$1 Billion Debt Offering Might Change The Case For Investing In Cheniere Energy Partners (

July 19, 2025

- On July 10, 2025, Cheniere Energy Partners, L.P. closed a private placement of US$1.0 billion in 5.550% Senior Notes due 2035, with the notes maturing on October 30, 2035 and bearing semi-annual interest payments starting April 30, 2026.

- This significant debt issuance highlights the company’s efforts to strengthen its liquidity and enhance financial flexibility, supported by guarantees from subsidiaries and restrictive covenants.

- Let’s explore how this substantial capital raise shapes Cheniere Energy Partners’ investment narrative with greater balance sheet flexibility in focus.

Advertisement

What Is Cheniere Energy Partners’ Investment Narrative?

For anyone looking at Cheniere Energy Partners, the big picture centers on stable cash flows from long-term LNG contracts, disciplined management, and whether the company’s high debt load remains manageable as energy market volatility persists. The fresh US$1 billion in senior notes gives Cheniere Energy Partners more room to maneuver in the short term, with improved liquidity and reduced near-term refinancing pressure, a positive backdrop for quarterly distribution consistency and ongoing debt service. However, this added leverage also sharpens the focus on interest costs and the company’s ability to maintain profitable operations as its net income and margins trend a bit softer than the previous year. If the additional capital preserves flexibility without triggering dividend cuts or balance sheet stress, it could dampen some immediate risks, but it does not remove concerns about future dividend reliability and long-term debt sustainability given recent earnings softness. Recent price action appears relatively stable, suggesting limited immediate impact, but investors should keep a close eye on how the capital raise affects risk factors moving forward.

But future dividend reliability may now deserve more attention than it did before this debt deal.Cheniere Energy Partners’ shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.

Exploring Other Perspectives

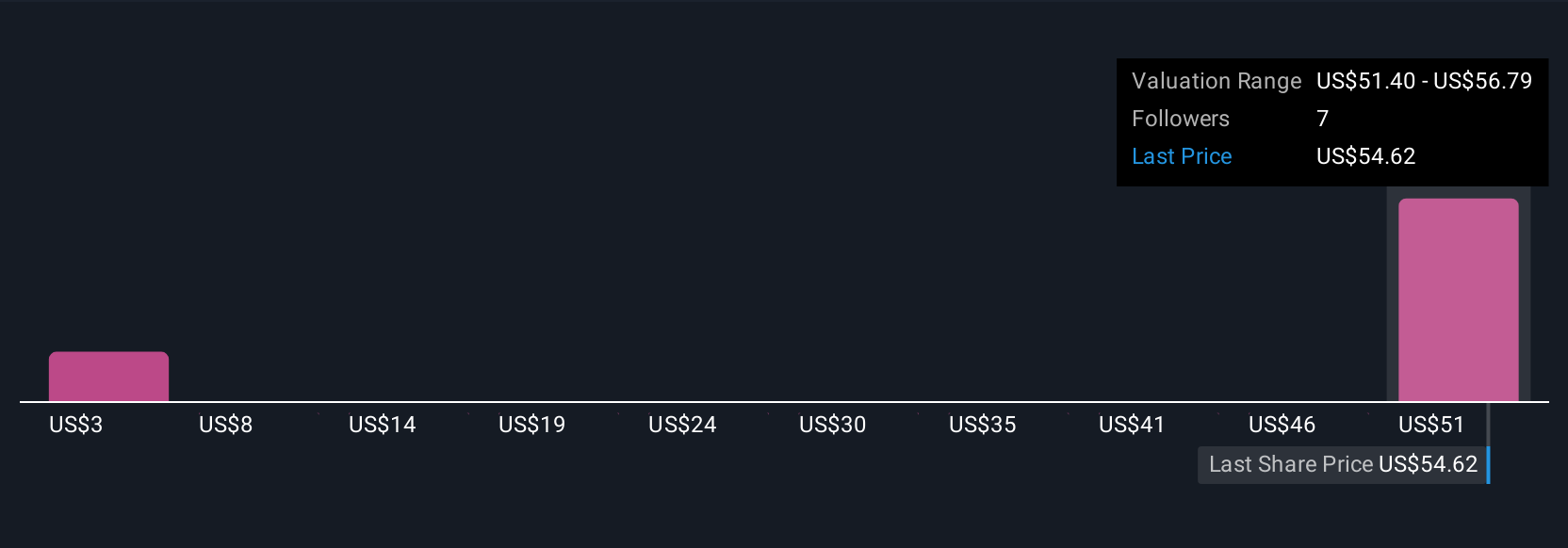

Two members of the Simply Wall St Community put fair value between US$2.92 and US$56.79, an almost US$54 difference. These divergent views echo how debt and distribution risks can shape confidence in future performance, and show why a range of perspectives is worth considering.

Build Your Own Cheniere Energy Partners Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cheniere Energy Partners research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Cheniere Energy Partners research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Cheniere Energy Partners’ overall financial health at a glance.

No Opportunity In Cheniere Energy Partners?

Don’t miss your shot at the next 10-bagger. Our latest stock picks just dropped:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post