$2 Billion Ethereum Bet By Shanghai-based Firm Gets Wrecked As Ethereum Slides

February 7, 2026

Traders observed Ethereum whale trades during the selloff after Vitalik Buterin sold 2,961 ETH for roughly $6.6 million over three days at $2,228 per coin.

- On Friday, an X user, Daxx, said Trend Research blew out a roughly $2 billion leveraged Ethereum long, putting total PnL near $686 million.

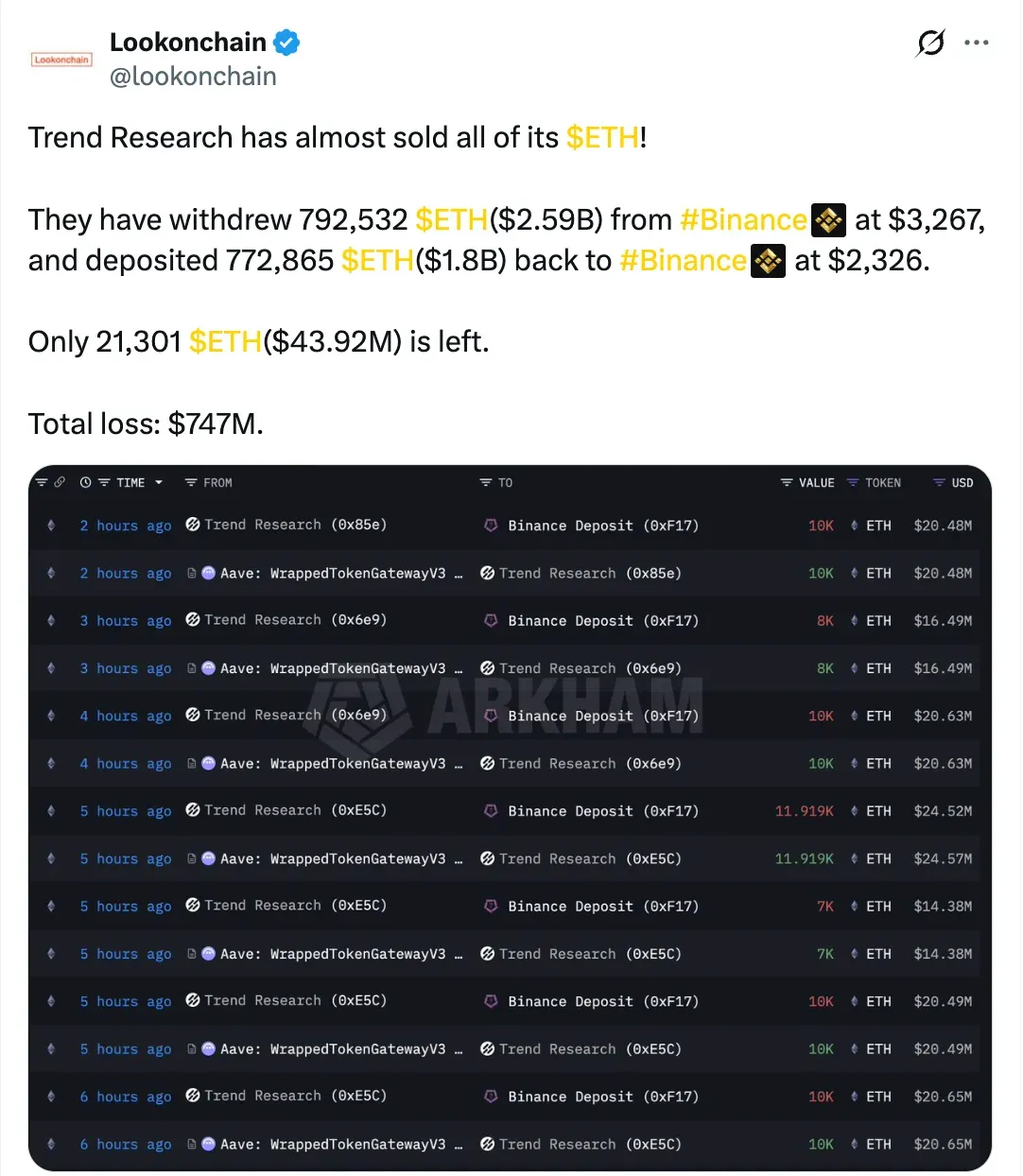

- Lookonchain said the fund withdrew 792,532 Ethereum from Binance at $3,267 and later deposited 772,865 Ethereum back at $2,326, leaving 21,301 Ethereum and estimating total losses at $747 million.

- Tom Lee said recoveries have often been V-shaped after deep drawdowns, noting multiple over 60% declines since 2018.

Trend Research unwound a large, leveraged Ethereum (ETH) position after it slid sharply, according to crypto educator and YouTuber Daxx, who said on Friday that the Shanghai-linked firm “blew out” a roughly $2 billion long.

On X, Daxx explained that Trend Research is a secondary-market crypto investment and trading arm operating under LD Capital, a Shanghai-based venture firm founded by longtime Ethereum supporter Jack Yi. Daxx said the fund had built a high-conviction ETH position and amplified it with leverage, leaving it exposed as prices fell. With Trend Research essentially completing its liquidation, analyst Yu Jin’s final loss on ETH is now a clear amount, approximately $734 million

Following this, Lookonchain, a leading data analysis platform, reported that Trend Research “has almost sold all of its ETH,” and posted figures showing heavy transfers through Binance. Lookonchain further said the fund withdrew 792,532 ETH worth $2.59 billion from Binance at $3,267, then deposited 772,865 ETH worth $1.8 billion back to Binance at $2,326. It added that only 21,301 ETH, about $43.92 million, remained, and estimated total losses at $747 million.

Ethereum (ETH) was trading at $2,028, up by 7% over 24 hours. On Stockwits, the retail sentiment around ETH remained in the ‘neutral’ territory, as chatter levels around it remained ‘extremely high’ over the past day.

The unwind was tied to leverage built through Aave’s lending protocol, with Trend Research borrowing nearly $1 billion in stablecoins against ETH collateral, Daxx explained in his post. As ETH dropped from above $3,000 to below $1,900, the fund accelerated selling to repay loans and reduce liquidation risk.

Separately, traders have been sensitive to large-holder ETH movements during the selloff. Previously, it was reported that Ethereum co-founder Vitalik Buterin sold about 2,961 ETH worth roughly $6.6 million over three days, after previously flagging planned withdrawals, with the sales executed at an average price around $2,228 per ETH.

Fundstrat’s Tom Lee argued that ETH has repeatedly seen sharp, V-shaped recoveries after steep drawdowns. He said that since 2018, Ethereum has recorded seven drawdowns of 60% or worse, and suggested that faster declines have often been followed by faster rebounds.

Read also: Crypto.com Founder Buys AI.com In Most Expensive Domain Sale Ever

For updates and corrections, email newsroom[at]stocktwits[dot]com

Search

RECENT PRESS RELEASES

Related Post