20 Billion Reasons Why Apple Stock Could Be Headed For a Crash

May 14, 2025

Apple (AAPL 1.15%) is one of the world’s most profitable companies. It earns most of its profits from sales of various devices and services, but one profit source is more lucrative than any other: The money that Alphabet (GOOG 0.89%) (GOOGL 0.73%) paid Apple to ensure that its search engine is the default choice for iPhones.

Alphabet paid Apple $20 billion in 2022 for this commitment, but there is no public information about that payment in the following years. However, it’s significant enough that Apple’s vice president of services, Eddy Cue, recently said in a testimony to federal court that he “loses sleep” over the thought of losing that revenue.

Because this revenue doesn’t cost Apple anything, there’s a high probability that this $20 billion or so payment goes directly toward Apple’s bottom line. Apple’s stock could be primed for a crash if this profit source disappeared.

Image source: Getty Images.

Apple could struggle if it loses a critical profit source

Cue was testifying in federal court regarding the ongoing Google search engine illegal monopoly case. Alphabet’s $20 billion payment was a huge part of this case, described as exercising its dominance and size to ensure others couldn’t take its spot as the top search engine option.

While investors still don’t know how the companies’ relationship will play out, Cue mentioned that he believes that AI-powered search will eventually replace the traditional type of search that Google operates. As a result, it may not be worth it for Alphabet to pay Apple the $20 billion or so anyway.

So, whether traditional search engines are eventually eliminated or Alphabet is barred from paying Apple to be the default search engine, the $20 billion payment is in jeopardy.

Again, this is likely pure profit for Apple. But how much would it cost Apple if it disappeared? Quite a lot.

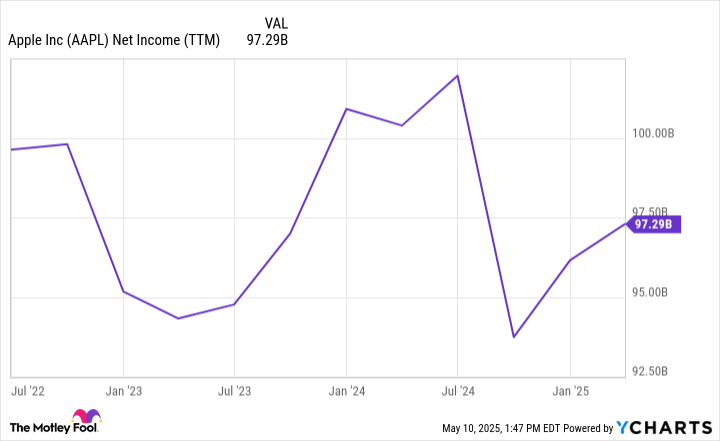

Over the past three years, Apple’s trailing 12-month net income has essentially hovered at or slightly below the $100 billion mark.

AAPL Net Income (TTM) data by YCharts.

So, if Apple were to lose that lucrative payment from Alphabet, Apple’s net income would likely drop around 20%. Because Apple is a fully mature company where investors are mostly focused on profits, that drop would likely coincide with a similar level of stock price drop.

A quick 20% drop would likely prompt investors to label it a “crash,” so this is a reality that Apple investors must address. However, there’s another danger that Apple shareholders face.

Apple’s stock has a premium valuation

Apple’s stock is already priced for perfection, which means that it can’t afford any execution slip-ups.

AAPL PE Ratio data by YCharts.

At 31 times trailing earnings and 28 times forward earnings, Apple is expensive from both a historical standpoint and a general standpoint, especially considering that the S&P 500 (^GSPC 0.72%) trades for 22.8 times trailing and 21.2 times forward earnings. Despite trading for a significant premium over the broader market, Apple is only expected to grow revenue by 4.1% in fiscal year 2025 and 6.1% in FY 2026.

Apple’s stock is priced for perfection and growth, yet both of those assumptions are being called into question right now. As a result, I think investors should look at other big tech companies that don’t face nearly as many challenges and don’t have the premium price tag attached to them.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet and Apple. The Motley Fool has a disclosure policy.

Search

RECENT PRESS RELEASES

Related Post