2 AI Stocks to Buy in 2026, and 1 to Avoid

January 17, 2026

Some AI-focused companies are not worth the trouble.

Artificial intelligence (AI) excitement has been sweeping through Wall Street for several years now. The technology is transforming the world and presenting investors with attractive opportunities in the process. Investing in companies that can capitalize on the AI wave in one way or another could lead to substantial returns over the long run.

However, not every AI stock is created equal. Let’s consider three AI stocks on the market right now, two of which are attractive options, and one that isn’t.

Image source: Getty Images.

Meta Platforms

Meta Platforms (META 0.04%) is investing heavily in AI, and so far, its strategy is having a significant impact on its financial results. Revenue and earnings growth have been strong in recent years for the social media giant, partly due to its AI-powered algorithm on its websites and apps, which is helping drive more engagement. The more time Meta Platforms’ users spend on, say, Instagram, the more attractive the website becomes to advertisers. Time spent is important, but how that time is spent is, too.

Deeper engagement enables Meta Platforms to gather more data on user habits, which it can use to help businesses create targeted and more impactful ad campaigns. Meta Platforms is investing a substantial amount in AI infrastructure, which is alarming some investors. The company’s shares dropped after it released its third-quarter earnings for that reason.

Meta Platforms

Today’s Change

(-0.04%) $-0.26

Current Price

$620.54

However, Meta is betting that the investments will pay for themselves, and if they don’t, the tech leader should be able to pivot relatively quickly. Meta Platforms once made a similar bet that its metaverse ambitions would materialize. They didn’t, but the company was able to cut expenses and costs and bounce back relatively quickly.

Advertisement

In my view, the most crucial point about Meta Platforms is that, with an ecosystem of over 3.5 billion daily active users — and strong network effects across its websites and apps — there are numerous monetization opportunities it can exploit beyond its core advertising business.

And its investments in AI could, eventually, lead to important monetization opportunities even beyond advertising, perhaps through initiatives like Meta AI. In short, Meta Platforms remains an attractive investment in AI stocks to consider in 2026.

Apple

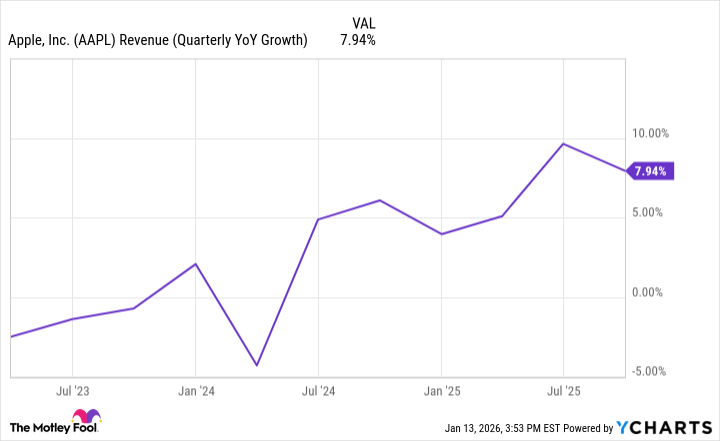

Apple (AAPL 1.04%) hasn’t benefited from AI as much as some of its similarly sized tech peers; however, the company’s latest iPhone, the 17, is proving to be a huge success. That’s partly thanks to various AI features the device comes with. The iPhone 17 is ushering in a robust cycle of renewals for the company. Revenue growth in the last two quarters was the highest it has seen over the past three years, and things will only get better, judging by Apple’s guidance.

AAPL Revenue (Quarterly YoY Growth) data by YCharts

The company is projecting double-digit revenue growth for its upcoming quarter, a milestone that has not been achieved by the tech leader in several years.

Apple will continue to invest in AI to enhance its devices, thereby attracting more users and expanding its installed base. With over 2 billion devices in circulation, Apple also has massive monetization opportunities through its services segment, a high-margin unit that has been growing faster than the rest of its business for years.

Apple’s long-term prospects through this strategy remain strong, and AI will play a role in that by helping it introduce nifty features on its devices, which will attract more users and expand its installed base.

Today’s Change

(-1.04%) $-2.68

Current Price

$255.53

Recursion Pharmaceuticals

Recursion Pharmaceuticals (RXRX +0.65%) is a small drugmaker with a big goal. The company aims to revolutionize the way drugs are developed. Through an AI-powered operating system (OS), the company performs millions of virtual experiments that test various compounds against a library of human genes to predict the most promising to send to clinical trials.

Currently, the process of transitioning from drug discovery to clinical studies and approval can take over a decade and cost more than $1 billion. Recursion Pharmaceuticals claims that its approach could significantly reduce the time and money pharmaceutical and biotech companies spend on research and development (R&D).

Recursion Pharmaceuticals

Today’s Change

(0.65%) $0.03

Current Price

$4.67

If successful, everyone would benefit: Medicines would reach patients faster and at lower costs, while drugmakers would spend less and generate higher profits. That’s all well and good.

However, Recursion still doesn’t have any products on the market, so it’s hard for the company to argue that its approach is effective. Further, none of its candidates are currently in phase 3 studies. And to make matters worse, other companies, including some far larger than Recursion Pharmaceuticals — such as Eli Lilly — are now also going all in on AI drug discovery, which would undercut Recursion’s efforts, since one of the company’s goals is to eventually license its OS to other drugmakers.

Bottom line: Recursion Pharmaceuticals is a highly risky stock, and those who are not comfortable with this level of risk should look elsewhere.

Search

RECENT PRESS RELEASES

Related Post