over the year.

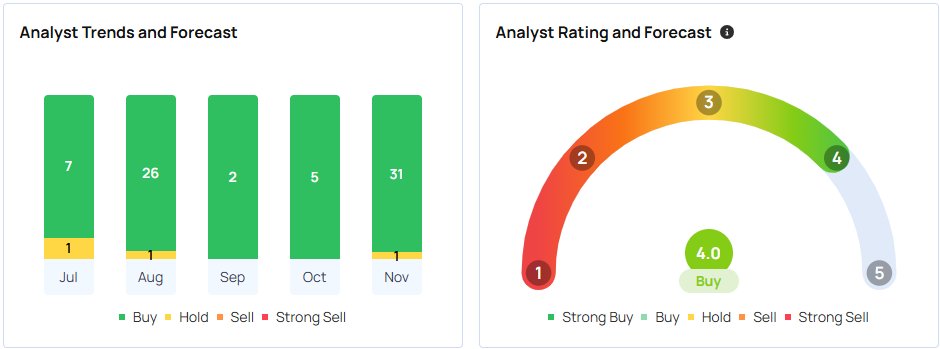

According to Benzinga, Nvidia has a consensus price target of $170.56 based on the ratings of 40 analysts. The highest price target out of all the analysts tracked by Benzinga is $220 issued by Rosenblatt as of Nov. 21, 2024. The lowest target price is $120 issued by New Street Research on Aug. 6, 2024.

The average price target of $154.67 between DA Davidson, Phillip Securities, and Truist Securities implies an 11.83% upside for Nvidia.

Shares of Meta are up 0.48% in premarket and 70.74% on a year-to-date basis, outperforming the Nasdaq 100, which was up 28.13% over the year.

According to Benzinga, Meta has a consensus price target of $642.51 based on the ratings of 41 analysts. The highest price target out of all the analysts tracked by Benzinga is $811 issued by Rosenblatt as of Oct. 31. The lowest target price is $360 issued by Exane BNP Paribas on May 2.

The average price target of $154.67 between JPMorgan, Truist Securities, and Piper Sandler implies a 17.55 upside for Meta.

Read Next:

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Search

RECENT PRESS RELEASES

Related Post