Oil Majors Slash Renewables and Boost Biofuels

November 22, 2024

– European oil majors are winding down investments into renewable energy projects after the double whammy of low returns and skyrocketing costs prompted them to look towards more profitable deals.

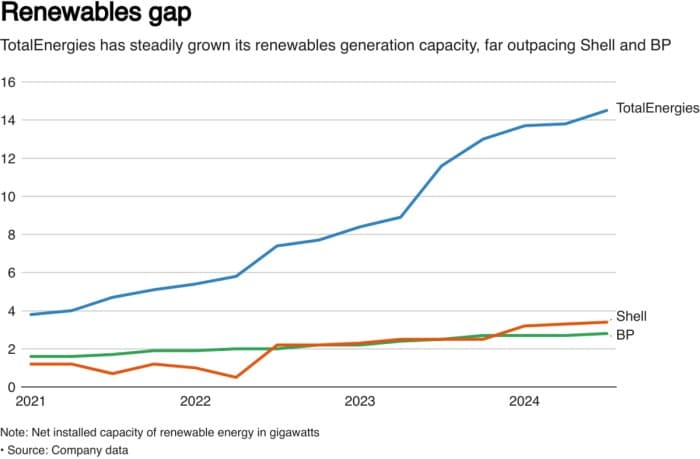

– BP has halted 18 potential hydrogen projects already and is set to divest several existing wind and solar operations, similarly Shell which cut back on its 2030 carbon reduction target, leaving TotalEnergies the only major to stick to its initial commitments.

– At the end of 2023, BP and Shell had 2.7 GW and 3.2 GW of operational renewable capacity available, however their potential capacity stood as high as 58.3 GW and 34.6 GW, respectively, suggesting ample divestments over the upcoming period.

– Norway’s Equinor has announced this week that it would cut 20% of the staff from its renewable energy division, some 250 employees, and will take on less project exposure in the upcoming years.

Whilst Slashing Renewables, Biofuels Become Next Best Thing For Oil

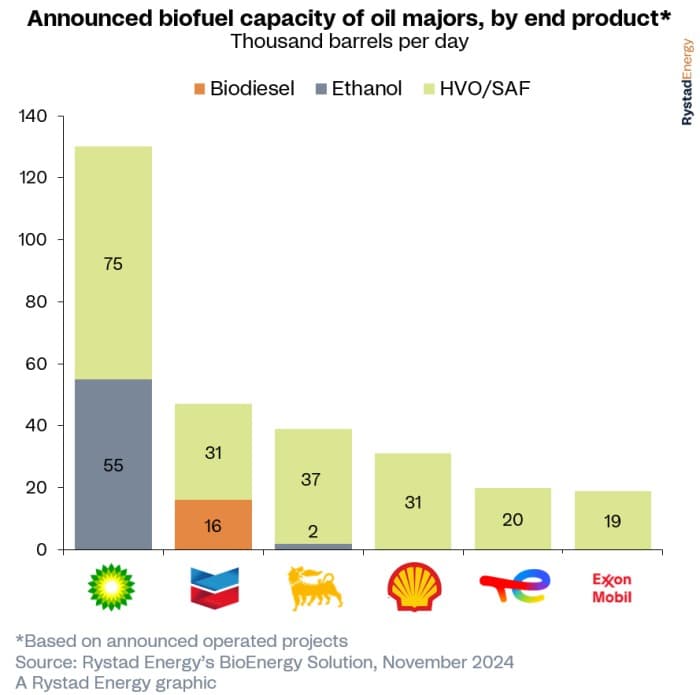

– In contrast to loss-making renewable energy projects, the portfolio of oil companies in biofuels keeps on increasing with the world’s six largest oil majors collectively developing 43 biofuel projects.

– Whilst majors tentatively eye opportunities in biodiesel or bioethanol as well, the main focus of the oil industry has been on hydrotreated vegetable oil (HVO) and sustainable aviation fuel (SAF) which make up 90% of those projects.

– Amongst…

- Oil Majors Give Up the Renewable Ghost

– European oil majors are winding down investments into renewable energy projects after the double whammy of low returns and skyrocketing costs prompted them to look towards more profitable deals.

– BP has halted 18 potential hydrogen projects already and is set to divest several existing wind and solar operations, similarly Shell which cut back on its 2030 carbon reduction target, leaving TotalEnergies the only major to stick to its initial commitments.

– At the end of 2023, BP and Shell had 2.7 GW and 3.2 GW of operational renewable capacity available, however their potential capacity stood as high as 58.3 GW and 34.6 GW, respectively, suggesting ample divestments over the upcoming period.

– Norway’s Equinor has announced this week that it would cut 20% of the staff from its renewable energy division, some 250 employees, and will take on less project exposure in the upcoming years.

- Whilst Slashing Renewables, Biofuels Become Next Best Thing For Oil

– In contrast to loss-making renewable energy projects, the portfolio of oil companies in biofuels keeps on increasing with the world’s six largest oil majors collectively developing 43 biofuel projects.

– Whilst majors tentatively eye opportunities in biodiesel or bioethanol as well, the main focus of the oil industry has been on hydrotreated vegetable oil (HVO) and sustainable aviation fuel (SAF) which make up 90% of those projects.

– Amongst oil majors, BP stands out with the largest announced production capacity of biofuels, reaching a combined 130,000 b/d of ethanol and HVO/SAF capacity, partially aided by its purchase of Bunge Bioenergia, a Brazilian biofuel producer.

– Chevron’s 22,000 b/d Geismar project in Louisiana is the single largest greenfield project taking place, whilst BP’s Kwinana project in Australia is the largest announced refinery conversion project so far.

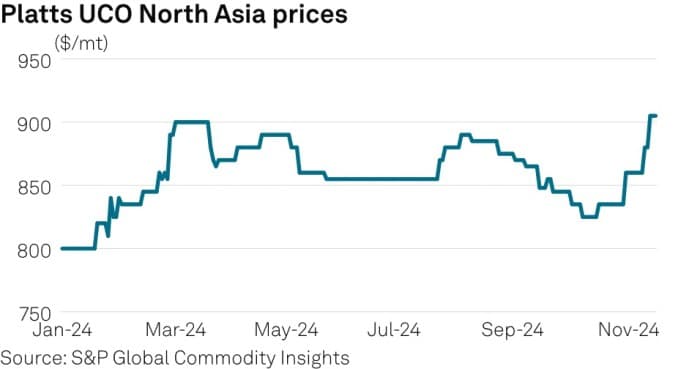

- China Scraps Export Tax Rebates, Sends UCO Flying

– China will be ending tax rebates on the export of Used Cooking Oil (UCO), implying a 13% change to the profitability of UCO outflows from the world’s largest producer, adversely impacting biofuel makers globally.

– Accounting for almost 55% of global UCO flows, the tax rebate cuts will also impact oil products, metals, batteries and photovoltaics, however in biofuels the price reaction was almost immediate.

– Recent offers on the Chinese market saw bids soaring above $1,000 per metric tonne, some 15% higher compared to the beginning of this month, with expectations of UCO rising further once Donald Trump is inaugurated.

– China is tightening its SAF mandates, demanding at least 2% blending of SAF by 2025 which would require at least 3 million metric tonnes of UCO as feedstock, but that might not be enough to offset weaker exports.

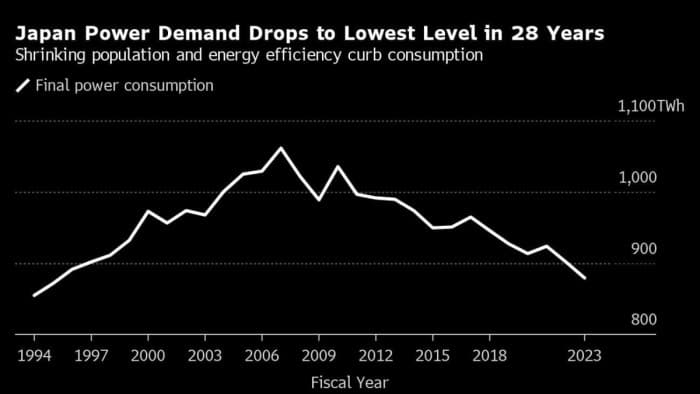

- Japanese Electricity Generation Falls to Decade-Low

– Japanese power generation dipped to its lowest in a decade in the year through March, whilst the Asian country’s electricity demand fell to a 28-year low as the double whammy of a shrinking population and energy efficiency brought about less power consumption.

– Japan’s oil industry has been a harbinger of falling consumption, with demand peaking at 5.7 million b/d in 1996, only to steadily decline to 3.3 million b/d currently.

– Shutting three major refineries in 2022-2024 alone, the number of Japanese refineries halved from 36 in the early 2000s, whilst gas generation has been declining every single year since 2017.

– Nuclear has been the bright spot in Japan’s power industry, rising on the heels of returning post-Fukushima capacity with its overall share in generation rising to 8.5% in fiscal 2023, the highest since 2012.

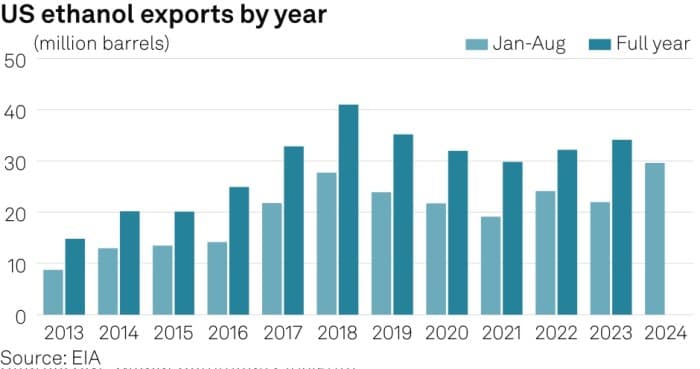

- US Ethanol Exports Set for Record Performance

– EIA records indicate that US ethanol exports are set to reach an all-time high this year after totaling 29.6 million barrels in January-August, up 35% compared to the same period last year.

– US flows were boosted by a weaker performance from Brazil where domestic ethanol fuel demand soared to multi-year highs amidst favorable pricing ratios vis-à-vis gasoline, keeping a larger share of Brazilian ethanol at home.

– Export economics remain attractive thanks to a bumper corn crop harvest in 2023 that depressed feedstock corn prices, lifting US ethanol production to a record production average of 1.113 million b/d in early November.

– Canada has remained the most important market for US ethanol outflows, accounting for 36% of all exports, followed by the United Kingdom or countries like Colombia where the Petro government recently restored its E10 gasoline blending mandate.

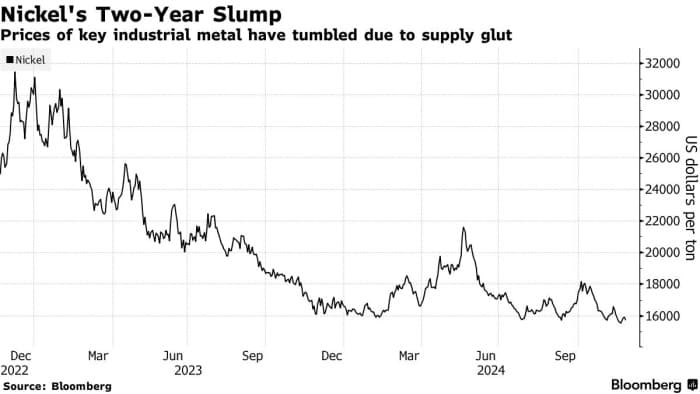

- Indonesian Nickel Is Flooding The Market, Aggravating Inequalities

– Nickel producers in Southeast Asia have entered a period of fierce competition as French mining major Eramet accused the Indonesian government of squeezing supplies of nickel ore to protect smaller local producers.

– Eramet claims that the quota offered by Jakarta is 29% lower than expected, with the government seeking to keep prices rangebound within $15,000-18,000 per metric tonne.

– Indonesia now accounts for more than 50% of global nickel output, spearheaded by Chinese smelters operating in the country, whilst the mining side is much more dispersed and combines giants like Eramet and Vale with smaller local producers.

– As nickel is mostly used either in stainless steel or EV battery production, Indonesian miners have been focusing on higher-grade ore that’s usually used for the former, at the expense of the less-rich limonite form that could impact EV battery pricing.

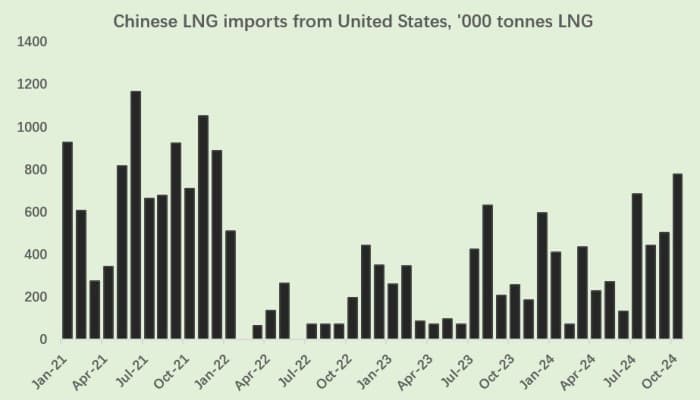

- China Binges on American LNG Before Trump Tariffs Kick In

– Chinese importers of liquefied natural gas are ramping up LNG deliveries ahead of a potential trade war between the US and China, with overall imports rising by 63% in the first 10 months of 2024 so far.

– Although is still placed ‘only’ fifth in the total list of Beijing’s suppliers, shipping in 3.9 million tonnes so far this year, Chinese gas buyers have contracted a whopping 14 mtpa of US LNG starting from 2026.

– The gas markets are speculating that should President Trump slap a 60% tariff on Chinese goods, China would retaliate by implementing levies on American gas, as was the case back in 2019.

– From the US perspective, China accounts for 5% of LNG exports, with the Sabine Pass liquefaction facility running the highest risks of seeing Chinese buying dip, overtaking Freeport as the largest supplier this year.

<!–

Trending Discussions

–>

Search

RECENT PRESS RELEASES

Related Post