1 Major Reason Cannabis Stocks Surged This Week

October 1, 2025

Key PointsPresident Trump posted a video suggesting that seniors would benefit from hemp-derived CBD.He’s also suggested reclassifying marijuana on a federal level.10 stocks we like better than Tilray Brands ›

Marijuana stocks are getting some attention this week following new interest from President Donald Trump.

Trump on Sunday posted a video on his Truth Social account that promoted the health benefits of hemp-derived CBD for seniors, suggesting it could be included under Medicare. The video suggests CBD can help seniors manage pain, reduce stress, and get more sleep.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

The video comes just a few weeks after Trump said he was considering reclassifying marijuana on the federal level as a less dangerous drug. Several states already allow marijuana for recreational purposes, but it remains a Schedule 1 substance under the Controlled Substance Act, and there’s been no action on the federal level to change it, despite advocates pushing for it for years.

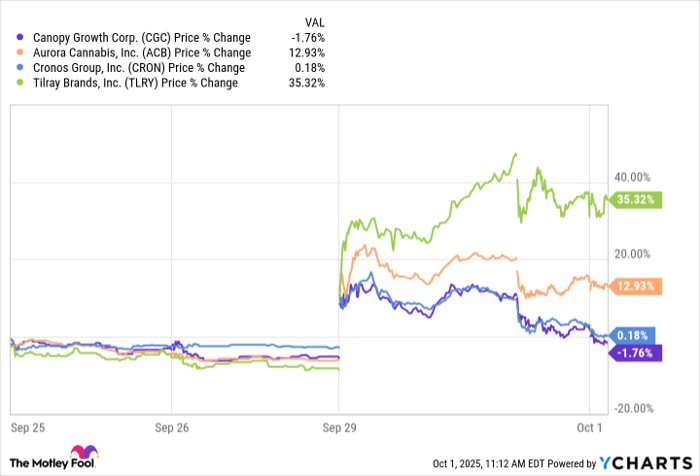

However, the twin tailwinds gave a sharp boost to marijuana stocks, including an 18% jump for Canopy Growth (NASDAQ: CGC), a 25% upward move by Aurora Cannabis (NASDAQ: ACB) and a 15% increase for Cronos Group (NASDAQ: CRON). One of the biggest gains was for Tilray Brands (NASDAQ: TLRY), which rose 42% on the news.

While Cronos and Canopy Growth have already given back their gains, Tilray and Aurora continued to show positive momentum this week.

What’s the outlook for cannabis stocks?

Before Trump posted the video on his Truth Social feed, Grand View Research estimated that the U.S. market size for cannabis would grow from $38.5 billion in 2024 to $74 billion by 2030, for a compound annual growth rate of 11.51%. That’s not a huge market, and investing can be challenging because the market capitalizations of some companies are exceptionally low. For instance, Aurora Cannabis has a market cap of only $329 million.

For investors who have a strong risk tolerance, a marijuana-themed exchange-traded fund could be a better option than individual stocks. The top-performing names this week include the following:

- The Amplify Seymour Cannabis ETF (NYSEMKT: CNBS) and the Amplify Alternative Harvest ETF (NYSEMKT: MJ): These are operated by the same company. Alternative Harvest’s biggest holding is Seymour Cannabis, which accounts for 48% of the fund. The largest individual company Alternative Harvest holds is Tilray Brands, which makes up 18% of the fund and is one of the best-performing cannabis stocks this week. That’s how Alternative Harvest, with a 17.2% gain over the last week, managed to outgain Seymour Cannabis, whose biggest holding is U.S. Treasury bills. Seymour Cannabis is up 12.2% this week.

- AdvisorShares Pure US Cannabis ETF (NYSEMKT: MSOS): This is marketed as the first actively managed U.S.-listed ETF with cannabis exposure from U.S. companies, but much of this ETF is made up total return swaps. That means it pays a fee to a third party, such as a bank, to invest in a company and also pays a fee to receive the gains or absorb the losses. The fund is up 11.9% this week.

- AdvisorShares Pure Cannabis ETF (NYSEMKT: YOLO): This ETF includes what you would expect when you think about cannabis stocks, but its biggest holding (nearly 40%) is AdvisorShares Pure US Cannabis. This fund is up 11% in the last week.

Should you invest $1,000 in Tilray Brands right now?

Before you buy stock in Tilray Brands, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Tilray Brands wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $646,567!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,143,710!*

Now, it’s worth noting Stock Advisor’s total average return is 1,072% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 29, 2025

Patrick Sanders has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Cronos Group. The Motley Fool recommends Tilray Brands. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Search

RECENT PRESS RELEASES

Related Post