Unleashing the residential rooftop solar potential

October 15, 2024

The rooftop solar market in India consists of residential, commercial and industrial (C&I) and government segments. In comparison to C&I, the uptake of rooftop solar in the residential sector has been largely underwhelming. As of March 2024, residential rooftop solar installed capacity in India was about 3.2 gigawatts (GW), or 27% of the total rooftop solar installations in the country, with about three-quarters of this capacity in Gujarat.

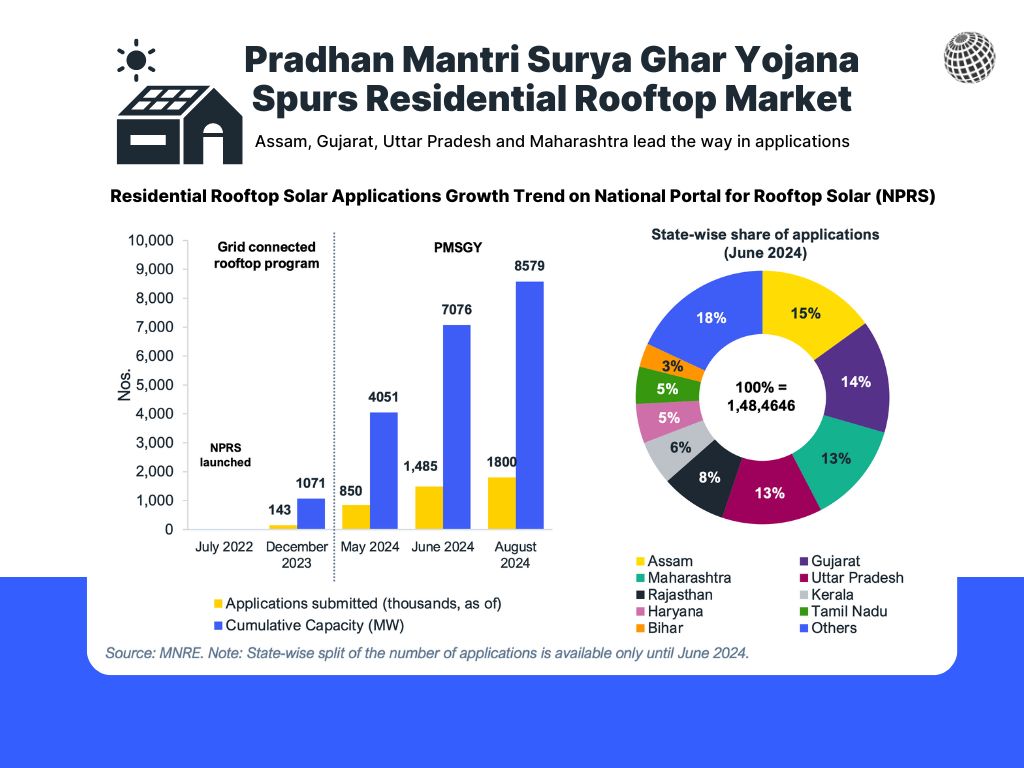

In February 2024, the Government of India (GoI) announced a revamp of the subsidy structure for residential consumers opting for rooftop solar systems through Pradhan Mantri Surya Ghar Yojana (PMSGY). The scheme aims to foster an enabling ecosystem for the residential rooftop solar market and cumulative installations of 30GW solar systems in 1 crore (10 million) households in India by March 2027. To do so, PMSGY increased the central financial assistance (CFA) for systems below 3-kilowatt peak (kWp) capacity, set stringent process timelines and integrated itself with the National Portal for Rooftop Solar (NPRS) to provide a digitised user experience to residential consumers.

As of August 2024, the scheme has garnered around 1.3 crore (13 million) registrations and 18 lakh (1.8 million) applications, leading to a total of 3.85 lakh (385,000) installations. This translates to about 1.8GW of new residential rooftop solar capacity, or more than half of India’s total, in just six months.

With strong impetus from the GoI, the financing options and terms for the residential rooftop solar market have improved significantly. The number of financers has risen from just a handful a few years ago to more than 25, including all leading private and public sector banks, non-banking financial companies (NBFCs) and fintechs. Several financiers focus on industry-wide tie-ups with project-executing entities and equipment suppliers, offering a one-stop solution to rooftop solar consumers. For financers, this ensures supply chain reliability, enhanced cost dynamics and the ability to tap a broader consumer base by leveraging the skills of multiple entities involved.

With the rooftop solar market attaining technological maturity, market commoditisation has increased noticeably, and several brands, such as Havells, Luminous, Livguard and Oswal, have introduced customised residential kits for swift project installation.

Despite the positive developments, some challenges need to be addressed to ensure the success of PMSGY. The primary challenge is the need for more availability of domestic content requirement (DCR) modules for the residential sector, considering the wide gap between photovoltaic (PV) cell and module manufacturing capacity in India. Additionally, there are some concerns about scheme adoption by its target demographic (i.e. small- to medium-scale electricity consumers), as cost economics and loan availing capability still favour the wealthier and creditworthy residential consumers. In certain states, such as Assam, there is a considerable mismatch between the number of project applications and the availability of vendors, which may affect the near-term growth of installations.

A firm policy and regulatory framework support should be reflected in its implementation to build a resilient and vibrant decentralised energy ecosystem with residential rooftop solar at the forefront. The technical issues and glitches of the National Portal for Rooftop Solar (NPRS), which several users across India have reported, must be resolved immediately. The state government must upgrade the endpoint transmission infrastructure, including the locality distribution transformer and power feeders. The Ministry of Power (MoP) directive to automatically award feasibility approval for project capacities under 10kWp should be implemented across India. In addition, the GoI must consider temporarily relaxing the mandatory usage of DCR modules until the enabling ecosystem of domestic PV cell manufacturing develops.

The adoption of residential rooftop solar is a “win-win” scenario, resulting in significant savings for consumers and state electricity distribution companies (DISCOMs) on cross-subsidisation costs and reduced aggregate technical and commercial (ATC) losses. A large share of demand will come from tier-2 cities and rural areas. According to industry stakeholders, other states apart from Gujarat, such as Maharashtra, Kerala, Uttar Pradesh and Madhya Pradesh, will also add significant rooftop solar capacity in the residential segment. Community solar adoption in India will increase as states levy regulatory acceptance to models such as group net metering (GNM) and virtual net metering (VNM).

The growth of the decentralised energy market in India (of which rooftop solar is a crucial component) will be critical to unlocking energy independence and ensuring energy security. With 8-10GW annual installations targeted under PMSGY, it will contribute immensely to India reaching its overall renewable energy target of 500GW by 2030.

Search

RECENT PRESS RELEASES

Related Post