$100M Ethereum Power Play: BTCS Unveils Revolutionary DeFi-TradFi Hybrid Financing Strateg

July 8, 2025

Rhea-AI Impact

Rhea-AI Sentiment

Rhea-AI Summary

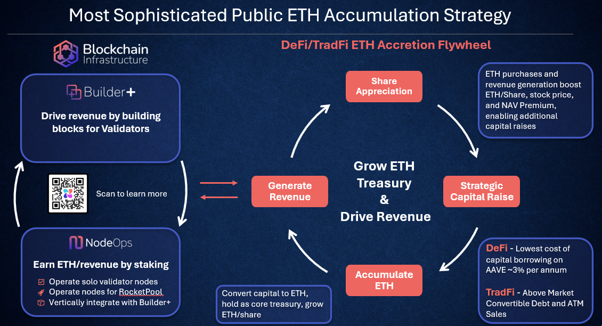

BTCS (Nasdaq: BTCS) has announced plans to raise $100 million in 2025 to acquire Ethereum as part of its strategic expansion. The company is implementing a hybrid DeFi/TradFi financing model that combines multiple funding sources including ATM equity sales, convertible debt, and DeFi borrowing through Aave.

The strategy maintains a 40% NAV leverage cap and utilizes a sophisticated accretion flywheel incorporating NodeOps staking and Builder+ block building integration. The financing structure aims to minimize dilution while maximizing ETH holdings, with Aave borrowing offering an attractive 3% annual cost of capital with no dilution.

BTCS’s initiative comes as Ethereum returns to 2021 price levels, positioning the company to become a leading publicly traded entity focused on Ethereum infrastructure.

BTCS (Nasdaq: BTCS) ha annunciato l’intenzione di raccogliere 100 milioni di dollari nel 2025 per acquisire Ethereum come parte della sua espansione strategica. L’azienda sta adottando un modello di finanziamento ibrido DeFi/TradFi che combina diverse fonti di capitale, tra cui vendite di azioni tramite ATM, debito convertibile e prestiti DeFi tramite Aave.

La strategia prevede un limite di leva finanziaria del 40% sul NAV e utilizza un meccanismo sofisticato di accrescimento che integra lo staking NodeOps e la costruzione di blocchi Builder+. La struttura finanziaria è progettata per minimizzare la diluizione massimizzando la detenzione di ETH, con i prestiti Aave che offrono un costo del capitale annuo del 3% senza diluizione.

L’iniziativa di BTCS arriva mentre Ethereum ritorna ai livelli di prezzo del 2021, posizionando l’azienda come un protagonista pubblico di primo piano focalizzato sull’infrastruttura Ethereum.

BTCS (Nasdaq: BTCS) ha anunciado planes para recaudar 100 millones de dólares en 2025 para adquirir Ethereum como parte de su expansión estratégica. La compañía está implementando un modelo de financiación híbrido DeFi/TradFi que combina múltiples fuentes de fondos, incluyendo ventas de acciones ATM, deuda convertible y préstamos DeFi a través de Aave.

La estrategia mantiene un límite de apalancamiento del 40% del NAV y utiliza un sofisticado mecanismo de crecimiento que incorpora staking de NodeOps e integración de construcción de bloques Builder+. La estructura financiera busca minimizar la dilución mientras maximiza las tenencias de ETH, con préstamos en Aave que ofrecen un atractivo costo de capital anual del 3% sin dilución.

La iniciativa de BTCS llega en un momento en que Ethereum regresa a los niveles de precio de 2021, posicionando a la empresa para convertirse en una entidad pública líder centrada en la infraestructura de Ethereum.

BTCS (나스닥: BTCS)는 2025년에 1억 달러를 조달하여 전략적 확장의 일환으로 이더리움을 인수할 계획을 발표했습니다. 회사는 ATM 주식 판매, 전환사채, Aave를 통한 DeFi 대출 등 여러 자금원을 결합한 하이브리드 DeFi/TradFi 금융 모델을 도입하고 있습니다.

이 전략은 순자산가치(NAV) 레버리지 한도 40%를 유지하며, NodeOps 스테이킹과 Builder+ 블록 빌딩 통합을 포함하는 정교한 누적 성장 메커니즘을 활용합니다. 금융 구조는 희석을 최소화하면서 ETH 보유를 극대화하는 것을 목표로 하며, Aave 대출은 연 3%의 매력적인 자본 비용을 제공하며 희석이 없습니다.

BTCS의 이번 이니셔티브는 이더리움이 2021년 가격 수준으로 회복됨에 따라, 회사를 이더리움 인프라에 중점을 둔 선도적인 상장 기업으로 자리매김하게 합니다.

BTCS (Nasdaq : BTCS) a annoncé son projet de lever 100 millions de dollars en 2025 pour acquérir Ethereum dans le cadre de son expansion stratégique. La société met en place un modèle de financement hybride DeFi/TradFi combinant plusieurs sources de financement, notamment des ventes d’actions via ATM, de la dette convertible et des emprunts DeFi via Aave.

La stratégie maintient un plafond de levier de 40 % de la valeur nette d’inventaire (NAV) et utilise un mécanisme sophistiqué d’accroissement intégrant le staking NodeOps et l’intégration de la construction de blocs Builder+. La structure de financement vise à minimiser la dilution tout en maximisant les avoirs en ETH, avec les emprunts Aave offrant un coût du capital annuel attractif de 3 % sans dilution.

L’initiative de BTCS intervient alors qu’Ethereum retrouve les niveaux de prix de 2021, positionnant la société comme un acteur public de premier plan axé sur l’infrastructure Ethereum.

BTCS (Nasdaq: BTCS) hat Pläne angekündigt, im Jahr 2025 100 Millionen US-Dollar aufzubringen, um Ethereum im Rahmen seiner strategischen Expansion zu erwerben. Das Unternehmen setzt ein hybrides DeFi/TradFi-Finanzierungsmodell um, das mehrere Finanzierungsquellen kombiniert, darunter ATM-Aktienverkäufe, wandelbare Schulden und DeFi-Kredite über Aave.

Die Strategie hält eine Hebelobergrenze von 40 % des NAV ein und nutzt einen ausgeklügelten Akkretions-Mechanismus, der NodeOps-Staking und die Integration des Builder+ Blockaufbaus einbezieht. Die Finanzierungsstruktur zielt darauf ab, Verwässerung zu minimieren und gleichzeitig die ETH-Bestände zu maximieren, wobei die Aave-Kredite einen attraktiven jährlichen Kapitalkostensatz von 3 % ohne Verwässerung bieten.

Die Initiative von BTCS erfolgt, während Ethereum auf das Preisniveau von 2021 zurückkehrt, und positioniert das Unternehmen als führendes börsennotiertes Unternehmen mit Fokus auf Ethereum-Infrastruktur.

Positive

- Implementation of innovative DeFi/TradFi hybrid financing model with 3% cost of capital

- Conservative 40% NAV leverage cap to maintain sustainable balance sheet

- Multiple revenue streams through NodeOps staking and Builder+ block building

- Access to $250 million shelf registration for strategic growth

- Zero banking or underwriting fees for Aave-based borrowing structure

Negative

- Potential shareholder dilution through ATM equity sales

- Significant leverage exposure through combined convertible debt and Aave borrowings

- High dependence on Ethereum price performance

- Complex financing structure carries execution risks

Insights

BTCS plans $100M Ethereum acquisition using innovative DeFi/TradFi financing, potentially strengthening their position as a public ETH infrastructure player.

BTCS’s announcement represents a significant strategic move in the cryptocurrency infrastructure space. The company intends to raise $100 million specifically to acquire Ethereum, utilizing what they’re calling a “DeFi/TradFi accretion flywheel” – an innovative financing approach combining traditional capital markets tools with decentralized finance mechanisms.

The company is implementing a multi-pronged financing strategy with several components: their existing ATM (At-The-Market) equity program, convertible debt arrangements with ATW Partners, DeFi borrowing via Aave using ETH as collateral, yield generation from staking (what they call “NodeOps”), and integration with block building services. Notably, their Aave borrowing structure offers a remarkably low 3% capital cost without diluting shareholders.

What makes this approach distinctive is BTCS’s commitment to maintain a conservative 40% NAV (net asset value) leverage cap across their convertible debt and DeFi borrowings, suggesting a disciplined risk management framework. The company appears to be positioning itself as a publicly-traded proxy for Ethereum exposure with added operational capabilities.

The timing is strategic – they specifically note Ethereum is at “2021 price levels,” indicating they view current market conditions as favorable for accumulation. Their reference to a “crypto-friendly administration” suggests they’re anticipating a regulatory environment that could further support their expansion plans. This move could potentially strengthen BTCS’s position as one of the larger public holders of ETH while developing infrastructure around the Ethereum ecosystem.

07/08/2025 – 08:35 AM

Silver Spring, MD, July 08, 2025 (GLOBE NEWSWIRE) — BTCS Inc. (Nasdaq: BTCS) (“BTCS” or the “Company”) short for Blockchain Technology Consensus Solutions, a blockchain technology-focused company, today announced its strategic intent to raise $100 million in 2025 to acquire Ethereum. This initiative is part of the Company’s long-term vision to build the leading publicly traded company focused on Ethereum infrastructure while remaining one of the largest holders of ETH among public companies.

“We believe that Ethereum has significant growth potential and is central to the future digital financial infrastructure. Now, with Ethereum at 2021 price levels, is the time to deepen our exposure,” said Charles Allen, CEO of BTCS. “Our approach to capital formation has been – and continues to be – designed to minimize dilution, maximize flexibility, and align with our commitment to sound financial management for the protection of our shareholders.”

This initiative represents a transformative expansion of BTCS’s Ethereum-first strategy, leveraging a cutting-edge financing model that combines both decentralized finance (“DeFi”) and traditional finance (“TradFi”) mechanisms. The planned capital raises1 will be structured through a sophisticated DeFi/TradFi accretion flywheel consisting of At-The-Market (“ATM”) equity sales, convertible debt issuance, on-chain borrowing via Aave, yield generated from NodeOps (staking Ethereum), and vertical integration with Builder+ (block building), one of the most advanced opportunities for driving revenue and increasing ETH per share while minimizing dilution.

Key principles of the DeFi/TradFi Strategy

Subject to market conditions, the Company intends to raise funds to acquire Ethereum on a rolling basis, with a targeted emphasis on maximizing capital efficiency. BTCS plans to adhere to a strict net asset value (“NAV”) leverage cap of up to 40% at the time of each financing, covering its combined exposure to convertible debt and Aave borrowings, to ensure a conservative and sustainable balance sheet. The strategy includes:

- ATM Equity Sales: Opportunistic issuance through the Company’s existing ATM program, designed to access equity markets efficiently and transparently. This would utilize BTCS’s current $250 million shelf registration to the extent it is not restricted by baby shelf limitations.

- Convertible Debt: Opportunistic use of the previously announced convertible debt arrangement with ATW Partners LLC (“ATW”), which BTCS may utilize upon mutual agreement with ATW, provided it represents the lowest cost of capital. This arrangement, which forms part of BTCS’s broader capital strategy, is designed to provide access to funding while minimizing shareholder dilution.

- DeFi Borrowing via Aave: Continuing to borrow stablecoins from Aave using ETH as collateral. This structure operates as a perpetual loan, carrying no associated banking or underwriting fees. The current net annual cost of capital remains extremely favorable at around 3%, with no shareholder dilution. This structure can be implemented in minutes, is highly scalable, and provides a flexible mechanism for rapid growth.

This innovative mix of financing is designed to achieve the least dilutive cost of capital while expanding the Company’s Ethereum holdings in a responsible and forward-looking manner, with the goal of increasing its ETH per share and simultaneously driving revenue growth.

A New Frontier in Crypto Capital Formation

By utilizing both decentralized and institutional capital markets, BTCS aims to set a precedent for how public blockchain companies can bridge DeFi and TradFi to create shareholder value and foster trust in programmable financial systems.

“We’re engineering a capital structure that mirrors the ethos of crypto itself—efficient, transparent, and decentralized,” said Allen. “With 20 years of capital markets experience and 10 years at the forefront of crypto, BTCS is uniquely positioned to lead in this new paradigm. With a new crypto-friendly administration and increased institutional interest in Ethereum, now is the time to rapidly scale our operations.”

The chart below illustrates the history of BTCS’s ETH accumulation over the last 5 years:

The Company plans to provide additional updates, in accordance with its disclosure obligations under securities laws, regarding the specific timelines, instruments, and market conditions as part of its regular investor communications.

About BTCS:

BTCS Inc. (Nasdaq: BTCS) (short for Blockchain Technology Consensus Solutions) is a U.S.-based blockchain infrastructure technology company currently focused on driving scalable revenue growth through its blockchain infrastructure operations. BTCS has honed its expertise in blockchain network operations, particularly in block building and validator node management. Its branded block-building operation, Builder+, leverages advanced algorithms to optimize block construction for on-chain validation, thus maximizing gas fee revenues. BTCS also supports other blockchain networks by operating validator nodes and staking its crypto assets across multiple proof-of-stake networks, allowing crypto holders to delegate assets to BTCS-managed nodes. In addition, the Company has developed ChainQ, an AI-powered blockchain data analytics platform, which enhances user access and engagement within the blockchain ecosystem. Committed to innovation and adaptability, BTCS is strategically positioned to expand its blockchain operations and infrastructure beyond Ethereum as the ecosystem evolves. Explore how BTCS is revolutionizing blockchain infrastructure in the public markets by visiting www.btcs.com.

Cautionary Note Regarding Forward-Looking Statements

Certain statements in this press release, constitute “forward-looking statements” within Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 including statements regarding plans to raise $100 million in 2025, Ethereum’s growth potential, plans for capital raises and limiting our NAV leverage cap and rapidly increasing the Company’s ETH per share and simultaneously driving revenue growth. Words such as “may,” “might,” “will,” “should,” “believe,” “expect,” “anticipate,” “estimate,” “continue,” “predict,” “forecast,” “project,” “plan,” “intend” or similar expressions, or statements regarding intent, belief, or current expectations, are forward-looking statements. While the Company believes these forward-looking statements are reasonable, undue reliance should not be placed on any such forward-looking statements, which are based on information available to us on the date of this release. These forward-looking statements are based upon assumptions and are subject to various risks and uncertainties, including without limitation market conditions, regulatory issues and requirements, unexpected issues with Builder+, as well as risks set forth in the Company’s filings with the Securities and Exchange Commission including its Form 10-K for the year ended December 31, 2024 which was filed on March 20, 2025. Thus, actual results could be materially different. The Company expressly disclaims any obligation to update or alter statements, whether as a result of new information, future events or otherwise, except as required by law.

For more information follow us on:

Twitter: https://x.com/NasdaqBTCS

LinkedIn: https://www.linkedin.com/company/nasdaq-btcs

Facebook: https://www.facebook.com/NasdaqBTCS

Investor Relations:

Charles Allen – CEO

X (formerly Twitter): @Charles_BTCS

Email: ir@btcs.com

1 Subject to regulatory approval and market conditions.

FAQ

How much does BTCS plan to raise for Ethereum acquisition in 2025?

BTCS plans to raise $100 million in 2025 to acquire Ethereum as part of its strategic expansion initiative.

What financing methods will BTCS use for its $100M Ethereum acquisition?

BTCS will use a hybrid approach combining ATM equity sales, convertible debt issuance, DeFi borrowing through Aave, NodeOps staking yields, and Builder+ integration.

What is BTCS’s leverage cap for its Ethereum acquisition strategy?

BTCS has set a 40% NAV (Net Asset Value) leverage cap for combined exposure to convertible debt and Aave borrowings.

What is the cost of capital for BTCS’s Aave borrowing structure?

The net annual cost of capital for BTCS’s Aave borrowing structure is approximately 3%, with no shareholder dilution or banking fees.

How will BTCS generate revenue from its Ethereum holdings?

BTCS will generate revenue through NodeOps (Ethereum staking) and vertical integration with Builder+ (block building) to increase ETH per share while minimizing dilution.

Search

RECENT PRESS RELEASES

Related Post