This Earnings Number Is Keeping Tesla Short Sellers...

April 30, 2018

Jonas Elmerraji

Apr 30, 2018 2:48 PM EDT

On average, 19 analysts expect Tesla to lose $3.47 a share for the quarter, as huge costs from factory upgrades and production ramp-ups help obliterate revenue increases. But that’s not the earnings number that matters most for Tesla’s stock price this week.

Instead, that number is Model 3 production.

All year long, Tesla-watchers have been fixated on the company’s ability to scale up production of its mass market Model 3 sedan at its Fremont, Calif. factory. Some high-profile production misses have been the defining catalysts that have pressured shares lower in 2018.

And because Tesla is the most-shorted stock on the market right now, Wednesday’s earnings call might just be the most high-stakes event this earnings season.

The irony is that, from a practical standpoint, shifting Model 3’s production curve to the right doesn’t have a particularly direct impact on shorts’ selling thesis. Tesla isn’t going bankrupt because it gets to 3,000 units a week a couple months later than originally planned.

Regardless, that’s the metric that the market is watching the closest right now.

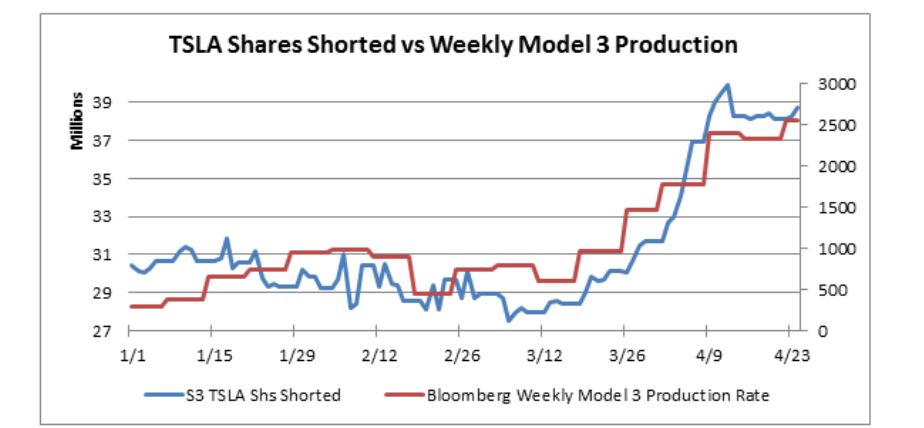

Likewise, as S3 Partners pointed out in a recent analyst note, the number of Tesla shares shorted has had a very high correlation with weekly Model 3 production numbers; simply put, shorts have been playing a game of financial brinksmanship with Elon Musk all year long. And earnings could help usher a conclusion to that back and forth, one way or another.

According to Bloomberg’s estimates for Model 3 production, Tesla is currently building approximately 2,323 units a week – with more than 22,000 Model 3s on the road at this point.

Meanwhile, a recently leaked internal email to Tesla employees from Elon Musk showed that the company is targeting 6,000 units a week of production in order to hit their end-of-Q2 target of 5,000 cars a week with a reasonable margin of safety.

Even though Tesla conspicuously missed production targets set early after the Model 3 launch, the firm has been tightening in on its goals more recently. Last quarter, for instance, Tesla’s goal was 2,500 units a week, a target missed by fewer than 500 vehicles.

The firm’s factory closures earlier this month in order to retool for faster production could have the side-effect of making it look like Tesla produced fewer vehicles in April than it’s capable of building today.

A combination of extreme short interest in Tesla and relatively tepid expectations make this a stock with significant volatility potential in the wake of Wednesday’s earnings release. The only question is which way that volatility unfolds. We’ll have our answer soon.

Search

RECENT PRESS RELEASES

Related Post