Stablecoins on Ethereum Layer-2 Hit $13.5 Billion Milestone

December 21, 2024

Ethereum’s layer-2 networks have reached a record $13.5 billion in stablecoins, according to Tie Terminal’s latest data.

This massive milestone is driven by the role of digital assets in practical applications, particularly stablecoins like Tether (USDT), USD Coin (USDC), and USDe. The total circulation of stablecoins now stands at an impressive $205 billion, underscoring their centrality in global blockchain operations.

Source: The TIE Terminal

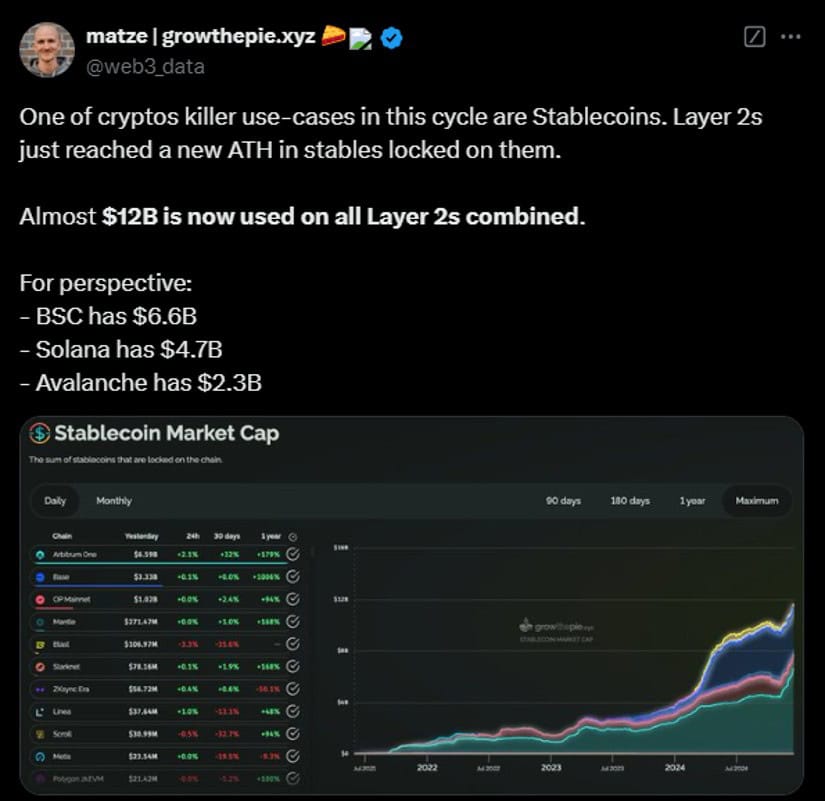

On December 15, Matthias Seidl, co-founder of growthepie.xyz, highlighted the surge in stablecoins locked within Ethereum’s layer-2 systems. He noted that stablecoins have emerged as a pivotal use case in this cycle, with these networks achieving new all-time highs in locked values.

Source: X

Layer-2 solutions like Arbitrum One, leading with $6.75 billion, and Base, with $3.56 billion, illustrate the growing adoption of these systems. This momentum has accelerated since the Dencun upgrade in March 2024, which significantly lowered transaction fees, enabling higher user engagement and broader activity within the Ethereum ecosystem.

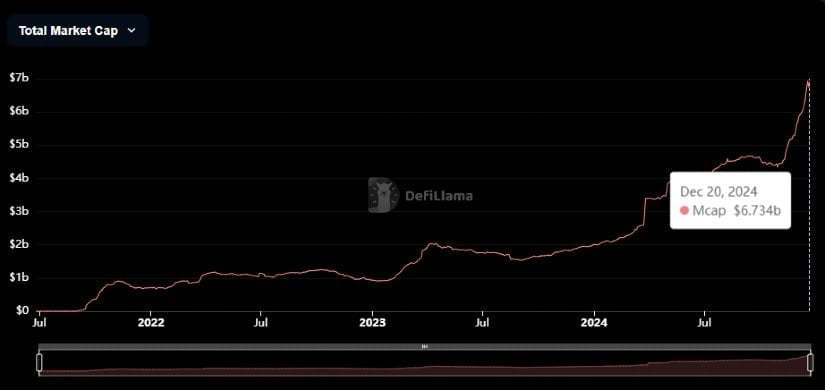

Source: DefiLlama

Ethereum Layer-2 Networks Surge Post-Upgrade

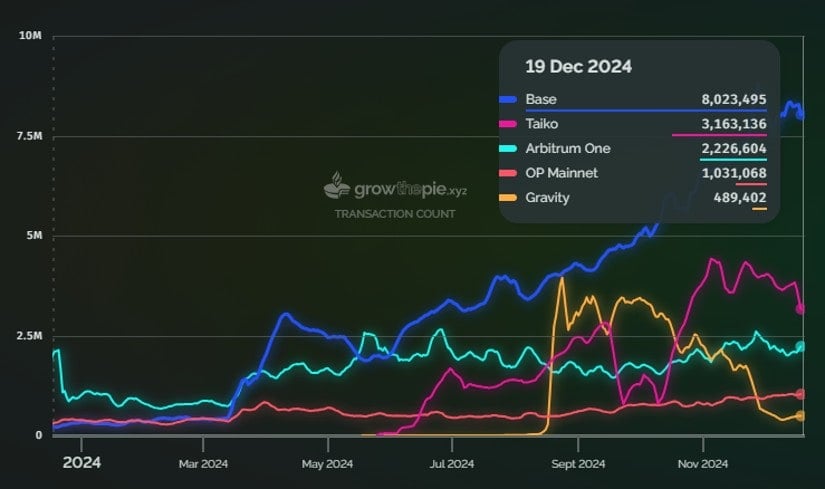

Ethereum layer-2 activity has skyrocketed since the upgrade, with networks like Base growing from roughly 400,000 daily transactions in March to an astounding 8 million by the end of 2024. Taiko has also gained momentum, boasting over 3 million daily transactions, while Arbitrum remains a significant player with over 2 million transactions, according to Growthepie.

Source: Growthepie

Unfortunately, not all layer-2 networks share this growth. Linea, for example, has seen its daily transaction count plummet to just 200,000—a significant drop from its 800,000 peak. Despite this, Base leads in active addresses, followed by Arbitrum and Linea, reflecting the shifting dynamics within the ecosystem.

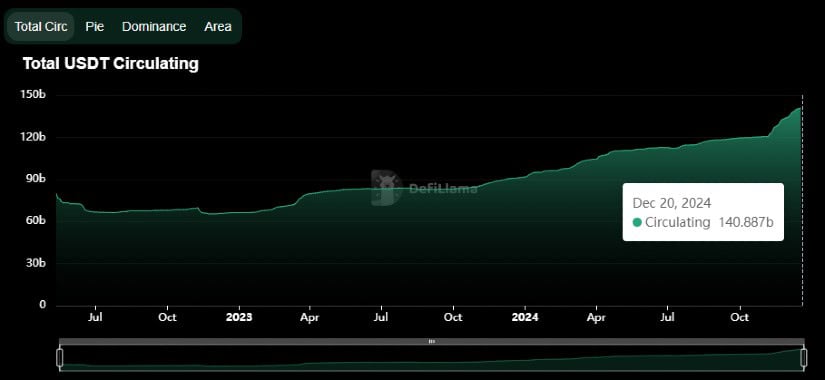

Meanwhile, Tether (USDT) continues to dominate the stablecoin market, reaching $140.88 billion in market capitalization as of Dec. 19. This is a significant jump from its $91.7 billion cap at the start of the year. Circle’s USDC also saw gains, peaking at $42 billion, though it still trails its June 2022 all-time high of $55.8 billion.

Source: DefiLlama

Blob Fees, Revenue Cuts, and Deflationary Trends

The Dencun upgrade introduced “Blobs” as a cost-saving feature, temporarily storing transaction data to reduce fees. These fees are burned, mirroring Ethereum’s transaction fee mechanism, which reduces ETH supply. Since the merge, Blob fees have burned over 1,200 ETH, most of it in the past few weeks.

Base has emerged as the largest contributor to Blob submissions, while Taiko leads in total Blob fees, accumulating $3.5 million. Although the average Blob count per block fell short of the target earlier this year, it hit the mark consistently in November, reflecting a renewed efficiency in Ethereum’s rollup-centric roadmap.

However, the reduced transaction fees have sharply cut revenues for Ethereum. Despite this, Base and Taiko are mounting comebacks, with increasing rent paid to the Layer-1 chain. As Ethereum activity shifts toward layer-2 rollups, the main chain has seen its ETH burn rate decline, even as Blob fees offer a deflationary counterbalance.

Layer-2 Growth Reshapes Ethereum’s Ecosystem

Layer-2 activity isn’t just expanding—it’s reshaping Ethereum’s entire ecosystem. As Blob usage rises, Ethereum’s supply could once again turn deflationary. Time Robinson’s Ethereum Blob simulator suggests that ETH supply could shrink by 6.5% at 100 transactions per second for 100 rollups, a medium-term goal endorsed by Ethereum founder Vitalik Buterin.

Source: Time Robinson

Amid all this, stablecoins remain the star of the show. They have transformed into a critical financial tool, with Arbitrum maintaining its leadership in stablecoin market cap, followed by Base and Optimism. Even as concerns linger over declining main-chain revenues, the growth of layer-2 networks offers an optimistic outlook for Ethereum’s future.

In the end, this milestone for Ethereum and its layer-2 networks is not just about numbers. It’s about the evolving potential of blockchain technology, and how innovations like stablecoins and reduced fees are shaping a decentralized future. With over $13.5 billion locked in layer-2s, the road ahead looks promising—and Ethereum appears ready to lead the way.

Search

RECENT PRESS RELEASES

Related Post