Renewable Energy Provider Eyes Africa Expansion, Partners with SEFE

September 24, 2024

Distributed renewable energy provider Ignite Power has signed a term sheet with SEFE for a carbon offtake transaction.

The transaction targets carbon markets under Article 6 of the Paris Agreement, which establishes international compliance carbon markets where countries can trade carbon credits.

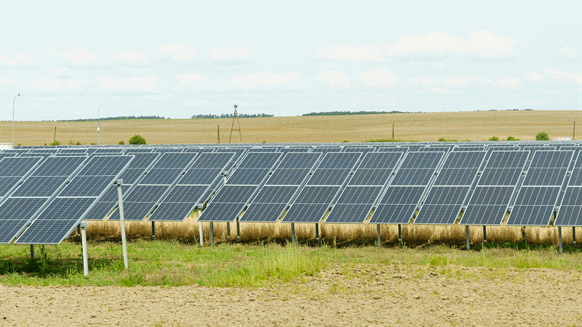

The transaction will drive the company’s expansion across both West and East Africa, where it is deploying off-grid solar systems to underserved and unserved communities, Ignite Power said in a news release.

According to Ignite Power, the funding allows the company to “improve end client affordability and scale more rapidly across multiple countries”. By receiving payments in hard currency, the company also mitigates the financial risks associated with currency depreciation in local African markets, ensuring a stable revenue stream as operations expand, it noted.

Ignite Power said its advanced Monitoring, Reporting, and Verification (MRV) digital platform allows seamless real-time data collection and reliable verification of the carbon savings generated. The technology ensures full transparency, traceability and accountability, a set of key requirements for generating high-quality carbon credits.

The platform’s ability to track carbon savings in real-time, even in areas with limited or no connectivity, gives it a “significant competitive advantage”. By leveraging this data-driven approach, the company ensures compliance with international carbon standards and optimizes the value of carbon credits sold on the market, Ignite Power said.

Ignite Power CEO Yariv Cohen said, “Africa presents a unique opportunity to build the next generation of utility infrastructure—one that is 100 percent clean, renewable, and sustainable. If we fail to establish the sector in this way, the alternative is adding extremely polluting projects at a high cost. On the other hand, off-grid solar solutions have proven to be the most impactful, affordable, and scalable option for large-scale electrification efforts and have a critical role in providing hundreds of millions with electricity. This $24 million off-take agreement with prepayment, made possible through our partnership with SEFE, is just the first step, as the combination of advanced financial structures, carbon markets, and cutting-edge technology is a game changer for Africa’s energy future. The road to connecting 100 million people is challenging, but with the right partners and financial tools, we’re confident in our ability to achieve this ambitious goal and redefine what’s possible in the off-grid solar sector”.

According to the release, SEFE, a leading player in carbon market solutions, has extensive experience in structuring innovative financial mechanisms that unlock capital for climate impact. The transaction is part of a larger strategy to create scalable, replicable carbon finance models that drive both environmental and social benefits.

Through the agreement, SEFE will facilitate the generation, verification, and trading of emission reductions tied to the deployment of Ignite Power’s solar systems. “This not only provides capital to Ignite but also positions the company to generate additional revenue through the sale of emission reductions on global markets,” Ignite Power said.

SEFE Chief Commercial Officer Frederic Barnaud said, “At SEFE, we are deeply committed to supporting only the highest quality projects with the utmost integrity, and our partnership with Ignite Power perfectly embodies this commitment. Beyond the substantial CO2 [carbon dioxide] emission reductions this project will achieve, we are particularly proud of the profound impact it will have on the lives of countless African families, providing them with clean and affordable energy instead of relying on harmful kerosene for lighting. This initiative holds tremendous developmental potential, and we are optimistic that it will bring lasting, positive change to these communities”.

The carbon market in Africa has tremendous growth potential, according to the release. While the global voluntary carbon market is currently valued at over $2 billion and projected to reach $50 billion by 2030, Africa remains a largely untapped frontier for carbon finance.

To contact the author, email rocky.teodoro@rigzone.com

Search

RECENT PRESS RELEASES

Related Post