US presidential election ’24 and energy storage: ‘Result will not change clean energy megatrend’

October 30, 2024

However, the basic stances on the climate crisis— “a scam” according to Donald Trump and “an existential threat” according to Kamala Harris—have been widely reported, as outlined in a New York Times editorial this week.

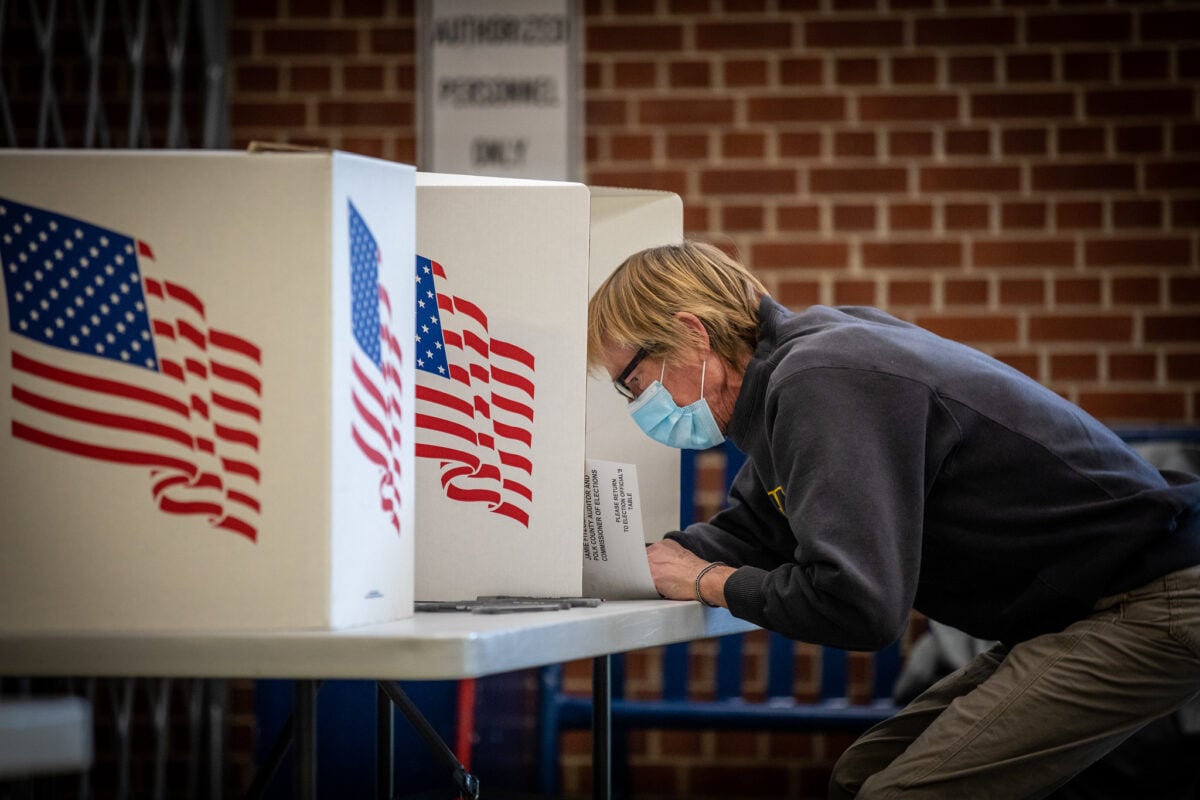

From a global perspective, 2024 has seen more people vote in general elections than in any other year historically. While much has been at stake already, none have gathered more attention than the whirlwind of the campaign trail played out between the diametrically opposed candidates for the White House.

Interestingly, the industry voices we talked to at RE+ in September largely expressed a collective view that the energy storage industry will thrive in either a Republican or Democrat administration.

Of course, there were many nuances within that consensus, as we’ve heard from developer rPlus, system integrator Fluence, and engineering, procurement, and construction (EPC) firm Burns & McDonnell in the previous two instalments of this week’s series.

We have heard that the run-in to the election in itself has caused some of the market to slow down, with Ben Echeverria, regulatory and compliance lead for energy storage at Burns & McDonnell saying that while projects and investments haven’t stopped, they’ve been put on pause.

Another source, speaking off-the-record in a separate interview, said that they expected to see a rush of decisions made between November and January in the event of a Trump win, with some predicting that Biden-era incentive schemes and regulatory frameworks could be at risk.

This time out, we speak with Lindsay Gorrill, CEO of battery and battery energy storage system (BESS) provider KORE Power, system integrator Wärtsilä ESO’s president Andy Tang, and Jaehong Park, CEO of LG Energy Solution’s integrator arm, LG ES Vertech.

Battery and BESS manufacturer Kore Power: Both sides have reasons to support US battery industry

Lindsay Gorill, CEO and founder, KORE Power

Even during the previous Trump administration, promoting the US battery value chain was a stated objective, but under Joe Biden, it has gone gangbusters.

KORE Power is a US-headquartered startup looking to establish everything from cell manufacturing to complete BESS system integration and many of the design and assembly steps in between.

It is currently sourcing cells for its own battery modules from its factory in China, but has secured land, state-level funding support and according to Gorrill, most of the financing for a 12GWh nickel manganese cobalt (NMC) and lithium iron phosphate (LFP) combined production facility in Arizona.

Called the KORE Plex, the gigafactory looks set to be a beneficiary of US$850 million from the US Department of Energy’s Loan Programs Office—an institution which lay dormant during the 2016-2020 Trump years.

The CEO emphasised in a recent ESN Premium interview that plans were in place long before the Biden-Harris administration unlocked billions in loans and tax incentives for clean energy.

Gorrill says that whichever side wins, he believes the battery industry will continue to enjoy support.

“We talked to a lot of people in the House and the Senate on both sides of the aisle, and they all want US manufacturing,” he says.

“There may be differences in policies and how they get there, but I really believe that both sides of the aisle, they all want sustainability and US manufacturing.”

While KORE Power is preparing for a range of outcomes, “whatever way the election goes, is not going to stop the KORE Plex,” Gorrill says.

He claims that KORE Power’s plan responds to a need for domestic supply chains, particularly as it is so far one of a small handful of US-owned entities looking to make cells as well as modules, racks and enclosures within the country.

Gorrill agrees that the lead-up to the election did create some market inertia but doesn’t expect it to last.

“A lot of capital markets are just pausing for a second to just see what’s going to happen, and then what that really means, but I think that everybody would want a sustainable manufacturing economy in the United States.”

System integrator LG ES Vertech: Clean energy megatrend isn’t

going away

Jaehong Park, CEO, LG Energy Solution Vertech

LG Energy Solution is also committed to manufacturing lithium-ion cells for energy storage in the US, with a 16GWh production line in the works, in addition to its other seven factories making batteries for electric vehicles (EVs).

In its latest quarterly earnings reports this week, the OEM confirmed that its US-based battery production for energy storage system (ESS) applications will begin next year.

It also said that during a challenging quarter, revenue decline caused by slower-than-expected EV demand was partially offset by sales for its grid-scale ESS business in the US and tax incentives realised by the Inflation Reduction Act (IRA).

It expects to see “strong demand momentum” in the ESS segment particularly for grid-connected applications, and wants to capitalise on opportunities for “long-term, large-volume projects in North America,” while also manufacturing lithium iron phosphate (LFP) cells in the country.

To that end, the South Korean OEM launched its own US-based system integrator arm to work on those projects. LG Energy Solution Vertech (LG ES Vertech) was built up from the acquired business of NEC Energy Solutions.

While LG Energy Solution will continue supplying cells to third-party system integrators, LG ES Vertech will benefit from a direct supply from the ‘mother company,’ LG ES Vertech’s Jaehong Park told us in a recent ESN Premium feature interview.

Park and his colleague Hyung-Sik Kim, LG Energy Solutions’ global ESS lead, point out that the company has been investing in US manufacturing and active in the clean energy business long before the IRA tax incentives brought many others into the game and supercharged investments.

“We think that clean energy is a megatrend, and the result of the election will not be able to change this megatrend,” Jaehong Park says.

The outcome could perhaps slow the industry’s momentum down “a little bit,” Park says, but the energy transition “is already the direction that everyone is moving forward [to].”

“Even though there is a lot of noise, just we do what we need to do. Our decision to localise in the US was made before the IRA kicked in. We just wanted to be local because there are a lot of advantages.”

It’s hard to argue with Park’s suggestion that, irrespective of the election, the world is moving into “an uncertain era” and localising supply chains can go some way towards mitigating risk.

“Everything is uncertain, everything is so volatile, and there’s already a lot of logistics issues, supply chain issues and even geopolitical issues. So, we want to be local regardless of the political issues. We are just working on our mission to provide clean energy infrastructure.”

System integrator Wärtsilä ES&O: Tariff risk higher with Republicans

Andy Tang, VP of energy storage and optimisation (ES&O), Wärtsilä Energy

For now, the US industry is largely dependent on Chinese battery imports, and while US battery manufacturing at scale is an achievable goal, it’s unlikely to be able to meet its demand enough to move the needle until around 2027 at the earliest, says Andy Tang.

Tang is the VP of Wärtsilä ES&O, part of the Finnish marine and energy solutions company, but based in the US and built up from the acquisition of Silicon Valley-based storage software maker and system integrator Greensmith Energy.

As has been the case in the solar industry with anti-dumping tariffs, some in the energy storage sector are concerned that heavy tariff burdens for products that US companies have little choice but to import, will slow down the energy transition and damage the industry.

Whether Democrat or Republican, there seems no turning back on the rise in import duties, which are currently scheduled to go from 7.5% to 25% in 2026, Andy Tang says.

“We’re inextricably on a path where, if the Republicans win, who knows where the tariffs go, but there’s only one direction they could move. If the Democrats win, we’re probably in a status quo environment,” he says.

“They [the Democrats] cannot lower tariffs because they cannot be seen as being weak on China. That will create too much political hay for the other side.”

So, regardless of who wins, the industry is in a “tariff war environment,” and the Section 301 tariffs on batteries may be limited to a 25% rise, but it won’t likely be lower than that “from this point forward,” Tang believes.

“Now, whether we stay at 25% or whether we go to 50% or even beyond, [the election in] November is going to decide that.”

Search

RECENT PRESS RELEASES

Related Post