The Changing Landscape Of Clean Energy After The Recent Election

November 25, 2024

Recent U.S. election results introduce new challenges and opportunities for a clean energy sector heavily influenced by the political climate, regulatory shifts, and financial markets.

United States

Energy and Natural Resources

To print this article, all you need is to be registered or login on Mondaq.com.

THE STATE OF CLEAN ENERGY AFTER THE 2024 ELECTION

Recent U.S. election results introduce new challenges and

opportunities for a clean energy sector heavily influenced by the

political climate, regulatory shifts, and financial markets. As

myriad fundamentals — including the cost of capital and policy

– evolve, so too will the sector’s growth prospects.

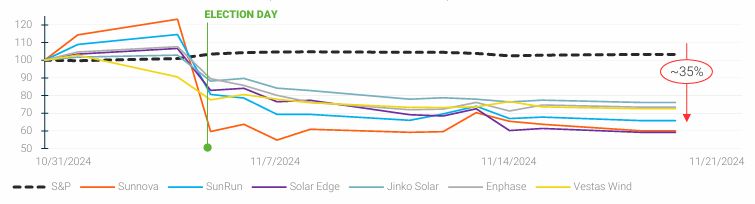

Investors seem to be extremely cautious about the potential

impact on the renewable sector. A representative set of publicly

traded industry leaders are underperforming the broader market in

response to the election.

AlixPartners Power & Renewables Team offers a subjective

view on changes to come and how to best prepare business for the

shift of power in Washington.

REPRESENTATIVE PRICE RETURN (INDEXED FROM

31-OCT)

SIX KEY IMPACTS ON THE RENEWABLES INDUSTRY

1. HIGHER RISK PREMIUM DRIVEN BY POLICY

UNCERTAINTY

Clean energy projects are capital-intensive, and this changing

of the guard may result in slower-than-expected interest rate

declines. At the same time, potential policy shifts could drive up

borrowing costs for renewable investments. Even though the

Inflation Reduction Act may not be fully repealed, there is still

considerable legislative risk to clean energy programs in the wake

of the election.

Any changes to the IRA provisions could disrupt the flow of

subsidies and tax credits, making it harder for companies to access

capital. Smaller clean energy firms are especially vulnerable to

financial difficulties if government loans or subsidies are delayed

investors should be prepared for disruption across the renewable

supply chain.

With possible higher risk premiums driven by uncertainty ahead,

companies should immediately explore alternative funding

strategies, tighten cash management, and scrutinize capital

projects. Companies dependent on federal loan commitments or

subsidies should prepare for potential setbacks, while larger firms

may need to focus on accelerating projects before funding sources

dry up.

2. SHORT-TERM SCRAMBLE FOR KEY COMPONENTS

Those anticipating higher tariffs and a tougher regulatory

climate may rush to start clean energy projects before changes to

subsidies and credits take effect, or deadlines for existing tax

incentives are accelerated. A short-term demand surge would further

pressure supply chains, creating near-term upward pressure on

prices for key components.

Swift action is required to secure supplies and meet deadlines

tied to current incentives before new tariffs take effect.

3. ONSHORING AND NEARSHORING MAY INTENSIFY

Trade policies are in flux, with tariffs and geopolitical

tension affecting Asian supply chains and potentially fueling a

more aggressive shift to nearshoring. Focus may shift to building

resilient production closer to home or within allied nations,

helping avoid disruptions and ensure stability.

This significant shift in supply chain and potential need to

develop new manufacturing capacity requires a deep review of

internal capabilities resulting in realignment of the operating

model to enable success.

4. SUBSIDY AND LOAN DELAY, CHANGES IN IRS

GUIDELINES

Election results are stoking concern about potential delays in

grants, loans, and tax credits. The processing of support from the

Department of Energy’s Loan Programs Office may slow down, for

instance, impacting firms dependent on government assistance.

The Trump administration’s approach to the Waste

Emissions Charge – the source of revenue for the IRA tax

credits – should be closely watched. Changes to IRS

guidelines on tax credit rules would make it harder for companies

and consumers to claim credits for renewable energy technologies

like solar and electric vehicles. This could dampen the growth of

these markets, slowing investment and reducing the attractiveness

of clean energy projects for consumers.

Business models heavily dependent on governmental programs may

want to reassess economic viability of their projects, revise

growth plans and profitability assumptions in the business plan.

Organizational rightsizing may be required to adjust cost base to

the new normal.

5. RE-ALIGNMENT TO LOCAL INCENTIVES

While the federal government has clout via many general tax

credits, each state will work to fortify their own energy policies.

The already significant divide for ISOs deploying more renewable

generation (CAISO; SPP, ISO-NE) may further deepen driven by local

incentives and weakened federal policy. States pushing more

renewables will shore up local incentives to meet the energy

transition targets.

Regionalization of incentives will widen the gap in energy

deployment, perhaps causing more shift in business footprints over

the next four years. Companies must rethink its go-to-market

strategies to best position their businesses to capitalize on local

incentives. This shift may add further complexity to the business

and drive short-term uncertainty. True winners will be able to

re-align their geographic focus and accelerate growth through

selective M&A.

6. DEREGULATION OPPORTUNITIES

Deregulation is likely to continue, potentially including repeal

of environmental reviews and attempted dismantling of the EPA.

Improved economics for fossil fuels may not be enough to attract

more investments as clean energy already competes without subsidies

in many markets. Historical EPA regulations (Clean Air Act and

Clean Water Act) will be difficult to dismantle due to history and

entrenched processes and will likely remain intact.

If certain environmental protections are rolled back, however,

this could streamline project approval timelines and reduce

bureaucratic hurdles, allowing companies to bring products to

market faster. For clean energy projects like solar farms and

energy storage systems, shorter approval timelines could

significantly speed up deployment and reduce costs.

Companies should explore opportunities to capitalize on less

strict regulatory environment. As the economics of many businesses

shift, legal, regulatory and permitting may be areas of substantial

savings if managed properly. New, possibly compressed timelines and

lower third-party spend may offer much needed tailwind to the

already challenged capital projects in renewable space.

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.

Search

RECENT PRESS RELEASES

Related Post