$16 Billion of Bitcoin and Ethereum Options to Expire on Oct. 31, Major Volatility Ahead?

October 31, 2025

Key Notes

- Bitcoin price dropped all the way to $106,000, scooping downside liquidity before recovering back to $110,000.

- Crypto analyst Ali Martinez identifies $112,340 as a crucial resistance level for the next major move.

- Ethereum trades at $3,837 with 646,902 options contracts worth $2.49 billion expiring today with a max pain point of $4,100.

Following the FOMC meeting earlier this week, Bitcoin

BTC

$109 904

24h volatility:

0.3%

Market cap:

$2.19 T

Vol. 24h:

$67.26 B

and altcoins have seen selling pressure as the crypto market faces a monthly options expiry on Oct. 31. Nearly $13.5 billion in Bitcoin options, and another $2.5 billion of Ethereum

ETH

$3 846

24h volatility:

1.3%

Market cap:

$464.01 B

Vol. 24h:

$35.57 B

options will expire today, as the market braces for strong volatility ahead.

Bitcoin Price Cracks Under $110K Ahead of $13.5 Billion Options Expiry

On the weekly chart, Bitcoin price action shows strong movement from the highs of $116,000 to the lows of $106,000. Furthermore, the flows into spot Bitcoin ETFs have moved into the negative territory, showing waning institutional sentiment.

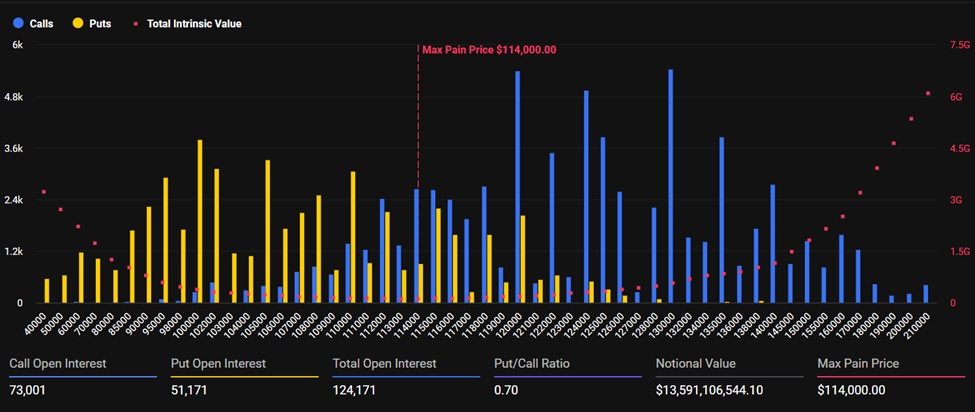

In the last 24 hours, BTC price has scooped the downside liquidity at $106,000 and surged from there onwards, again closer to $110,000. According to the data from crypto derivatives platform Deribit, a total of 124,171 Bitcoin options contracts, valued at $13.59 billion, are set to expire in the upcoming cycle.

Bitcoin options expiry data | Source: Deribit

Data from Deribit shows a put-to-call ratio of 0.70, signaling a mildly bullish market sentiment. Of the total open interest, 73,001 are call options and 51,171 are put options, reflecting stronger trader positioning on the upside.

The max pain point is positioned at $114,000. Historically, the BTC price moves to the max pain point as the expiry approaches. However, it first needs to break some important resistances in the mid-way.

Crypto analyst Ali Martinez has identified $112,340 as the key resistance level currently facing BTC. Martinez noted that breaching this level could determine the next major directional move for the leading cryptocurrency.

Related article: ETH Price in a “Classic Bear Trap” Under $4,000 Says Expert, While Ethereum ETF Flows Turn Negative

https://twitter.com/ali_charts/status/1984130210619371612

$2.5 Billion of Ethereum Options to Expire on Oct. 31

Ethereum price has slipped under $4,000 level amid continuous selling pressure as bears take the upper hand. As of press time, ETH price is trading at $3,837 levels with 646,902 contracts worth $2.49 billion set to expire.

The max pain level is positioned at $4,100, slightly above the current spot price. Similar to Bitcoin, Ethereum’s put-to-call ratio stands at 0.70, signaling a mildly bullish market sentiment. However, data from Deribit indicates a more defensive tone among traders.

Ethereum options expiry data | Source: Deribit

Call open interest totals 381,462 contracts, exceeding the 265,440 put contracts. This suggests that while traders maintain upside exposure, others are simultaneously hedging against potential downside risks.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Author

Bhushan Akolkar

Bhushan is a FinTech enthusiast and holds a good flair in understanding financial markets. His interest in economics and finance draw his attention towards the new emerging Blockchain Technology and Cryptocurrency markets. He is continuously in a learning process and keeps himself motivated by sharing his acquired knowledge. In free time he reads thriller fictions novels and sometimes explore his culinary skills.

Search

RECENT PRESS RELEASES

Related Post